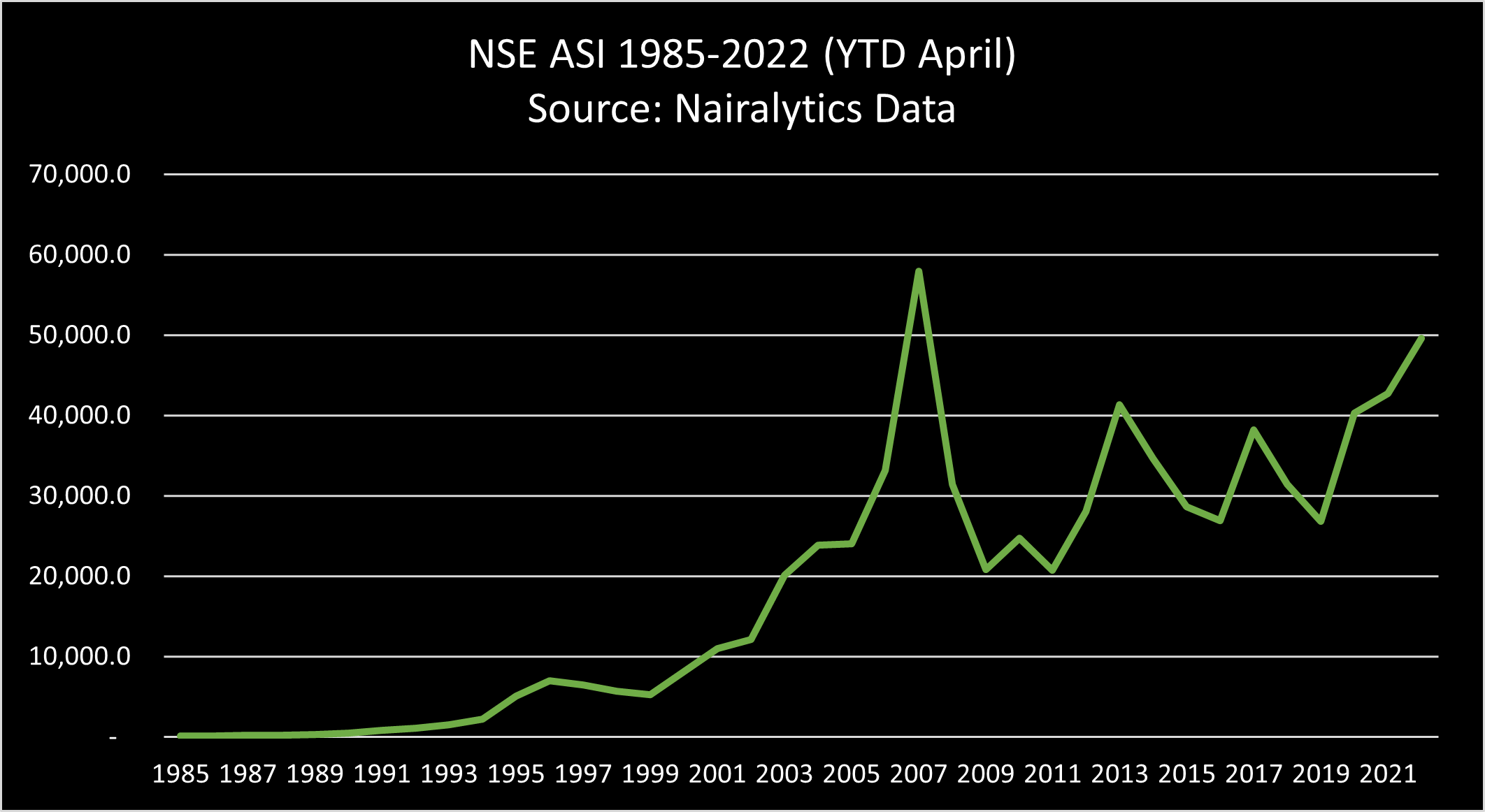

Stocks trading on the Nigerian Exchange reported a collective gain of 16.2% as of the month of April year to date. This is according to data from Nairalytics which includes a historical performance of the Nigerian Stock Market All Share Index since 1980.

Globally, stocks have had a difficult year exacerbated by rising inflation and geopolitical challenges. The Nigerian Economy has also faced difficulties with rising inflation, scarcity of forex, and a rise in Ponzi schemes.

The impending 2023 elections which many expect to be a potential headwind for stocks have also not deterred investors from piling on to Nigerian stocks.

ASI Performance

According to the data, the All-Share Index, which measures the broad performance of all stocks ended the month with a total of 49,965.5 points, the highest since July 2008 when stocks were trading as high as 53,111.09 points.

- That month marked the turning point for stocks as it precipitated the beginning of the great stock market crash of 2008 which saw stocks lose over half of their value in less than six months.

- However, at 49,638 stocks are close to hitting the 50,000 point mark for the first time in over 14 years, marking a remarkable turnaround for the beleaguered Nigerian Exchange.

- The All Share Index has also stayed about 40,000 points consecutively for 8 straight months, the first time since 2008. The last time the All Share Index stayed above 40,000 points for 6 months was in 2014.

- The month of April has turned out to be positive for Nigerian Stocks and has now ended on a positive note for three consecutive months. Stocks ended the month with a 5.69% gain, following 9.1%, 1.65%, and -0.91% returned in January, February, and March respectively.

What is driving the gains?

Several factors could explain why stocks have performed very well this year especially as the stock market globally grapples with the higher inflation rate, higher energy prices, and geopolitical turmoils highlighted by the war between Ukraine and Russia.

What the data is saying: A total of 47 stocks have posted double-digit gains this year alone.

- Among them are stocks in the Pension Fund Index, Nairametrics SWOOTs (Stocks Worth over One Trillion in market cap), Nairametrics FMOs (stocks with majority foreign ownerships), and penny stocks.

- Among the top gainers were Meyer, Wema, and Academy Press with 552%, 386%, and 194% respectively.

- However, the SWOOT all performed well with BUA Foods, Airtel Plc, and Dangote Cement gaining 48%, 45%, and 14% respectively. MTN is also up 9% YTD.

What the market is saying: Another plausible reason is the lack of investment alternatives in the country.

- Most investors are overweight on fixed income securities such as treasury bills, bonds, and commercial papers.

- Thus, they see the stock market as a viable alternative especially with the most highly capitalized stocks at a single-digit price to earnings ratio.

- Some also point to high dividend yields for some valuable Nigerian stocks as an attraction. Dividend yields for some stocks traded at a higher premium to fixed income investments which offered single-digit yields.

- Another interesting thing to note is that most of the investors’ driving volumes are local investors rather than foreign investors.

Sell in May?

While stocks are performing very well, May could be a potential banana slip for Nigerian Stocks.

- A common phrase for most stock market investors is “Sell in May come back in September” referencing market downturns that often occur in the summer period.

- The data also points to this. Since 2018, Nigerian stocks have posted negative returns YTD in May.

- Stocks have also reported YTD losses between May and September, dating back to 2019.

- Another major headwind could be rising yield in the US which could make investments in Eurobonds very attractive to investors.