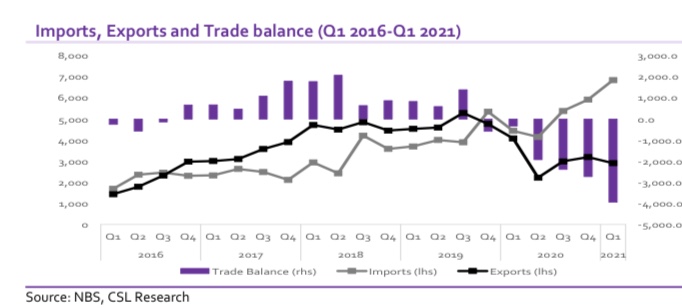

According to the foreign trade in goods statistics released by the National Bureau of Statistics (NBS), the total value of Nigeria’s merchandise trade increased by 7% q/q and 14% y/y to N9.8 trillion in Q1 2021 from N9.1trillion in Q4 2020 and N8.6 trillion in Q1 2020. The rise in total trade during the quarter was driven by an increase in imports (up 15.6% q/q to N6.9 trillion) while exports declined, down 9% q/q to N2.9 trillion in Q1 2021. We note that the total value of imports is the highest recorded in a decade. Consequently, the surge in imports compared with the decline in exports resulted in the sixth consecutive quarter of trade deficit in Q1 2021 (N3.9 trillion) and the highest trade deficit since 2011.

The increase in total trade is broadly reflective of the gradual recovery in the global economy following the removal of the movement restrictions that characterized the second to fourth quarters of 2020 and the widespread rollout of vaccines across the globe which has hastened recovery from historic economic blows caused by the pandemic.

These have led to a rebound in the global economy and improved growth projections by multilateral institutions. Analysis of the data revealed that the rise in imports was driven by increased patronage of manufactured goods from foreign sources (up 18% q/q and 70% y/y to N4.5 trillion).

On the other hand, the decline in exports was on the back of lower earnings from crude oil exports (down 23% q/q and 34% y/y to N1.9 trillion) on the back of lower production levels due to compliance with OPEC production cuts. Also, the emergence of the second and third waves of the pandemic which resulted in renewed lockdown measures undermined recovery.

Although trade activities continue to recover, nonetheless, the recovery is not broad-based. The nation’s compliance with OPEC’s productions cuts may continue to drag oil receipts despite rising crude oil price. We highlight the improvement in other products segment for exports. However, exports remain skewed towards crude oil exports.

So please help me I need money only

80,000 to the business please help me

Please sir i need covid19 loan only 200,000 to start up my fishiry farm. Please help me.

Pls, I need 450000 to help my business to developmety

Thank you for all your contribution

I love what the federal government is doing well, help people with money to there needs,a good work sir thank God, God bless you with your family.