The current price of petrol is 165 naira per litre.

The potential price of petrol after subsidy may range from 320 – 340 naira per litre according to Malam Mele Kyari, the Group Managing Director and Chief Executive Officer of Nigerian National Petroleum Company Limited.

How will Nigerians react to a 100% jump in pump price? The cost of road travel will increase, Uber and other driver-hailing apps will increase their fares to align with the potential pump price. Inflation will spike up by another 2-5%. Goods and services will become more expensive as businesses adjust to fuel pump prices.

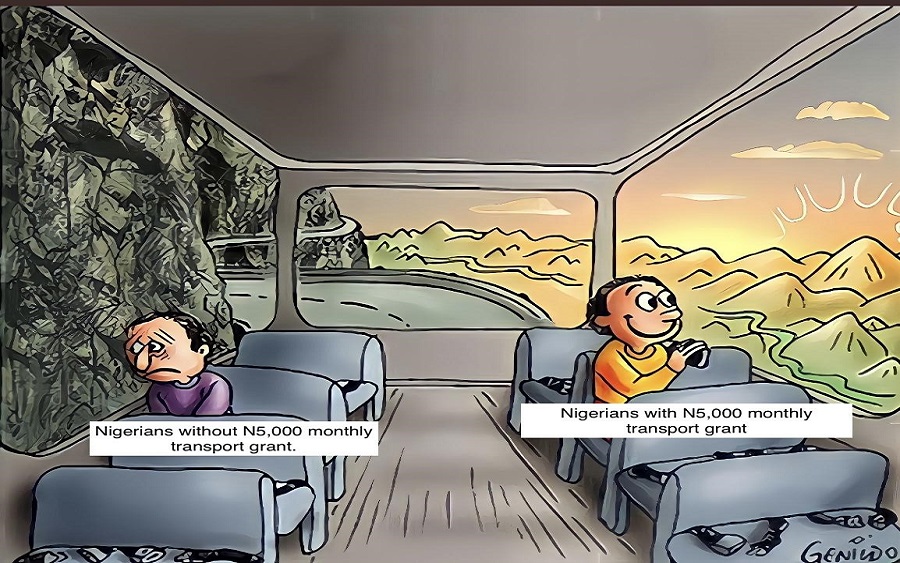

But not to worry, the Federal Government is preparing a package to protect poor Nigerians from this increase in price. According to Zainab Ahmed, the Minister of Finance, Budget, and National Planning – between 30 and 40 million poor Nigerians will benefit from a transport grant intervention of N5,000 monthly.

So N5,000 by 40 million poor Nigerians would equate to N200 billion monthly and N2.4 trillion for 12 months – the maximum period the Minister stated the transport grant might go on for.

Note: Earlier in the year, the cost of premium motor spirit (PMS) subsidies according to NNPC GMD, Mele Kyari was between N140 billion and N150 billion monthly.

So why are subsidies being removed if they are going to be substituted for grants that will not benefit over half of the entire population? Because there has been pressure from International bodies (IMF and World Bank), experts, and State governors to end the subsidy scheme and deploy the resources to other sectors like healthcare, education, and infrastructure.

So does the transport grant fall into any of these sectors? Apparently not.

Transport grant is still in the same socialism bracket with subsidies. Same objective. Same social contract to cushion the people from expensive fuel prices.

Additionally, the Minister of Finance has also raised concerns about registering these 40 million “poor” Nigerians for the intervention scheme. Bank Verification, National Identification registration etcetera.

So it seems the intervention is an inchoate idea to pacify the Labour unions who would automatically oppose and react to the removal of the subsidies – who in their jurisdiction are obliged to protect Nigerians.

Another grouse with this development is what happens to other Nigerians? Do they now resort to the life of Americans who pray oil prices don’t rise so that they can enjoy cheaper fuel? But would that not be disingenuous given that Nigeria relies on high oil prices to fund the majority of her budget and 90% of her foreign earnings?

In addition to the Finance Minister’s plans for post-subsidy life, Zainab Ahmed also said the Government was planning and deploying compressed natural gas (CNG) which is an alternative mass transit fuel to PMS.

An ideal situation for transiting to post-subsidy life should have been a laid-down infrastructure with cheaper buses and other means for every Nigerian to make use of. A phased transition out of subsidies where the cost of living improved significantly to the costs of fuel price. It should be in phases – not a sudden removal.

The Government should also have a mechanism in place to checkmate oil companies or marketers who would want to take advantage of the situation and inflate prices in the name of “exchange rate, distribution costs, freight costs, landing costs, and other “costs.”

Recently, the President of the United States, Joe Biden asked the Federal Trade Commission to examine oil and gas companies and their role in rising gasoline prices citing “potential illegal conduct.” A similar scenario might play out in Nigeria. The Government should be prepared as historical antecedents prove marketers can play foul.

The removal of fuel subsidies is a good step towards the economic and social development of Nigeria. Practically, Nigeria is one of the cheapest countries in the world to buy fuel and that is why people engage in smuggling fuel out to neighbouring countries to sell at higher prices for round-tripping profits.

Over the years, subsidies have exerted huge costs on the country. In a particular month recently, Nigeria spent N150 billion subsidizing petrol. Using data obtained from Tracka.ng, a community of active citizens tracking the implementation of government projects in Nigeria – the average cost spent on health care centres, skill acquisition centres, and school blocks range from 50 million naira upwards. At that price, the cost of that particular month’s subsidy could fund 3,000 of these types of projects.

In truth, subsidies should have been long gone and with the development and construction of private and public refineries coming into play in the next few years, Nigerians will have to hold on tight to the “short-term” inconvenience.

The jury is still out on whether fuel would be cheaper when refineries such as Dangote’s come into play. But with the 2023 elections coming after next year, there is a possibility politics might delay the subsidy removal. No Government would want to hold the tainted record of “N340 to 1 liter” as this has been a focal point for campaigns over the years alongside Naira-Dollar exchange rate promises.

Hopefully, with the Energy Information Administration (EIA) expecting the price of Brent Oil to fall from an average of US$84 per barrel in October 2021 to US$66 per barrel in December 2022, fingers are crossed that the price at the pump would not be too harsh for Nigerians without “transport allowance.”

This should be seen as an opportunity to build functional public transportation systems across the country and within major metropolitan areas. There is no reason for private car usage to be as high as it is, particularly in Lagos, where traffic is just pitifully poor.

Of course, that requires a level of investment and future focused planning that no government has yet to exhibit in 22 years of “democracy”.