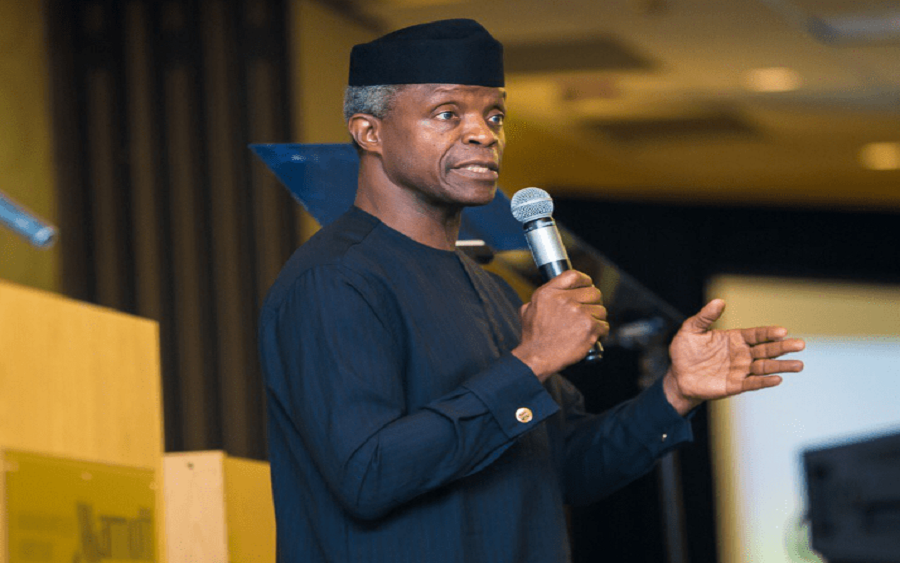

Vice President Yemi Osinbajo has revealed that 6.39 million farmers under the N2.3 trillion Economic Sustainability Plan (ESP) agriculture scheme have been enumerated across the country.

The Vice President disclosed this at a two-day Mid-Term Ministerial Performance Review Retreat, on Monday, at the State House Banquet Hall, Abuja, according to the News Agency of Nigeria.

The ESP was implemented by the FG last year to deal with the economic effects of the pandemic on the country, as the Vice President revealed that the farmers had also been tagged to their lands which would enable them work with the FG.

What the Vice President said

He said, “Then, we had the agric scheme; we called it Agriculture for food and Jobs Plans.

“Part of the programme was the enumeration of farmers; we enumerated 6.39 million farmers and these farmers were tagged to their lands.

“So, we have accurate record, verified by the Ministry of Communications and Digital Economy, of 6.39 million farmers with their lands duly tagged.

“We know where their farms are and we know where their lands are; so far, 3.63 million passed the first stage of validation and another 2.47 million passed the second stage of validation.

“We are validating them also for BVN; those who do not have BVNs are getting BVNs.”

He also added that a total of 320 hectares of land had been cleared in some states at 40 hectares per state, including Kwara, Plateau, Cross River, Edo, Kaduna, Ekiti and Osun States.

“These are states that require land clearing; N447 billion is allocated as loans to farmers across 14 crop value chains, be it production, aqua culture and poultry farming.

“But so far, only N14 billion has been disbursed to commercial banks and even this sum is yet to be utilised by farmers due to the late release for the 2021 wet farming season,” he said.

On the Fertiliser Subsidy Programme, he said the strategy was to pay the amount of the subsidy directly into the BVN verified accounts of the beneficiaries.

He disclosed that the ESP also prioritized healthcare, stating that the funds allocated to the health sector were for surveillance and epidemiology, establishing laboratories, point of entry management, infection prevention and control, health management, health-related communications, research and development.

“After full implementation, what we expect to see—although already we have seen several of these—15 federal tertiary health institutions, the availability of PPAs in all federal health institutions, 520 Intensive Care Units (ICU) beds, 52 isolation wards, with 1040 beds, 52 molecular laboratories to carry out, on the average, 150 (Polymerase Chain Reaction (PCR) tests every day.

“The states are also building up their own capacity.

“Vaccines are being administered across the states; as at Sept. 28, 4.8 million people or 4.3 per cent of the eligible population has received the first dose of the vaccine; 1.9 million people or 1.8 per cent of the eligible population has received the second dose,” he said.

In case you missed it

Recall Nairametrics reported yesterday that Nigeria’s Vice President, Professor Yemi Osinbajo, at the Presidential Villa in Abuja on Monday during the Mid-Term Ministerial Performance Review Retreat, tasked the Central Bank of Nigeria (CBN) on better forex demand management, citing also, the need to allow the naira to reflect market realities, which economists often refer to as a floating exchange rate.

Please Mr Vic President, CBN are not approving

the non-interest lending true Nirsal Bank to

Farmers, we farmers are suffering please a lot

happening there used ur office as a Vic president of the federal Republic of Nigeria

to check this corruption that is go on in

CBN and NIRSAL Microfinance Bank about

Agric Loans in Nigerian.

Loans disbursement should be disbursed directly to the beneficiary account.

Loans disbursement should be disbursed directly to the beneficiary account.