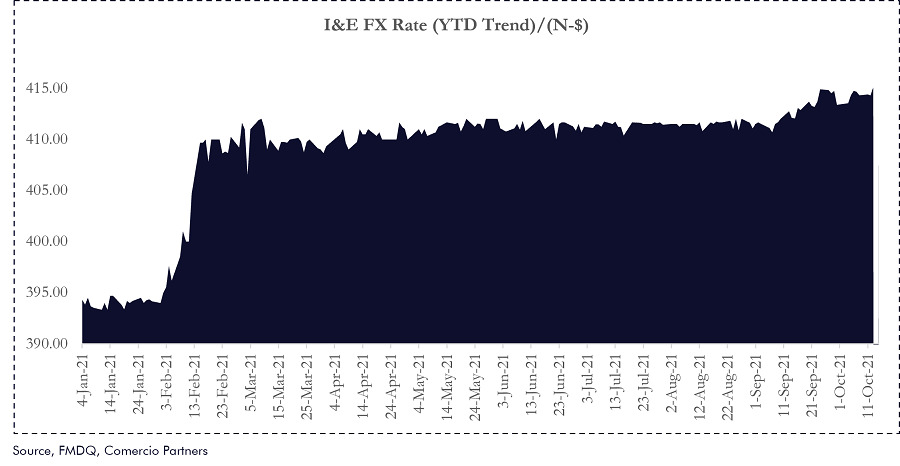

The supply side narrative to the perennial FX crisis in the Nigerian economy has been over-flogged, as a plethora of expert opinions usually center around an identical conclusion, echoing the need to sweat other sectors asides from crude oil for FX inflows and to boost exports. The need to change the monocultural structure of our economy has been rightfully emphasized in other to augment the economic support provided by a highly volatile oil sector. We have put all our eggs in one basket, which on its own comes with a handful of risks. Also, like Elon Musk opined, it is okay to have your eggs in one basket as long as you control what happens to that basket. That been said, we do not control what happens in the international oil market, hence, the echoes of diversification as a long-term antidote to the unending FX crisis and to the overall economic turmoil.

Three is the perfect number

There is a supply and demand side to the FX market, and as an offshoot of the inadequacy of supply to cater for demand, speculation is birthed. This is the trinity that nests the core of the problems that bedevil the FX market. But more often than not, we deemphasize the contribution of the demand side by skewing our attention to the inadequacy of supply and the shriveling impact of FX speculation and hoarding. Hence, should the government decide to prioritize export promotion policies in various sectors “that isn’t oil”, there has to be a conscious effort to plug some of the excesses of the demand side. Only when this is achieved can we record meaningful progress in the FX market, and possibly eliminate speculation which is merely a symptom of the underlying problem.

Accordingly, there are two key pressure points on the demand side that, in our view, are pertinent enough to be discussed, and the gradual resolution of both could possibly provide a great deal of relief to the growing pressures on FX demand. The first pertains to the enormous size of Nigeria’s import bill, while the other relates to the very contentious but exorbitant subsidies splurged on premium motor spirit (PMS).

