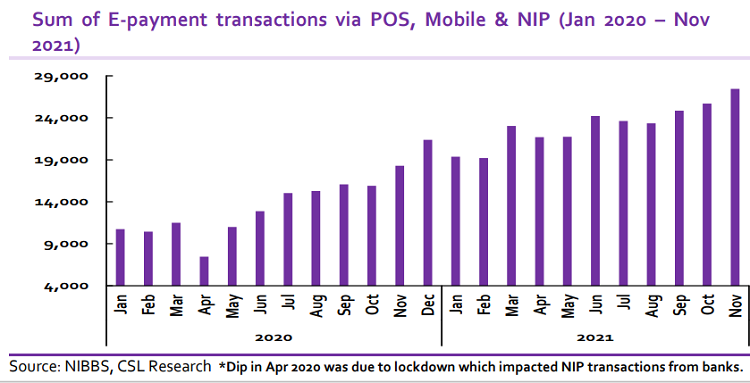

Recent data from the Nigeria Inter-Bank Settlement System (NIBSS) showed solid growth across the various e-payments channels for the 11 months of 2021. NIBSS Instant Payment (NIP) transactions recorded a 75.3% y/y and 74.2% y/y growth in transaction value and volume to N241.7tn and 3.1bn, respectively.

For POS transactions, total transaction value and volume also rose 38.1% y/y and 52.9% y/y to N5.7tn and 883.3m, respectively. The Mobile Inter-scheme transfers category saw the most impressive growth where transaction value was more than twice as tall, beating that of 2020 by 165.1% y/y to N6.9tn. Similarly, transaction volume grew 114.6% y/y to 249.0m.

The continued growth in e-payments transaction volume and value in Nigeria reflects an enduring shift away from cash. This has also been driven by the increasing internet & mobile penetration as well as investment by banks and other payment-based fintech companies in payment technology infrastructure. Beyond that, the pandemic which allowed the populace to spring quickly to the use of banking apps and USSD transfer channels to transfer funds have proved supportive in the remarkable rise in Mobile inter-scheme transfers.

Furthermore, the growth in POS transactions shows the increase in agency banking services. We believe the newly launched e-Naira if fully integrated into e-payment channels, will also spur growth.

Nigeria’s significantly under-tapped digital payments industry is poised for significant growth, which lends credence to the increasing foreign capital flow to the sector. A myriad of factors across industry fundamentals, positive country demographics, and regulatory support have formed the base for expected accelerated growth for the Fintech industry in Nigeria.

This expectation has received much attention from investors, which has led to significant investments as existing players look to position for future growth. The Fintech industry in the country has seen funding rounds from various global investors since 2014, either through equity or grants.

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.