Not all marriages last. Some end bitterly and some separate amicably citing irreconcilable differences while still maintaining a cordial relationship – most times for the kids. The union between the Nigerian economy and Oil appears to take the shape of the latter. On Friday, Oil prices hit a fresh three-year high climbing above $85 a barrel on forecasts of a supply deficit over the next few months.

Yet, the feeling in Africa’s largest oil producer, Nigeria, appears to be less than excited for a country that depends on crude oil sales for one-third of the government’s budget revenue and about 90% of their foreign earnings.

Questions have been asked if Nigeria is truly benefiting from its oil revenue and how positive the correlation between the Nigerian economy and Oil prices are. To understand this, we look at the matrimony between Nigeria and Oil.

Background

Nigeria and Oil have enjoyed a fruitful relationship ever since they met in the late 1950s. Oil revenue has financed most of Nigeria’s budgets over the years since then. It’s not clear if the Nigerian economic picture would be any worse now, if the nation did not discover oil. However, the relationship has been somewhat strenuous as the Nigerian government has abandoned other revenue streams in favour of an over-dependence on oil money. This situation made the country’s economy susceptible to oil crashes and oil price volatilities.

Like in every marriage, depending on one partner’s finances is unsustainable. Nigeria has been subject to quotas and reduced oil production as a result of OPEC and unrest in the Niger Delta respectively and oil money is not flowing in the pattern policymakers desire. Now the citizens (who are the kids in this analogy) are calling for the Nigerian government to find other sources of revenue as their growing number cannot keep depending on Oil money.

The truth is the Nigerian government has not made judicious use of its oil revenue. As of today, the West African nation does not have a refinery that can function at optimal capacity. In recent years, Oil has not accounted for more than 10% of the country’s GDP as fossil fuel is yet to realize its downstream potential in the country.

Source: Statista

The truth is Nigeria’s oil output is insufficient to spark an economic miracle like we witnessed in Saudi Arabia – the Middle Eastern country that produces an average of 11 million barrels per day while catering for 35 million people. In contrast, Nigeria produces an average 1.8 million barrels per day and caters for 150 – 200 million people. It’s woefully inadequate.

Whatever revenue Oil brings is something for the country to go by and sustain itself. Paycheck to paycheck style. It was never intended to scale the country to the greater heights the citizens desired. Then the crack between the Nigerian economy and Oil matrimony began to show when the Nigerian Government with all its inadequacies brought in a mistress.

Who is this mistress?

Subsidies!

Initially, Subsidy was brought in to be a nanny. A cushion for the poorer citizens to protect them from “market-determined” prices. The purpose of subsidies is to protect Nigerians from what Americans are currently going through – high gasoline prices from high oil prices that eat into disposable income.

However, the Federal Government began an illicit affair with subsidies – who has now assumed the role of the mistress that has exposed the failings of the Nigerian government over the years.

The subsidy scandal

Among OPEC countries, Nigeria is the largest importer of petroleum products and the only OPEC member bar Equatorial Guinea that does not export any petroleum product. The damning statistics are the reasons why the nation could do with a functioning refinery.

In terms of exports to imports ratio, the margin for the West African nation statistically is the most negative among the OPEC nations.

Source: OPEC Annual Statistical Bulletin 2021

Last week, the Central Bank Governor, Godwin Emefiele stated that Nigeria’s import of petroleum products uses 30% of its forex which would be reversed by the successful commencement of operations at the Dangote Refinery.

As reported by Bloomberg Business, if Dangote succeeds in building his $15 billion refinery that costs more than his net worth ($13.5 billion), he could end the irony of Africa’s biggest oil producer importing $7 billion of fuel a year.

