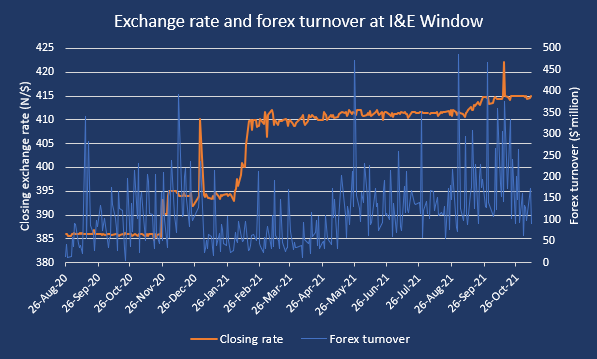

Tuesday, 9th November 2021: The exchange rate between the naira and the US dollar closed at N415.07/$1 at the Investors and Exporters window, where forex is traded officially. Naira depreciated further against the US dollar to close at N415.07/$1 on Tuesday 9th November 2021, representing a 0.13% decline compared to N414.55/$1 recorded at the close of trading activities on Monday, 8th November 2021.

This also represents the second consecutive depreciation in the exchange rate. Meanwhile, naira continues to trade at N570/$1 at the parallel market, maintaining the same rate since 1st November 2021. This is according to information obtained by Nairametrics from BDC operators in Lagos.

Nigeria’s foreign reserve resumed the week with a $103.69 million decline on Monday to close at $41.6 billion. This represents a 0.25% decline compared to $41.7 billion recorded at the end of the previous week.

READ: Naira falls at official market as forex turnover surges by 74%

Trading at the official NAFEX window

The exchange rate depreciated against the US dollar on Tuesday, 9th November 2021 for the second day in a row, to close at N415.07/$1 compared to N414.55/$ recorded in the previous trading session. This represents a 0.03% decline in the country’s exchange rate.

- The opening indicative rate closed at N413.57/$1 on Tuesday, indicating a 44 kobo appreciation compared to N414.01/$1 recorded in the previous trading session.

- An exchange rate of N444 to a dollar was the highest rate recorded during intra-day trading before it settled at N415.07/$1, while it sold for as low as N404/$1 during intra-day trading. The highest rate recorded during the day has been the same in the past eleven trading sessions.

- Forex turnover at the official window declined by 46.6% to $92.38 million on Tuesday.

- According to data tracked by Nairametrics from FMDQ, forex turnover at the I&E window reduced from $172.25 million recorded on Monday 8th November 2021 to $92.38 million on Tuesday 9th November 2021. A total of $264.63 million has been traded so far this week in the I&E window.

FMDQ, Nairalytics

FMDQ, Nairalytics

READ: CBN refutes claims that exchange rate has been removed from its website

Cryptocurrency watch

The cryptocurrency market started the day on a bearish note with a 0.62% decline in the industry’s market capitalisation to $2.863 trillion as of 7:00 am on Wednesday. The negative trade is mostly attributed to the performances of the two most capitalised crypto assets.

The flagship crypto asset, and the largest by market capitalisation, Bitcoin dipped 0.82% to trade at $66,388.79 on Tuesday, as at 7:00 am while Ethereum dipped 0.42% to trade at $4,713.21. The crypto assets had hit new record all-time highs on Monday.

Meanwhile, Nairametrics had reported that Bitcoin could rally as high as $80,000 in November as a result of volatility squeeze as well as net accumulation by Whales, a term used to describe institutions or big-money investors in the cryptocurrency market who are playing a huge part.

READ: Amidst exchange rate crisis, poverty, insecurity, Nigerian companies post mega profits

Crude oil price

The crude oil market gained momentum on Tuesday, rallying above $85 per barrel as the American Petroleum Institute reported its first crude oil inventory draw in about six weeks. The API estimated the inventory draw of crude to be around 2.485 million barrels.

Brent crude closed at $84.89 per barrel on Tuesday having gained 1.75%. However, early morning gains on Wednesday have seen the crude product surpass the $85 per barrel mark as of 6:30am. Similarly, WTI Crude gained 2.94% on Wednesday to close at $84.34 per barrel, while OPEC Basket closed at $82.34, indicating a gain of 2.78%.

Nigeria’s crude, Bonny Light gained 1.03% to close at $83.44 per barrel on Tuesday, while Brass River and Qua Iboe on the other hand both traded bearish with a loss of 0.25% to close at $83.3 per barrel.

READ: Exchange rate depreciates as forex turnover records marginal drop

External reserve

Nigeria’s foreign reserve declined for the seventh consecutive day, having recorded continuous positive growth in the past two months. The country’s reserves decreased by 0.25% to close at $41.6 billion as of 8th November 2021, compared to $41.7 recorded the previous day.

However, the nation’s foreign reserve gained $5.04 billion in the month of October, as a result of the $4 billion raised by the federal government from the issuance of Eurobond in the international debt market. The gains recorded in the previous month are higher than the $2.76 billion gain recorded in the month of September 2021, while the recent decrease puts the year-to-date gain at $6.22 billion.

So far in the month of November, Nigeria’s reserve has lost $221.42 million.