Sinkholes in the FX market

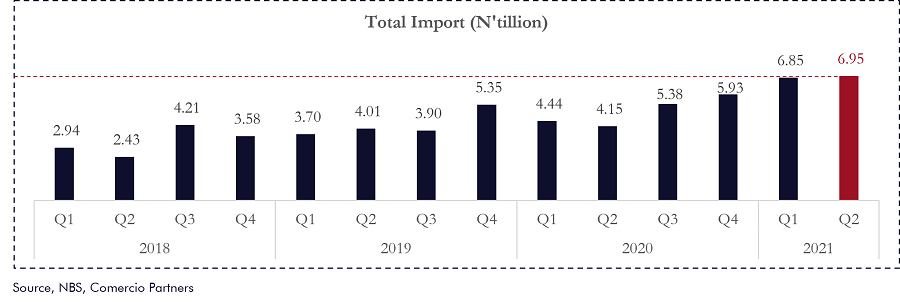

Import bill: The amount expended on imports has been on the rise, with the total value of importation for the second quarter of 2021 soaring to N6.95 trillion, the highest level in well over a decade. This is largely expected as the economy had been unable to ramp up its local production level significantly, or at least not enough to outpace the rate of population growth. Hence, with the decade long population growth averaging 2.63% (even outpacing the 10-year economic growth of 2.56%), and with local production failing to record meaningful growth, imports become the only way to partly provide for the underserved demand market. The consequence of this is the persistent uptick in our import bill, and the resultant pressure on FX demand. However, the causal relationship between importation and FX devaluation is a bit contentious, with many asking the metaphorical question, “which comes first between the chicken and the egg?”. Does the growth of importation birth the devaluation of the Naira, or is it the weakened Naira that makes the import bill seem bloated? However, in defense of the former, the volume of importation has also been on the rise, leaving import growth as the causative factor in this analogy.

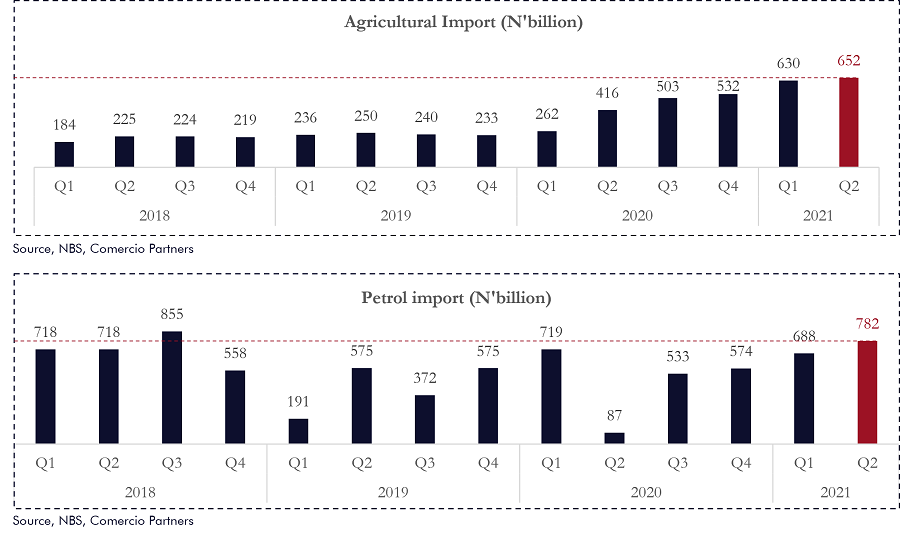

Decoupling the growth in Nigeria’s import bill, the key segments behind this increase is agricultural imports and petrol imports, both of which accounted for 20% of the total imports in the first half of this year. Agricultural imports have dramatically increased over the years, while petrol imports have remained elevated. Of all the problems stifling local supply of agricultural produce (creating a dependency on imported food), impoverished transportation infrastructure and insecurity seem to be the most pressing. A train line running from the north to the south-west delivering tomatoes would prevent spoilage, save time, and reduce costs. Likewise, the elimination of insurgency in the north should prove helpful in reducing disruptions to local production of food items like wheat. For petrol imports, the development of functional local refineries is a very welcoming solution, but Dangote Refinery’s 650,000 bpd capacity would not suffice. The government might just need to allow the private sector to take over its moribund refineries.

Petrol subsidy: Government subsidies on PMS is a major sinkhole contributing to the pressure on FX. As at March 2021, the Nigerian National Petroleum Corporation (NNPC) estimated the subsidy on PMS to be c.N120 billion monthly, and this sum has increased to c.N150 billion monthly (US$361 using N415.07/$) as of September 2021 according to the Ministry of Finance. Note that these sums are paid in US dollars by the government, and they are inflated due to corruption. Hence, eliminating this subsidy would help relief the pressure on FX demand, leaving industry players, who also contribute to FX hoarding, to service their PMS purchases. However, this is a move that comes with an undue amount of suffering to the average Nigerian, and it would be best to gradually phase out subsidies, rather than the abrupt stoppage that has been repeatedly touted by policymakers and economists.

Click HERE to download the report.