The Joint Admissions and Matriculation Board (JAMB) has announced that notification slips for its 2022 mock Unified Tertiary Matriculation Examination (UTME) is ready for print out.

JAMB had in February in a previous update announced that the mock examination exercise had been rescheduled to April 9 as against the earlier date of April 16.

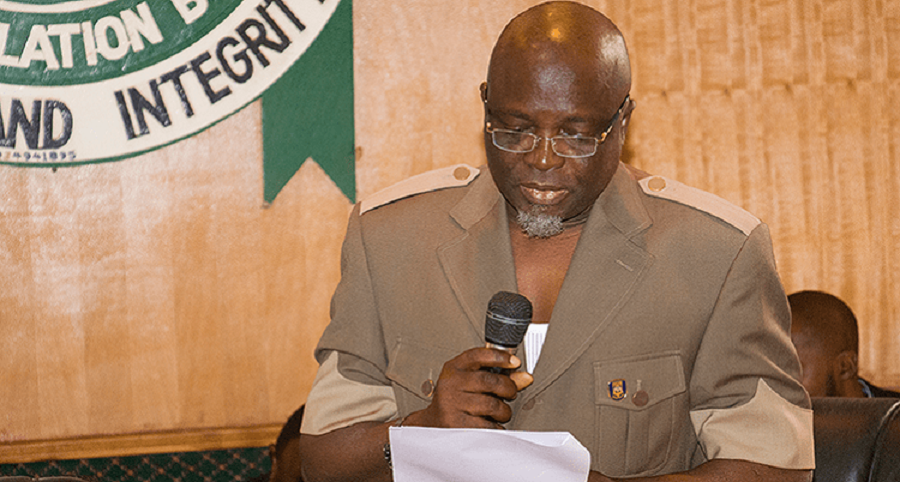

This was made known by the examination body in its Weekly Bulletin from the Office of the Registrar on Monday in Abuja.

JAMB in its update said that candidates, who registered for the UTME and indicated interest to sit for the exercise could now proceed to print out the slips, which contained their examination centres.

What JAMB is saying in the latest update

JAMB said, “The notification slips can be printed anywhere at the candidates’ convenience by visiting the board’s website at www.jamb.gov.ng.

“The examination slips contain the venue, time, date and other necessary instructions for the examination.”

It said that candidates were expected to pay N1, 000 to the Computer Based Tests (CBT) centres where they would sit for the examination as service charge.

JAMB noted that while the service charge was for candidates’ use of the private facilities used for the examination at the centres, those that will take the mock examination at JAMB CBT centres would not be required to pay for these services.

The board explained that the increase from the initial N600 to N1, 000 service charges for the mock was due to the prevailing high cost of diesel and other consumables needed to host the exercise.

It stated, “The board has thought this through and instead of cancelling the mock UTME, which has improved the confidence of candidates when sitting for the examinations, it is better to increase the service charge.

“This, we believe will make the exercise worthwhile to participating centres.”

What you should know

- It can be recalled that the registration exercise for the 2022 UTME/DE ended on March 26, with the main examination scheduled to hold from May 6 to May 16.

- The examination body had earlier revealed that a total number of 1, 837, 011 candidates are registered for the 2022 Unified Tertiary Matriculation Examination (UTME)/Direct Entry (DE) as the exercise came to an end.

Can someone do reprinting twice, coz i have done it before but i want to print out again

Yes,I think you can do reprinting twice