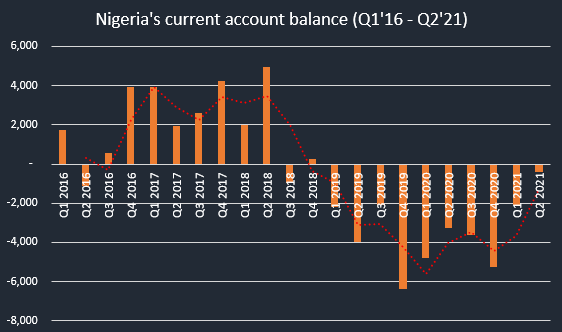

Nigeria recorded a current account deficit of $424 million in the second quarter of 2021, dropping to its lowest level in over two years. This is according to data on Nigeria’s balance of payment from the Central Bank of Nigeria (CBN).

Although Nigeria’s balance of payment continues to trail in the negative region, it dropped significantly by 79.8% compared to a deficit of $2.1 billion recorded in the previous quarter. Also, it reduced by 87% compared to a deficit of $3.27 billion recorded in Q2 2020.

The upward movement in the country’s balance of payment is attributed to the significant surge in crude oil export. Notably, crude oil export increased by 73% quarter-on-quarter in Q2 2021 from $6.48 billion to $11.22 billion. Compared to the corresponding period of 2020, crude oil export increased by 116.7% from $4.31 billion.

Read: Nigeria records highest trade deficit since 1981

It is worth noting that the rally in the global crude oil market and the reopening of economies and relaxation of lockdown measures around the world are major contributing factors to the surge recorded in the value of Nigeria’s crude export. However, when compared to pre-pandemic levels, we are yet to earn as much from crude oil exports. This is due to the decline in crude oil production.

According to data from the National Bureau of Statistics, crude oil production has hovered around 1.6 million barrels per day in the past year as against an average of 2.02 mbpd before the pandemic.

Read: FG to borrow again to finance N6.258 trillion 2022 budget deficit

Highlights

- In the period under review, goods worth $12.61 billion were exported, representing a 63.5% increase compared to the prior quarter.

- On the other hand, importation of goods stood at $11.55 billion in review period, resulting to a net credit of $1.06 billion.

- In terms of services, a net negative current account of $4.67 billion was recorded, increasing by 58.7% compared to a deficit of $2.94 billion recorded in the previous quarter and 80.6% increase when compared to a similar deficit of $2.59 billion in Q2 2020.

- Nigerians spent a sum of $1.54 billion on travelling in the period under consideration, an increase compared to the previous period. This is largely due to pent-up travel obligations carried over from the period of lockdown in major countries around the world.

Read: Can Infra-Co finance Nigeria’s infrastructure deficit?

Nigeria has now endured a negative balance of payment for 10 consecutive quarters, since Q1 2019. However, considering the appreciation in global crude oil prices as the economy continues to reopen amidst intensified vaccine roll-out, which could, in turn, see remittances receive some form of boost, we are likely to see positive numbers in the coming quarters.

Backstory

Nairametrics reported that Nigeria’s current account deficit stood at $1.75 billion in the first quarter of the year, due to a decline in foreign direct investments and diaspora remittances. However, the apex bank has reviewed the data downwards, as the deficit eventually stood at $2.1 billion in the period.

Read: BOP review: Nigerians spend $3.1 billion on foreign travels in 6 months

A cursory look at the foreign trade data from the NBS shows that Nigeria’s foreign trade deficit dropped in Q2 2021 to N1.87 trillion from N3.94 trillion recorded in the previous quarter. Just as the balance of payment has maintained a negative position since Q1 2019, Nigeria’s foreign trade balance has also been in a deficit since Q4 2019, exacerbated by a significant increase in import value.

What you should know about BOP

Balance of Payment (BOP) is a statement that records all the monetary transactions made between residents of a country and the rest of the world during any given period. It is ideal in measuring whether a country has a surplus or deficit of funds.

- It measures the inflow and outflow of goods, services, investment incomes, and transfer payments.

- There are basically three components of the balance of payment, which are the current account, capital account, and financial account.

- A balance of payment statement can be used as an indicator to determine whether the country’s currency value is appreciating or depreciating.

- The recent data points to the fact that Nigeria’s currency is still under pressure, which is why the federal government turned to the international debt market to source funds in other to boost the country’s forex reserve and aid its continued intervention in the market.