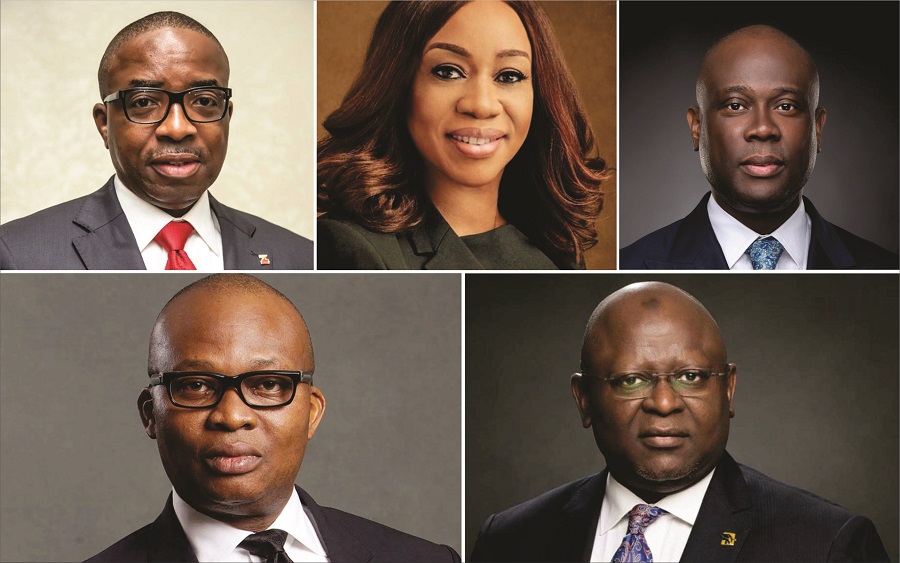

The market capitalization of the top five banks referred to as the Tier-1 banks decreased to N2.69 trillion at the close of business on the 22nd of October, 2021 as investors in these banks lost N39.24 billion during the trading week, with GTCO leading the decline.

After the four (4) trading days of the week, 3 of the 5 tier-1 Nigerian banks suffered negative market sentiments and recorded a decline in share prices.

According to data from the Nigerian Exchange (NGX), the market capitalization of the top five banks declined to N2.69 trillion to depreciate by 1.4% during the week. A summary of performance for each bank is captured below.

FBN Holdings PLC

The share price of FBN Holdings back-pedalled after two positive weeks, to close the week losing N16.15 billion, taking its market capitalization to N439.72 billion at the end of the week, making up 16.36% of the Fugaz capitalization. Amid sell-offs and buy-interests, at the end of the trading week, FBNH share price depreciated by 3.50% from N12.70 to N12.25.

During the week, investors traded 421,527,238 units of the bank’s shares valued at N5.13 billion, making the bank’s stock the most traded in volume and value amongst the FUGAZ.

The volume of shares traded depreciated by 272.92%, when compared to 1.57 billion units traded the previous week. The bank traded the highest number of shares in volume amongst the FUGAZ, trading its highest on Friday of 154.40 million units of shares, valued at N1.91 billion.

FBNH Plc’s second-quarter result revealed that Interest income for the period decreased by 19.36%. However, net profit for the period reported a growth of 79.76% from N12.50 billion in Q2 2020 to N22.47 billion in Q2 2021.

The bank is yet to release its Q3 2021 result.

UBA PLC

United Bank for Nigeria Plc gained N3.42 billion as its market capitalization closed the week at N287.28 billion, with its share price closing the trading week at N8.40.

UBA Plc, during the week, traded a total of 58,479,497 units valued at N487.11 million at the end of the trading day.

In comparison, the bank’s share volume depreciated by 20.79%, from 74.00 million traded last week.

UBA Plc released its half-year financials revealing a 33.4% growth in profit before tax which rose to N76.2 billion, up from N57.1 billion in the same period of 2020. In addition, the company’s gross earnings appreciated by 5.0% to N316 billion from N300.6 billion, while total assets grew to N8.3 trillion from N7.7 trillion.

UBA Plc is yet to release its Q3 2021 results.

GT Holding Company Plc

GTCO Plc lost a total of N32.37 billion after market capitalization depreciated to N838.79 billion from N871.16 at the end of the week’s trading session.

The decline can be attributed to the decrease in the share price, from N29.60 traded at the end of the previous week, to N28.50 at the close of business on Friday, reflecting a decline of 3.70%.

During the trading week, Investors traded a total of 68,147,060 units of the bank’s shares valued at N2.00 billion.

In contrast with the volume traded last week, share volume for this week decreased by 54.97% from 151.34 million.

In Q2 2021, the Group reported a decline of 15.2% in profit before tax from N109.7 billion recorded in the corresponding period of June 2020 to N93.1 billion in the current period. Also, post-tax profit depreciated by 15.76% from N94.27 billion in 2020 to N79.41 in the current period.

GT Holding Co is yet to release its Q3 2021 financial statement.

Access Bank Plc

Access Bank Plc’s share price depreciated by 1.0% from N9.60 to N9.50 at the end of the week as the market capitalization dropped from N341.23 billion to N337.68 billion to close the week.

At the end of the week, investors had traded a total of 100,190,543 units of the bank’s shares valued at N957.00 million. The total volume traded for the week grew by 83.40%, from a total of 54.63 million traded in the previous week.

Access Bank Plc released its Q2 financial result for the year which recorded an improvement in gross earnings by 14 percent to N450.6 billion, while profit rose by 42.4 percent, surging from N61.03 billion in June 2020 to N86.94 billion in half-year, 2021.

The bank’s Q3 financial result is yet to be released.

Zenith Bank Plc

Zenith Bank Plc gained N9.42 billion after its market capitalization appreciated to N784.91 billion from N775.49 billion at the end of the week. This appreciation can be attributed to the 1.2% increase in its share price from N24.70 traded at the end of last week, to N25.00 at the end of this week.

Hence, a total of 34,121,931 units of the bank’s shares were traded during the week, valued at N851.05 million. The total volume, in comparison with the previous week, depreciated by 10.19%, from 37.99 million units traded last week.

The bank released their second-quarter result which revealed that net interest income for the period increased by 1.61%. However, post-tax profit for the period reported a slight growth of 2.21% from N103.83 billion in Q2 2020 to N106.12 billion in Q2 2021.

The bank’s Q3 2021 financial result is yet to be released.

What you need to know

The Nigerian Exchange Limited (NGX) closed positive week-on-week as ASI appreciated by 0.76% to close at 41,763.26.

The FUGAZ banks make up over 70% of the NSE Banking Sector Index, hence, they strongly influence the growth or otherwise of the index.

The NGX Banking Index closed positive to appreciate by 0.69% and closed at 400.64.