The National Pension Commission (PENCOM) released the April 2021 Pension Fund Industry (PFI) portfolio report, yesterday. Bucking the trend of successive declines since January 2021, the Net Asset Value (NAV) for April 2021 rose (47 basis points m/m) to N12.40 trillion from N12.34 trillion in March 2021.

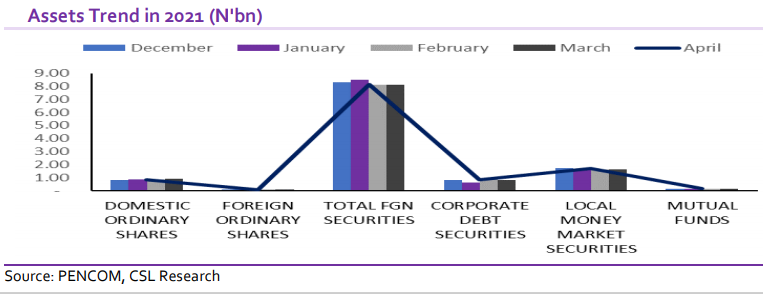

Investment in securities showed a different pattern in April. Aside from foreign ordinary shares (up 4.8% m/m to N101.63 billion), corporate debt securities (up 28.1% m/m to N794.67 billion), and local money market securities (up 3.6% m/m to N1.74 trillion), which grew in the month, other asset classes such as domestic ordinary shares (down 1.3% m/m to N830.62 billion), FGN securities (down 2.2% m/m to N8.32 trillion), and mutual funds (down 12.4% m/m to N129.14 billion) showed a decline.

Recall that FY 2020 was characterized by a significant drop in investment yields on fixed income instruments, which increased fixed-income instruments’ prices and, consequently, fair value gain in the period. Since the beginning of 2021, however, yields have begun to rise, and as such, PFAs are reorganizing their portfolios to avoid excessive losses on Assets held for trading.

For example, PFAs are investing fewer funds in FGN Securities, evidenced by the reorganization and declines recorded on FGN Bonds (down 2.9% m/m to N7.45 trillion), Treasury Bills (down 4.3% m/m to N690.43 billion), and SUKUK (down 6.8% m/m to N79.31 billion). We note that more assets are now being held to maturity amid a rising yield environment, which bodes fair value losses for assets held for trading.

To manage the effect of a rising yield environment, we have observed more Fund Managers tilting towards investment in corporate debt securities, local money market funds, and foreign ordinary shares as they seek stability. This aligns with our expectations, as these managers aim to mitigate the effect of rising fixed income yield, and a dwindling performance in the equities market.

In essence, more managers are prioritizing short tenor securities for trading purposes.

We expect PFAs to continue with the current strategy considering their historical tendency to invest heavily in fixed income instruments.

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.

I wish to know the phone number to call in case of error in pension.And when is the next verification coming up for pensioners ?Thank you.

It will be good if pensioners can reach your office through a designated e-mail or a phone number or both.Good jobs so far .