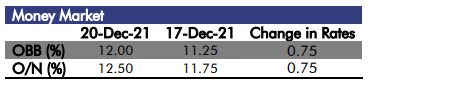

Money Market

In the absence of significant flows, system liquidity was relatively stable today. Nonetheless, the Open Buy Back (OBB) and Overnight (OVN) rates each rose by 75bps to 12.00% and 12.50%, respectively.

We expect interbank rates to hover around current levels, barring any significant flows.

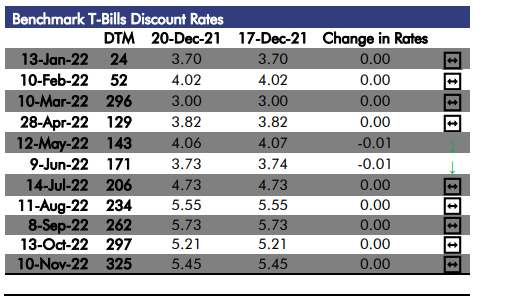

Treasury Bills Market

The treasury bills market was relatively quiet today, with minimal volumes traded across board. Average benchmark yield fell marginally by 1bp to 4.45%.

We expect the market to remain tepid in the near term.

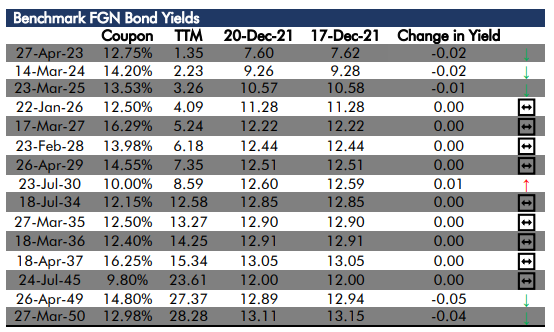

FGN Bond Market

The bond market swayed sideways today, with minimal volumes traded across board. Average benchmark yield declined marginally by 1bp to 11.88%.

We expect the seesaw trend to persist, in the absence of any catalysts.

FGN Eurobond Market

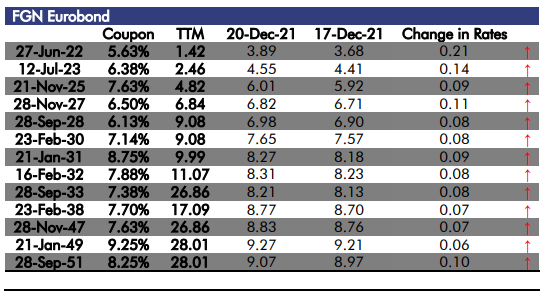

The Eurobond market was bearish today, as the persistent decline in crude oil price continues to weigh on market

performance. Average benchmark yield rose by 10bps to 7.43%.

We expect the bearish bias to persist, as global sentiment remains frail.

Currency Market

The Naira appreciated against the US Dollar by 6bps to $1/₦414.80 at the Investors and Exporters FX Window.

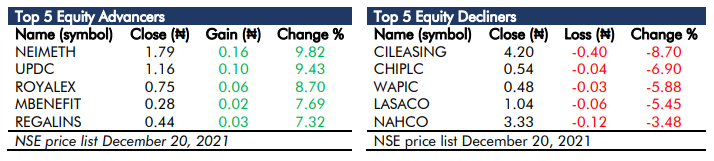

Equities Market

The equity market was bullish today, supported by gains in large tickers like DANGCEM (0.59%). The benchmark All Share Index advanced by 10bps to 42,394.71 points, while Year to Date return and Market Capitalisation settled at 5.27% and ₦22.13 trillion, respectively. However, market breadth closed negative at 0.52x, as we recorded 11 advancers as against 21 decliners.

Volume traded dipped by 58.42% to 142.07 million units, while value traded fell by 29.68% to ₦2,485.87 million.

The most traded stocks by volume were FBNH (20.19 million units), GTCO (10.57 million units) and SOVRENINS (10.11 million units), while DANGCEM (₦726.27 million), MTNN (₦357.20 million) and GTCO (₦270.91 million) topped the value chart.

We expect the quiet trend to persist tomorrow.