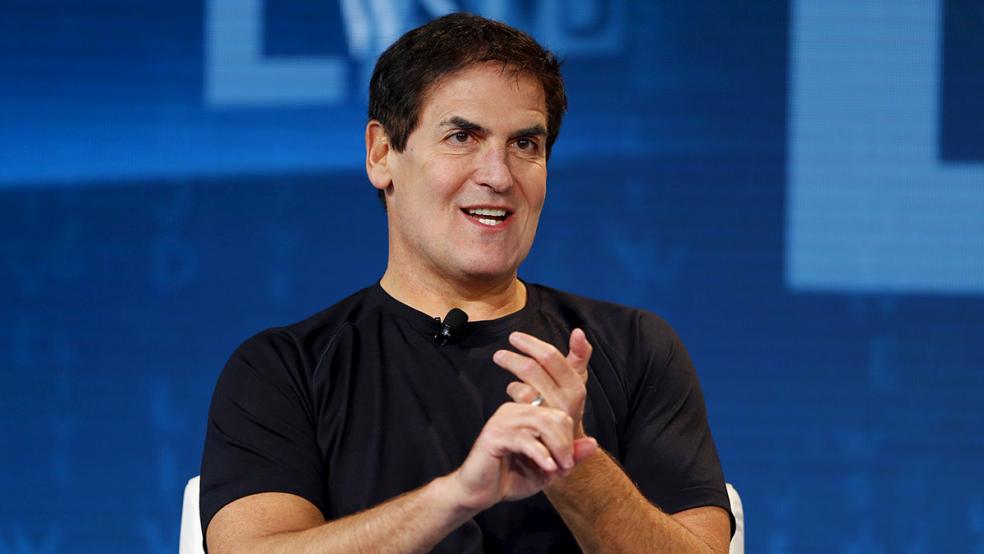

Popular billionaire investor, Mark Cuban who is a huge supporter of the cryptocurrency market, specifically Decentralized Finance (DeFi), has called for decentralized finance (DeFi) and stablecoin regulation after losing money on his investment in Titan token which crashed from an all-time high of 52$ to $0.

Although the cryptocurrency market is used to significant levels of volatility, this massive crash of 100% is pretty rare, especially in such short a time.

What happened to Titan token?

As earlier reported by Nairametrics, Titan token is part of an algorithmic stablecoin project called Iron Finance. Some stablecoin like USDT and USDC are pegged to the dollar by holding a basket of dollar-denominated assets, Titan token is a hybrid of algorithmic stablecoins, which use a dual-currency structure in an attempt to hold a peg by creating arbitrage opportunities between coins.

The token crashed because it had become overpriced and people began to sell, thereby triggering a high amount of volatility, overwhelming arbitrage opportunities and causing everyone to run to the door. Many comments on social media seem to believe that Mark Cuban had a hand in the downfall of the token.

Mark Cuban has been a huge supporter and investor in the DeFi space. He wrote a blog in which he expressed his support for DeFi on Sunday. He stated, “I’m going to make this as simple and straightforward an explanation as I can. Yield Farming via Staking and Liquidity Providing are a core feature of most, if not all Decentralized Finance (DeFi) projects. The principle behind why they are brilliant also applies to other crypto projects, but let’s put that aside. But first, let me say that this is not investment advice. This is how I see the market and there may be things that I am wrong about or could change by the time you read this. Feel free to add your thoughts in the comments below.”

He went further in the blog by listing Polygon, DAI, Titan and BNT as some cryptocurrencies in which he has invested.

After the meltdown of Titan token, Mark Cuban took to Twitter to mention that he got “hit like everyone else.”

Bloomberg reached out to Mark Cuban to ask more about how much he lost and how he got interested in TITAN in the first place. He responded via email stating,

“I read about it. Decided to try it. Got out. Then got back in when the TVL start to rise back up as a percentage of my crypto portfolio it was small. But it was enough that I wasn’t happy about it. But in a larger context it is no different than the risks I take [in] angel investing. In any new industry, there are risks I take on with the goal of not just trying to make money but also to learn.

Even though I got rugged on this, it’s really on me for being lazy. The thing about de fi plays like this is that it’s all about revenue and math and I was too lazy to do the math to determine what the key metrics were. The investment wasn’t so big that I felt the need to have to dot every I and cross every T. I took a flyer and lost. But if you are looking for a lesson learned, the real question is the regulatory one. There will be a lot of players trying to establish stable coins on every new l1 and L2. It can be a very lucrative fee and arb business for the winners.

There should be regulation to define what a stable coin is and what collateralization is acceptable. Should we require $1 in us currency for every dollar or define acceptable collateralization options, like us treasuries or? To be able to call itself a stable coin? Where collateralization is not 1 to 1, should the math of the risks have to be clearly defined for all users and approved before release? Probably given stable coins most likely need to get to hundreds of millions or more in value in order to be useful, they should have to register.”