It has been a very tough week for investors across the board.

This year the market has rewarded only Energy (crude oil and gas) and Commodities (Wheat etc). the reasons are numerous and energy especially was the standout performer in 2022 even before the Russian invasion of Ukraine. The mood in the markets is a risk-off and a run to safety

If you look at figure 1 below, it shows how risk-averse the markets have become. If an investor simply held notes of US currency the dollar since January 2022, that investor’s “returns” would have beaten, Gold, US Government bonds, US Equities AND Bitcoin. When markets are in decline and the bears run rampant, investors seek out the safety of the US Dollar.

This week we ask, what should investors do when the entire markets are falling? I have a few suggestions.

First do not panic, before hitting the sell button, be clear about why you are selling. Is the company failing? To avoid a loss, to reinvest somewhere elsewhere? Panic selling means you actualize a real loss. So first ask questions, do some research then take action.

Next, go back to your plan. Why did you buy the stock in the first place? Was this a trading portfolio? For short term gain? Or a long term holding for your retirement. A long term portfolio means you see falls in price as an opportunity if the company earnings are not impaired. For instance, Google (GOOG) is down 19.47% in 2022, does this mean no one is using Google to search or advertising revenues have dried up? If the business model is sound and you have a longer duration plan, then a fall in prices is a positive for you. Stick to your plan, not the market news.

However, if you are trading with margin, don’t wait, sell immediately. Trading with margin means you borrowed funds to buy those shares. Whenever you buy on margin set a stop loss (a trigger price to automatically sell the shares if it falls to a set price). If you are buying US-listed shares and also paying taxes in the US then you can reduce your tax liability to the IRS by claiming these losses as deductions. To learn more, speak with a tax expert or study Tax Loss Harvesting.

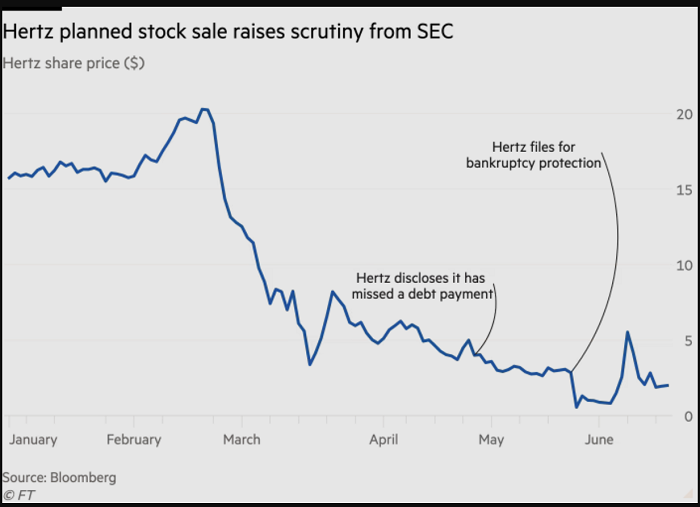

Watch the fundamentals and do not rush to sell any asset because the price has fallen. Remember the markets allow you to discover the price of an asset traded on the market, but the price is not always accurate when related to the value. Take a stock like MTNN, its market price is N261.60, but revenues have grown 16% in three years and forecast to grow 18% per annum. In terms of returns, MTNN’s 1 year return is 61% and the NGX All Share return for the same period is 28%. The intrinsic value of MTNN cannot be immediately reflected in the stock price. The share price is simply what a willing buyer is willing to pay to a willing seller. If MTN’s business still generates revenues and costs keep falling, then its intrinsic value will rise and eventually, the market price will reflect this value. Thus market prices alone do not indicate the strength or weakness of a company. Hertz for instance says its share prices rise as it was in bankruptcy. So stock prices are not the only guide.

Should you Buy when Markets are Fling?

Warren Buffets says, “be greedy when others are fearful and fearful when others are greedy.” When share prices tumble across board like they have all year, the fear (as opposed) to greed index always rises. If you have a longe term investment horizon this can be a good time to pick up stock on the cheap. Again, use the prices, if the fundamentals E.EG Return on Equity, Market Share, Cash generated from Revenues are all positive, and the market prices are below a significant moving average e.g the current market price is below 52-week low or 200MA, this could be an opportunity for you. Note that you DON’T buy the dip, you rather buy a stock trading at a price significantly at a discount to its intrinsic value.

Still, I would recommend two ways to buy in a down market

1. Dollar-Cost Averaging: With DCA you are buying the same qualities of stock with the same amount to capture the average of the market process. This way you are not seeking to time the market, but rather taking advantage of swings in the share price. See figure 2

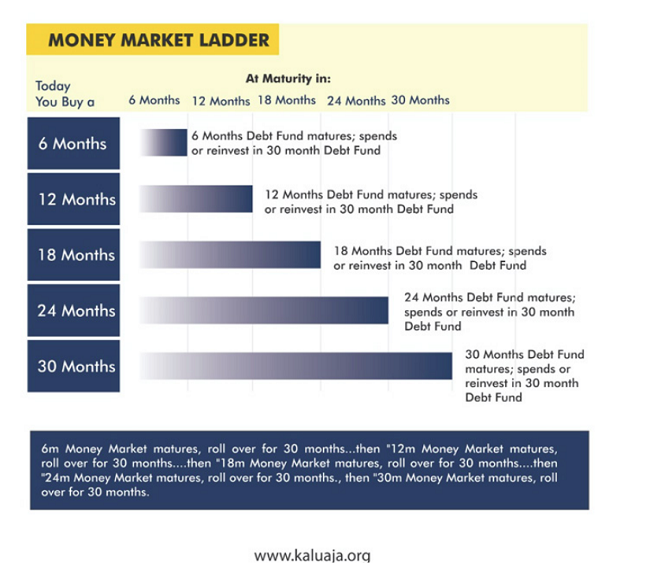

2. CD Laddering: This is especially important as interest rates are slowly moving up. If you are a fixed income investor, you do not want to place all your bets in invest everything in one lump sum, rather, you want to spread out the funds in overlapping duration. This enables you to take advantage of rising rates

In summary, a bear market is an opportunity and also a threat to any portfolio. Where you are exposed because of leverage, close down immediately, where you see pricing opportunities, take them.