Recently, Honeywell Group Limited (HGL) announced a deal to combine Honeywell Flour Mills Plc, one of its portfolio companies, and FMN. The deal, which is expected to go through before the end of 2021, is subject to regulatory approval. It will see Honeywell Group Limited transfer its 71.69% stake in Honeywell Flour Mills Plc to Flour Mills of Nigeria.

This transaction put Honeywell Group on the radar for many, as many were conversant with Honeywell Flour Mills, as opposed to the investment company, and the parent company of the foods manufacturing company as well as many other companies.

Here are three important things you need to know about this deal and the company leading the transaction.

1. Honeywell Group – a leading investment company

Honeywell Group is a leading investment company that began as a food trading company servicing the West African region before pivoting to importing a variety of goods including dairy products, stockfish, glass, and steel rods for the domestic Nigerian market.

It has evolved into an investment company, participating in major sectors of the Nigerian economy including foods, financial services, telecommunications, real estate, leisure and hospitality, energy, infrastructure, and security management, in the past 49 years. Honeywell Group invests heavily in these industries through its portfolio companies such as Pivot Engineering, Pivot Energy Services Group, Pavilion Technology Ltd, Uraga Real Estate (owners of Radisson Blu Anchorage, Victoria Island) and strategic investments like Airtel Nigeria and Fan Milk which it has successfully exited.

And now, the company has spearheaded an N80 billion agreement to ensure that Honeywell Flour Mills Plc (makers of the popular Honeywell Pasta, Spaghetti, Semolina, etc.) will merge with the only company in the country that can create a food business that is better positioned to benefit the growing Nigerian population and leverage opportunities stemming from the African Continental Free Trade Area (“AfCFTA”).

2. The transaction brings together two of the largest food manufacturers in Nigeria

On its own, Flour Mills of Nigeria is the largest flour milling company in Nigeria and has been operating for over 60 years. It began operations as a single flour mill in 1960 and has grown into a national conglomerate with an installed flour milling capacity of approximately 12,000 metric tonnes per day. It serves Nigerians through a diversified food portfolio built upon five core food value chains: grains, sweeteners, oils and fats, proteins, and starches.

Honeywell has also proven to be a formidable force over time, particularly in recent years. Its most recent financial results revealed that it grew its revenue by more than 36%, from N80.45 billion in 2019 to N109.59 billion in 2020. It also increased profit by 73.1% from N650.49 million in 2019 to N1.13 billion in 2020. In 2020 alone, its pasta production factory in Sagamu produced 138,600 metric tonnes of pasta and generated more than N19 billion in revenue. Its plants in Apapa and Ikeja also generated a combined N90.51 billion in revenue.

3. It is a merger of two robust businesses that have contributed highly to employment in Nigeria

The Honeywell Group is a family-owned investment holding company of Nigerian heritage that has transcended generations. It is well-established across critical sectors of the economy, including foods, real estate, infrastructure, energy and financial services, employing over 10,000 people in the process.

Over twenty years, HGL has invested in its portfolio company, Honeywell Flour Mills Plc, to build a robust wheat processing business alongside a manufacturing system that produces a range of staple foods, including baking flour, semolina, noodles and pasta.

Flour Mills of Nigeria, on the other hand, has a vast product portfolio and a wide distribution network that spans across the country. Its portfolio includes the largest single-site flour mill and most significant greenfield sugar production investment in Nigeria. It also has the largest edible oil and margarine factory and largest sorghum milling in Sub-Saharan Africa. FMN reports revenue over N770 billion through its vast operations and has always been at the forefront of Nigeria’s industrial development, employing around 15,000 people across the country.

4. The merger potentially creates a national champion for food manufacturing in Nigeria

The proposed merger will lead to a more resilient national champion for food manufacturing in Nigeria. This will ensure long term job preservation and create additional opportunities across different levels of operations. The new singular entity will benefit from the more than 85 years of combined history and track record of FMN and HFMP.

Through consistent investment in its infrastructure, HFMP has grown from a 200-metric-tonne per day business (70,000 metric tonnes per annum) to producing a capacity of 835,000 metric tonnes per annum. It now sits on an exclusive list of food and beverage businesses that have generated revenue of over N100 billion.

By merging with FMN, the new combined entity will give customers access to a broader range of products and provide a platform for a more proficient line of innovation. Employees will have access to more opportunities within the combined entity and will continue to help the company play a vital role in Nigeria’s food production and security.

Nigeria needs more viable and sizable businesses that have the financial capacity to invest massively in backward integration. The country will benefit from the companies’ focus on developing the agricultural value chain and backward integration of the food industry, ultimately improving food security.

The merger also creates a platform to strengthen the business, enhance growth potentials, and create many more jobs in the future. Beyond the jobs created, the increased productivity will also lead to higher levels of knowledge acquisition and transfer within the workforce as there will no doubt be a deeper investment in technology. The merger also provides a chance for talents from both companies to combine their unique abilities and strengths.

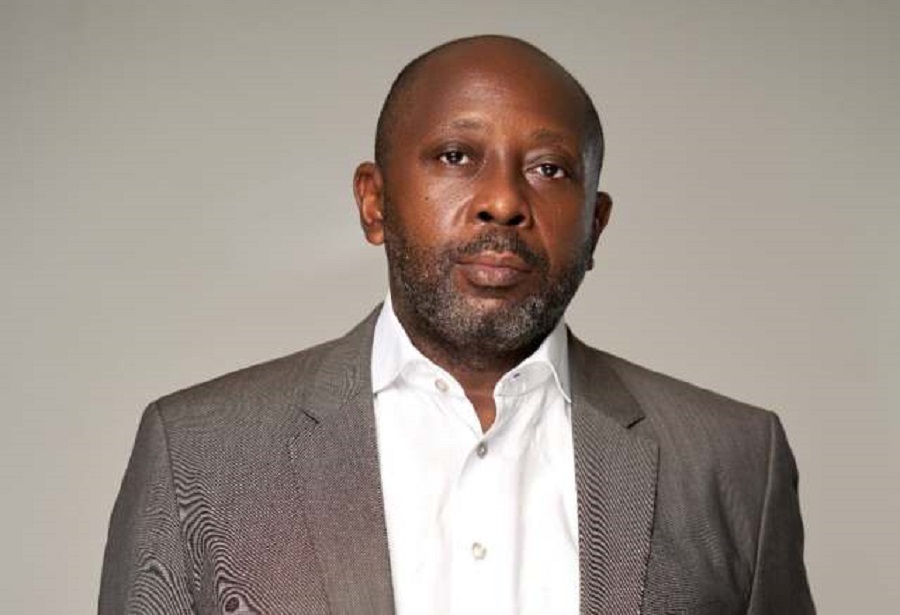

Oluwaseun Olanrewaju, an investment analyst writes from Lagos.

This article is not complete without a mention of the caveat from Ecobank and the intrinsic implication

It is also worth pointing out that Honeywell did NOT exit Airtel. Oba otudeko was forced to sell his 14% shareholding in airtel(Through his strategic SPV Broadview Engineering) because he had an outstanding loan with Standard Chartered for 120 million dollars (for which the shares in Airtel was the collateral). A similar thing is playing out now with the Honeywell flour mills shares and his 75 billion (Or is it 77 Billion naira) loan with First Bank after being eased out unceremoniously by the current CBN governor