As companies begin to release their quarter earnings, we see mixed reactions in the market as investors begin to react either positively or negatively towards released results and expectations of companies who are yet to disclose their earnings.

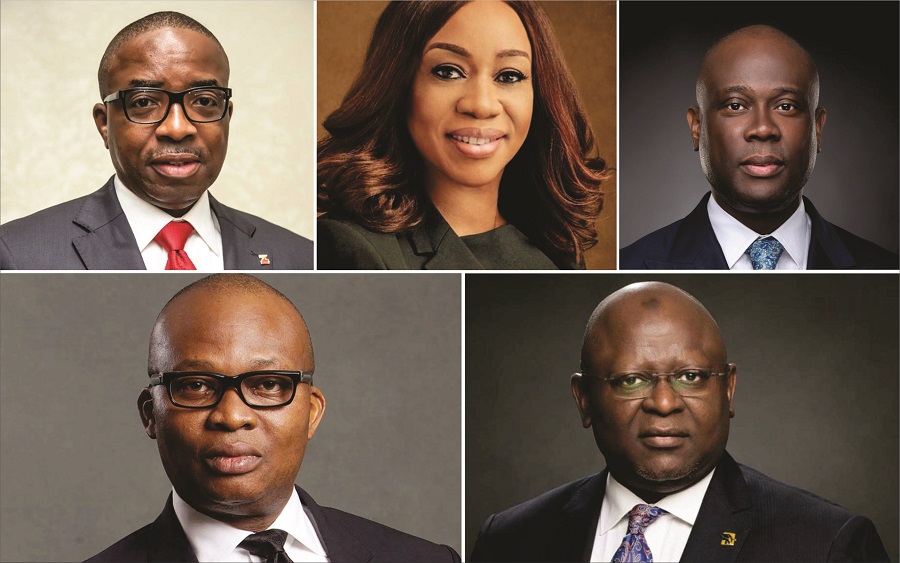

At the end of today’s trading activities, the FUGAZ banks all declined in share prices, which suggests that investors in these banks were having a field day taking profit.

FBNH Plc dropped by 2.71% from N11.05 to N10.75 at the end of the session, as the market cap also mirrored the decline to lose N10.77 billion.

UBA Plc declined by 0.58% from N8.60 to N8.55 taking the market cap down by N1.71 billion.

GT Holding Co Plc closed at N28.40 per share, declining by 0.87% from N28.65, dragging down the group’s market cap by N7.36 billion.

Access Bank’s share price depreciated by 0.53% from N9.50 to N9.45, weighing the market cap down by N1.78 billion.

Zenith Bank closed the trading day at N25.15, reflecting a decline of 0.40% from N25.25 and taking down the market cap by N3.14 billion.

Market Performance

The Nigerian Exchange market closed on a negative note amidst sell-offs and buy-interests as the benchmark All-Share Index (ASI) depreciated by 15 basis points.

The NGX ASI closed at 41,976.79 points, to reflect a decline of 0.15% from the previous trading day and a Year-to-Date (YTD) return of 4.24%. Meanwhile, the market capitalization decreased by N32.26 billion.

At the close of market today, Monday, 1st November 2021, the stock exchange market value currently stands at N21.91 trillion from N21.94 trillion in the previous trading day.

The market breadth closed negative as FIDSON led 20 Gainers, and 32 Losers topped by ETERNA at the end of today’s session.

The stock market has advanced 1,706.07 base points since the start of the year.

NGX ASI top gainers

- FIDSON +9.92% to close at N6.76

- GUINNESS up +9.92% to close at N39.90

- SOVRENINS up +9.09% to close at N0.24

- AIICO up +8.87% to close at N1.35

- REGALINS up +8.11% to close at N0.40

NGX ASI top losers

- ETERNA down –9.94% to close at N7.79

- UPDC down –9.44% to close at N1.63

- COURTVILLE down –9.09% to close at N0.40

- OANDO down –7.92% to close at N4.65

- HONYFLOUR down –7.78% to close at N3.32

NGX ASI top traded by volume

- MBENEFIT – 52,444,808 units

- UBA – 29,277,924 units

- FBNH – 27,545,394 units

- AIICO – 26,969,797 units

- TRANSCORP – 26,180,228 units

NGX ASI top traded by value

- ZENITHBANK – N339,792,420.00

- FBNH – N299,816,409.50

- WAPCO – N279,197,126.05

- GTCO – N263,868,402.20

- UBA – N250,854,012.65

Market sentiments trend towards the bears with the market differential being in favour of the decliners as 20 gainers were surpassed 32 losers.