Goldman Sachs investment strategy group released a report titled “Digital Assets: beauty is not in the eye of the beholder,” in which the investment banking giant wrote about the world of cryptocurrencies.

The report stated that the purpose of the insight was to “address our clients’ questions by analyzing the desirability, even viability, of cryptocurrencies as an investment asset class and examining a possible role for cryptocurrencies in our clients’ customized strategic asset allocation process, within the framework of our investment philosophy.”

A section of the report focused on hedge inflation or deflation as a store of value with Goldman Sachs stating that Gold is not an optimal store of value. Gold was introduced into the analysis because people have claimed Bitcoin to be the “Digital Gold.”

Goldman Sachs looked at the performance of Gold to shows that even if Bitcoin is supposedly Digital Gold, the commodity itself (Gold) has not been an effective hedge against inflation as most people think it has been. The reason stated in the report is described below.

The report stated that since the inception of pricing data, Gold has provided an annualized real return of 1%, barely outperforming inflation. Adjusting for storage and insurance costs, the estimated excess return drops to zero.

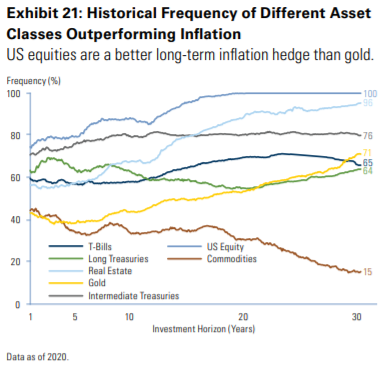

The report went further to state that the only asset class that hedges inflation on a consistent and reliable basis is US equities. US equities have outperformed inflation 100% of the time over any 19-year window. Gold outperforms inflation only about 50% of the time over a 19-year window. It concluded that owning US equities is a better long-term inflation hedge.

On a shorter-term basis, the report stated that US equities have outperformed Gold in most periods of positive inflation. Even when inflation was greater than 6%, Gold outperformed only between January 1970 and June 1970 and again between August 1973 and July 1982.

Bottomline

The report, as expected, stated that Bitcoin does not support Goldman’s multi-factor asset allocation model because it estimates the risk premium of the flagship cryptocurrency to be 1.9% per annum, with an extremely wide uncertainty (one standard error estimated to range between -35.2% and 39.1%) and volatility of 93.0%.

The report stated, “We also conclude that the risk, return and uncertainty characteristics of Bitcoin based on our multi-factor model do not support an allocation to Bitcoin. We do not believe that cryptocurrencies are a strategic asset class that adds value to our clients’ portfolios.”

Gold, so far, has been struggling this year to gain momentum, falling to the strength of the U.S Dollar. The yellow metal is down 7.77% at the current market price of $1,791, as of the time of writing this report.

The yellow metal, however, seems to be gaining momentum as Central banks from Serbia to Thailand have been adding to gold holdings. Also in Ghana, the country recently announced plans for purchases, as the worry of accelerating inflation looms and a recovery in global trade provides the firepower to make purchases.

Since banks are not required by law to hold gold, please contact me to disclose how much gold Goldman Sachs currently holds in all of its storage areas right now. By the tone of this article, it is a useless asset.

Oh, and they are going to offer Bitcoin trading now. How profitable…