For about two years, every time the price of popular cryptocurrencies or stocks has dropped by more than 10% it has bounced back and recovered the loss in a few weeks or days. If, like most people new to financial markets, your investment time frame is a few weeks or months, buying the dip must have worked unimaginably well for you these last few months.

That trend is shifting. Buying the dip as a quick way to make a profit is likely to stop working for a while.

We’ll explain why in a few. First, let’s get a few terms out of the way.

1. Inflation: Let’s look at inflation from the eyes of a primary school pupil. Assume he gets pocket money of ₦250 every school day and likes to buy four (4) things: a biro, a bottle of Fanta, an egg roll, and chilled Fanice yoghurt. The cost of the items over the years look like this:

Looks like not even primary school pupils are spared from the effects of inflation. The pocket money that used to be enough can now buy only half of their needs. They must now either settle for buying fewer things or beg for more pocket money.

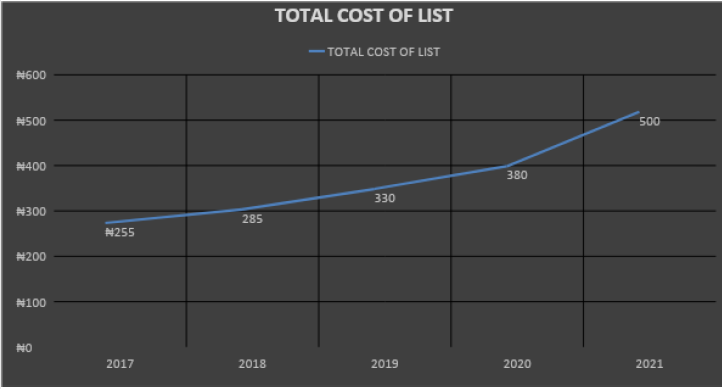

Here’s another illustration. The government keeps a list of products and services the average household relies on. This list is popularly called the Consumer Price Index (CPI) which is used to monitor the cost of those products and services over time. If the total cost of purchasing items in the list goes up, it means that inflation is on the rise.

2. Real interest rate: Let’s assume you had put $2000 (₦1,015,200) in your PiggyVest at the beginning of the year and they promised to give you 8% of your stash by December 2021. Now, you have $2160. Your ₦1,015,200 is now worth $2160 (₦1,231,200). When you convert to Naira, you’re excited because you’ve made a +23% gain.

Or so you thought. Because inflation in Nigeria for 2021 is around 14.7%, your real interest is only 8.3% on the Naira. In essence, you can now buy a mere 8.3% more goods and services in Nigeria than you could in January, despite saving in dollars. A useful way to think of the real interest rate is to look at it as the purchasing power of your capital + profit after you have subtracted inflation.

3. Risk-free rate: Investors assume that the Government will always repay their local currency debt since they can technically print more money and pay back, so whatever rate the government is offering on government bonds is risk-free.

Now, you’re probably wondering the connection between these terms and assets dipping.

Why assets are likely to drop further

The U.S Federal Reserve has two key jobs:

- To manage inflation (in practice, they try to keep inflation around 2%)

- Keep unemployment rates low (around 3%)

At the beginning of the pandemic in 2020, nobody knew how or if the global financial system would survive. Risk, fear and uncertainty was high. Investors rushed to sell their assets since nobody knew what the economy would look like after the pandemic. By March 2020, the most important U.S stock index had lost more than 35% of its value. Creditors were unwilling to lend money to companies and the risk of a systemic failure in the global

financial markets was imminent. To avoid a global financial disaster, the U.S Federal Reserve reduced the risk-free interest rate and made it negative. In effect, if you bought a government bond after the pandemic last year, you would have lost money, despite being generally considered risk-free . This policy forced people and institutions with lots of cash to invest in the economy instead of parking it in safe government bonds.

Since then, the job market has largely recovered from the COVID-19 slump (unemployment rate is now < 4.5% from > 14% in 2020), the S&P index price has now grown by more than 100% from the lows. At 6%, the inflation rate has overshot the government’s target of 2% annual inflation by a lot.

The Chair of the Federal Reserve, Chairman Jerome Powell, has stated that inflation in the U.S is becoming a problem (> 6%). He has officially stopped using the word “transitory” (which refers to a temporary sort of inflation) to describe the current rise in inflation. To rein in the inflation, the Federal Reserve has begun tapering (reducing the economic stimulus packages such as their mortgage-backed securities purchases). A reduction in the Federal Reserve’s asset purchase program would mean an increase in interest rates on the government bond and in the broader economy. You’ll soon see why this is important.

When the real risk-free rate (remember, it’s the real interest rate on the government bond after you’ve subtracted inflation) is high and attractive. Investors prefer to invest in government bonds because they can make enough to beat inflation without taking on any risk. When the risk-free rate is low, people don’t have the option to avoid risk and earn decent interest on their capital so they get into riskier investments with the hope of making a good profit.

When the inflation rate is high and the real risk-free rate is low and negative, people are forced to invest in risky assets with the hope of beating the high inflation. This is obvious in Nigeria — people are attracted to very risky assets, in part because of the promise of high returns, since money deposited in the bank loses value quickly. Nigerians need high returns to stay above water.

Given the current market conditions and asset valuations, the Federal Reserve Chairman’s announcement that they no longer see the high inflation as transitory, and that they have begun decreasing the amount of assets that the Federal Reserve purchases to support the economy makes investors wary of investing. If the Federal Reserve increases interest rates and makes the returns attractive, a few things will happen:

i. Large investors will prefer to put their capital in risk-free government bonds

ii. Cost of borrowing will go higher across the broader economy.; Since people would be able to beat inflation by holding government bonds, if a company or individual wants to loan some money, lenders would make their interest rates relatively higher than the risk-free rate.

iii. Much less capital would be used to buy into riskier asset classes.

iv. Prices of riskier assets will drop substantially.

In summary, larger investors (institutions and HNI’s) currently invested in riskier assets (such as stocks and crypto) because the risk-free rate is low and inflation is high would move most of their capital away from risky assets and into government bonds if the risk-free interest rates become more attractive. In short, if governments make their interest rates attractive again, it will reduce the number of people and institutions willing to take risk with their capital.

The increased probability of the risk-free interest rate going higher and the suspension of the Fed’s asset purchase program will mean that capital markets would likely lose some of their gains in the midterm as people would prefer to invest their capital in government bonds and less volatile asset classes.

Over the next few months we expect higher volatility in financial markets as investors try to figure out the government’s response to high inflation and a heated jobs market. The Federal Reserve has given some direction on macroeconomic policy going into next year and it implies some tightening, which means there’s less capital available to drive up prices of financial assets. Our primary advice would be to reduce leverage on your investments and to buy dips on volatile assets with more caution.

Written by Uyoyo Ogedegbe and Oluwafemi Fadahunsi