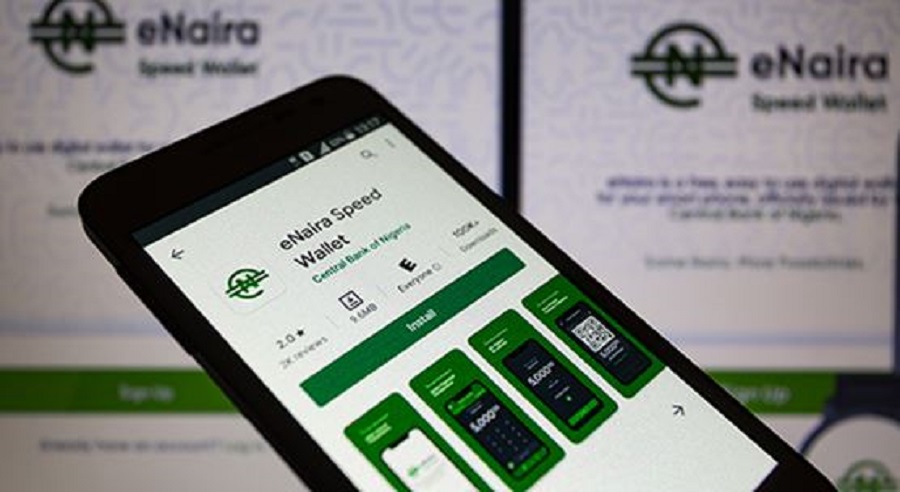

Africa’s first digital currency, eNaira, has been ranked No 1 global retail CBDC, and app downloads have jumped to 756,000 from 700,000 seen in December 2021.

PwC disclosed the ranking in its 2022 CBDC Global Index and Stablecoin Overview. The eNaira has also recorded 700,000 downloads as of December 2021, while over 35,000 transactions have been conducted on the platform.

Yesterday, the Managing Director of Guaranty Trust Bank, Mariam Olusanya, while speaking in a virtual press conference after the Bankers Committee’s meeting, revealed that e-naira wallet downloads have risen to 756,000 in six months. eNaira grew by 56,000 within the first quarter of 2021.

Nigeria ranks number 1

- Nigeria ranked number 1 in terms of retail CBDC projects ahead of 9 other countries currently doing similar.

- In second and third positions are the Bahamas and Mainland China respectively.

- Next were, Jamaica, Eastern Caribbean, Ukraine, Uruguay, Thailand, Sweeden, and the Republic of Korea.

- The report also gave Nigeria’s eNaira a retail index value of 95 while the country also ranked number one in Africa.

- The index is based on a BIS working paper, the World Bank, and PwC analysis.

- Nigeria did not rank for the Wholesale CBDC Project.

What they are saying

Mariam Olusanya said, “since it was launched we have seen 756,000 downloads of the app. In terms of consumer wallets, we have seen 165,000 downloads and 2,800 merchant wallet downloads.”

- Since its launch, the eNaira has reached 160 countries. Members of the Committee, according to Mariam Olusanya, will continue to advocate for the adoption of the e-naira across the country.

- The research also examines the current level of CBDC project development, taking into consideration central bank views and public interest, according to a statement on PWC’s website.

- “Retail projects in the Index are led by the Central Bank of Nigeria’s (CBN) eNaira, the first CBDC in Africa, and the Sand Dollar, issued by the Central Bank of the Bahamas as legal tender in October 2020, making the Bahamas the first country to launch a CBDC,” PwC said.

- According to the PwC analysis, more than 80% of central banks are planning or have already launched a CBDC.

What you should know

- The IMF has warned about the potential expansion of the use of the eNaira for cross-border fund transfers and agency bank networks could lead to new money-laundering and terrorism financing risks.

- The IMF welcomed the gradual rollout of the CBDC and highlighted the need for vigilance to various risks, including monetary policy implementation, bank funding, cyber security, operational resilience, and financial integrity and stability, through regular risk assessment and contingency planning.

While eNaira struggles to complete N188 million transactions in 3months, China’s e-CNY has outpaced it by completing 2 million yuan (approximately $315,761 or N131.35 million) in a single day. China’s Central Bank Digital Currency (CBDC), the e-CNY, is being used to make $315,761 or more of payments a day in its pilot at the Beijing Winter Olympics.

Africa’s first digital currency, eNaira, has recorded less than 10% in P2P transactions while Person to Bank and Bank to Person constitute 90% eNaira transactions.

What are the specific risks involved in the P2P ENaira transactions?

I would expect the risk to be just about the same as normal p2p Naira transactions because your enaira wallet is linked to your normal bank account.

I found a useful service. You can check out “Exchange Naira” if you want to circumvent CBN dollar limits to fund your dollar account, make an international purchase by card above $20 since the provide card details for this or send money abroad.