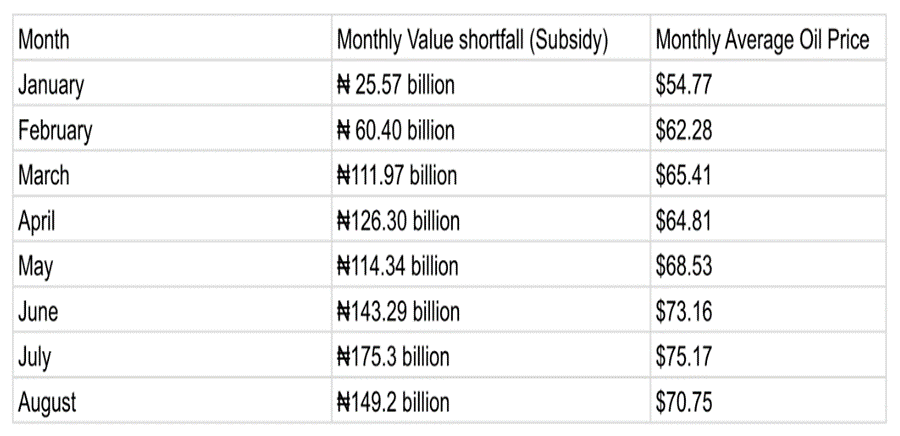

Government subsidies on petroleum products is a major sinkhole contributing to the pressure on FX. In the month of September 2021, the Ministry of Finance assessed the monthly subsidy bill at N150 billion, which shows an unsustainable yearly sum of N1.8 trillion. For reference, Nigeria’s annual budget is about 13.6 trillion.

Source: NNPC notes to FAAC Executive summary 2021

As Oil prices go higher, the cost of subsidies goes higher and this has caused the divorce of the Nigerian economy and Oil as money to boost the economy has been deployed to import petroleum products.

Oil revenue is spent on debt servicing (74% of revenue) and subsidies (crude for refined oil swaps, Direct-Sale-Direct-Purchase, value shortfall, under-recoveries and all the terminologies NNPC uses). This situation is the equivalent of earning $100,000 but your income is used in financing your credit card debt of $74,000 with child support growing parallel with your income. What then is left for the ever-growing family to build on?

How then is the economy benefiting from oil? The economy is hanging in there no matter how high the prices of Bonny Light, Brass River and Qua Iboe go in the International oil market.

Recent trends show the Nigerian Government has failed to maximise their full oil potential. OPEC says Nigeria’s crude oil production averaged 1.451 million barrels per day in September 2021 which is short of its OPEC quota of 1.61 million bpd. Falling short of their allocation has been the trend in recent months – 1.23 million barrels per day in August, and 1.32 million barrels in July. That’s leaving money on the table.

Investment Bank Goldman Sachs postulates prices could go up higher from here ($85) in the coming years. Even if Oil prices hit the most desired $100, Nigeria would not be better off than they currently are unless the government fixes the leakages.

To rub salt upon injury, the amount of fuel brought into the country is inflated due to corruption and there have been legitimate calls to put an end to the subsidies as fuel “allocated” for Nigerians is smuggled out to neighbouring countries for arbitrage profits.

The Government should work out ways to ensure that Nigeria is paying what’s right for subsidies. The full implementation of the Petroleum Industry Act would end the present subsidy regime. The Federal Government has to implement full deregulation in the sector as the benefits go beyond product importation, and would bring in investments into the downstream sector.

In one year the Department of Petroleum resources said the country’s consumption rate is 38.2 million litres per day. Few months later, NNPC claimed that the figure had jumped to 102 million litres. Another day, the figures come down to 60 million litres per day. This aberration has to be corrected. Subsidies protect the poor but that should not open a channel for market stakeholders to illegally take advantage of the scheme for profiteering.

The second step the Government can take to fix the economy’s marriage with Oil is to focus on building refineries that put an end to importing petroleum products. This would allow for a phase by phase transition away from subsidies. There would be money aside for economic-stimulating projects that would increase productivity in the country.

The cliche “Diversification of revenue” is still paramount. This month, Nairametrics reported that non-oil revenue has surged past oil revenue and maybe this might be the beginning of a new dawn for the Nigerian economy. Diversification of revenue conversely can be a breath of new life into the economy despite oil money still being very much needed for the citizens.