As the flagship crypto falls, it now faces the prospect of resistance that cemented it at the $40k mark, as traders showed little confidence in a short-term rebound.

In a very busy earnings week for U.S. stocks, bitcoin traded slightly below $39K as of this writing.

Those who are less sensitive to short-term noise may find that the crypto market is now in an accumulation phase, during which the risk/return ratio tends to be a positive bullish indicator of the market direction.

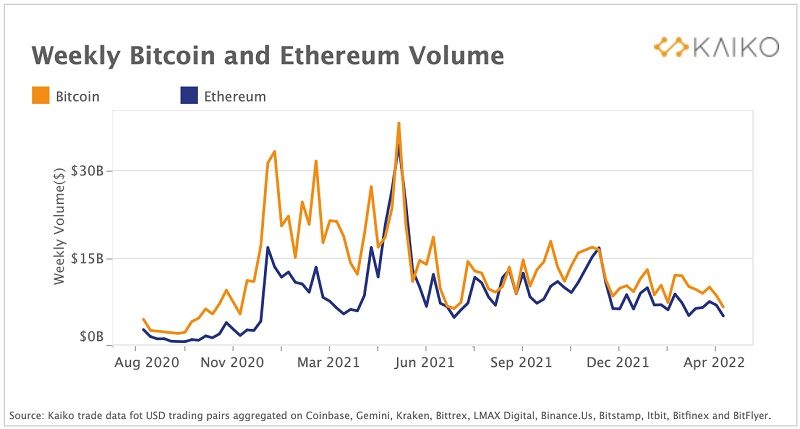

Also buttressing growing accumulation sentiments include Kaiko data revealing that bitcoin and ether (trade volumes on major centralized exchanges decreased to their lowest levels since the short-lived crypto bear market last summer.

Though compared to assets ranging from commodities and gold to tech stocks and even bonds (which have been a disaster), bitcoin has surprisingly underperformed.

It’s not surprising given bitcoin’s positive correlation with equity risk and the stock market’s poor performance generally.

What you should know

- Coinglass, a site that analyzes blockchain data, confirmed that funding rates across derivatives exchanges were firmly negative into the weekend, suggesting that most market participants considered shorting a profitable next move

- According to CoinMarketCap, the global crypto market cap is $1.80 trillion, a decrease of 2.81% over the past day

- In the past, a reversal in the U.S. dollar currency index has allowed Bitcoin to break long-term downtrends.

- BTC prices will likely drop to the $30K demand zone if the $36K-$37K level fails to hold.

- A low RSI indicator is also below 50 points, indicating a change in control, as is the long-term resistance trendline. RSI’s descending trendline needs to be broken for Bitcoin’s price to increase.

- On the bullish side, the 50-day and 100-day moving average lines are the next major resistance levels.

- There’s a chance this relationship will break and bitcoin will trade independently of equities, but it’s difficult to say that the souring macroeconomic backdrop and monetary policy impacting stocks don’t also affect bitcoin.