Global Events

While tensions from Eastern Europe have gradually eclipsed the Covid-19 pandemic as the leading market and economic disruptor, the recent job update from the U.S. has provided a clearer signal that the economic impact of the pandemic has increasingly waned, with the labour market delivering brilliant numbers in February 2022. The non-farm payroll report for February was released by the Labor Department’s Bureau of Labor Statistics today, revealing that 678,000 jobs were added in the review month. The job gains recorded dwarfs Wall Street’s expectations of some 440,000 job growth, and also brings the economy closer to its pre-pandemic level.

Similarly, the unemployment rate for the review month stood at 3.80%, printing behind an anticipated level of 3.90%. Decoupling the jobs report, leisure and hospitality championed the job gains adding 179,000 in February, and the sector was trailed by professional and business services, healthcare, and construction, which saw non-farm payroll gains of 95,000, 64,000, and 60,000, respectively.

For the market, the attention remained steered towards fallouts of Russia’s invasion of Ukraine, as well as the spiraling inflation rate in the U.S. that is currently flirting with levels last seen since the wake of the 1970s stagflation. On the policy end, deliberations of the U.S. Federal Reserve concerning the crisis in Eastern Europe is not expected to deter an anticipated quarter-percentage-point hike in March, with February’s sturdy non-farm payroll performance serving as a catalyst to embrace a more contractionary policy approach.Elsewhere, despite elevated crude oil prices, with Brent futures trading as high as US$114 per barrel as of print time, the OPEC+ bloc has shrugged off pressures to accelerate supply, sticking to its earlier agreed output increase plan. At the bloc’s policy meeting held during the week, the producer alliance retained a modest output increase of 400,000 barrels per day in April, forcing nations to further embrace the difficult option of tapping into their strategic oil reserves.

Money Markets

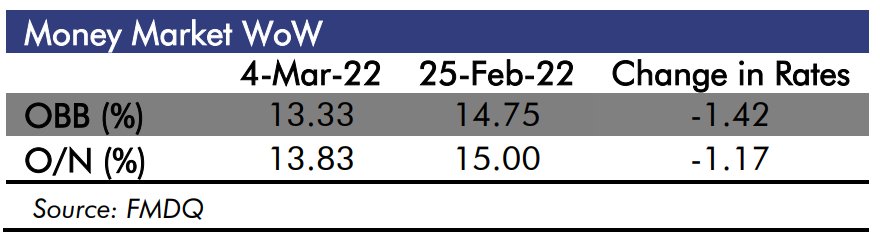

System liquidity was elevated for most of the week, bolstered by inflows from an OMO repayment and the FAAC allocation for February. However, the liquidity in the system was drained today by a CRR debit and the retail FX auction funding. Nonetheless, the Open Buy Back (OBB) and Overnight (O/N) rates fell by 1.42% and 1.17% to 13.33% and 13.83%, respectively. We expect interbank rates to hover around current levels, in the absence of major flows.

Treasury Bills

Treasury Bills

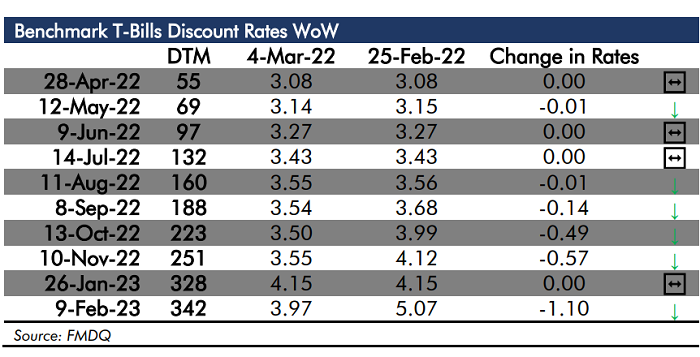

The treasury bills market was mostly quiet this week, albeit with some aggressive cherry-picking. Average benchmark yield declined by 23bps to 3.23%.We expect activity to be steered towards next week’s PMA.

Bond Market

Bond Market

The local bond market was mostly bullish this week, as massive liquidity inflows drove interests across most maturities. Average benchmark yield dipped by 41bps to 10.56%.We expect the bullish bias to wane significantly, given the absence of any catalyst.

Eurobond Market

Eurobond Market

The Eurobond market was bearish all week, albeit with some brief moments of respite. The escalating tensions in Eastern Europe sustained a global risk-off sentiment, hence, fueling selloffs across board on the Nigerian sovereign curve. Average benchmark yield advanced by 52bps to 7.99%, week on week. We expect market sentiment to remain influenced by fallouts of the war in Eastern Europe. FX Market

FX Market

The Naira depreciated against the US Dollar by 16bps to $1/₦416.67 at the Investors and Exporters FX Window this week.

Equities Market

Equities Market

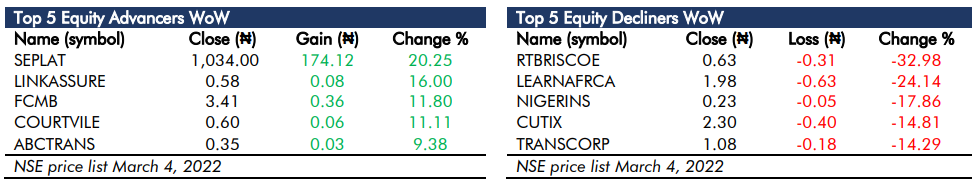

Bulls resurfaced on the local bourse this week, with gains recorded in four of the five trading days of the week. At the close of the market today, the benchmark index rose by 0.40% week on week, to close at 47,328.42 points. Year-to-Date return settled at 10.80%, while the Market Capitalisation stood at ₦25.51 trillion. However, investor sentiment as measured by the market breadth closed positive at 2.15x on the back of 43 advancers and 20 decliners.Volume traded rose by 3.05%, while value traded fell by 31.76%, week-on-week. The most traded stocks by volume were TRANSCORP (231.05 million units), UCAP (141.31 million units) and ZENITHBANK (119.31 million units), while ZENITHBANK (₦3.22 billion), UCAP (₦1.91 billion) and SEPLAT (₦1.85 billion) topped the value chart for the week.We expect the bullish momentum to persist next week, as earnings updates and declining fixed income yields act as catalysts.