A fortnight ago, the Federal Reserve (FED) and the European Central Bank (ECB) released their semi-annual financial stability reports whilst, the Bank of England (BoE) released its latest quarterly Monetary policy report.

Collectively, these three central banks have monetary policy responsibility for over 40% of the world’s GDP.

- Therefore, investors pay close attention to information generated by these major Central banks. Especially as these periodic macroeconomic reports outline several major concerns being monitored by the central banks in pursuit of optimal policy actions required to sustain a post-COVID19 global economic recovery.

- From a Nigerian perspective, the prevalence of technology that enables wealth diversification into foreign assets across the US, Europe, and UK, simply means Nigerian investors need to be aware of key concerns contained in these macroeconomic reports.

Nairametrics reviewed these macro-economic reports and brings you 5 key concerns to be aware of.

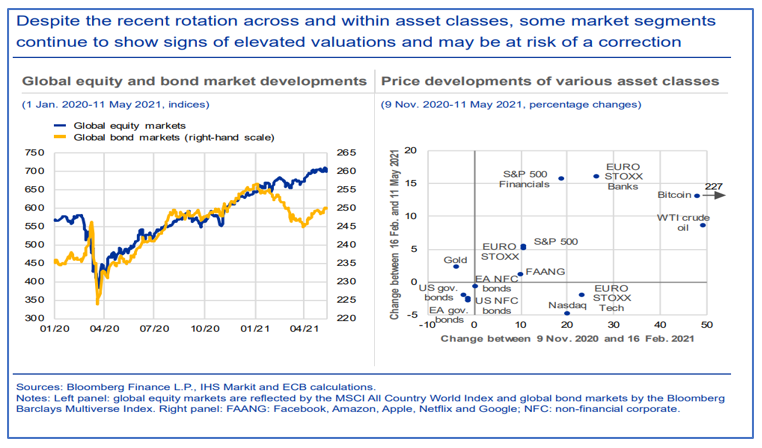

1. Asset Price Valuations

- For the US Federal Reserve, high valuations of risk assets are a concern (i.e. Stock market, residential real estate) because the current valuations appear to be supported by a low interest rate environment, therefore, there is a risk that future interest rates upticks may reduce the net-cashflow from these investments thereby causing investors to flee these assets. This would trigger a significant decline in these risk assets.

- For the European Central bank (ECB), the financial stability risk posed by high valuations of risk assets is viewed from the perspective of the balance sheet exposure of banks and non-banks.

Specifically, many corporates are either exposed to the US Equities markets or have large loans on their books. Therefore, increases in interest rates would mean businesses face twin challenges of higher debt servings costs, as well as declining asset values.

- For the Bank of England (BoE), in its monetary policy report, the spike in risk assets prices were acknowledged, however, from a monetary policy perspective, low productivity, low inflation and exchange rate concerns outweighed BoE concerns on risk-assets valuations.

2. Household and businesses (non-banks) debt levels.

- Secondly, the US Federal Reserve outlined its concerns about the level of company and household debt, which remains high in relation to GDP.

- Specifically, as households take out larger mortgages to fund purchases of ever-increasing house prices, a scenario is created where a rise in interest rates for these large mortgages will suddenly result in affordability challenges. Additionally, current mortgage delinquency statistics are likely muted due to special COVID-19 policies in place, such as mortgage forbearance and level of stimulus which is being consumed by accommodation.

Similarly, for small caps and unlisted businesses with outstanding credit who had to scale back operations, the paycheck protection program liquidity facility (PPPLF) served as government support to keep businesses afloat.

- Therefore, as these special COVID-19 policies end, there may be an uptick in delinquencies which create financial stability risks given cascading effects of rising delinquencies on banks’ balance sheets and risk to liquidity pools.

- The European Central bank also expressed significant concerns about increasing delinquencies creating solvency risks across all classes of borrowers from nonbanks (corporates) to households as well as banks.

As a result, if interest rates rise, the cost of credit rises, resulting in affordability challenges adversely impacting businesses and subsequently households. This might lead to a decrease in company expenditures, particularly labour costs, resulting in a rise in unemployment claims in the economy and signalling the start of a recession.

- The Bank of England’s looks at this concern from the perspective of household propensity to save.

- Specifically, the savings buildup which occurred during the pandemic was driven by the higher income and older citizens (i.e., a demography who typically have a higher propensity to save).

- Therefore if more households start saving or paying down debt rather than spending due to uncertainty. This is likely to result in a suboptimal outcome including risk of economic contraction.

3. Leverage/Risk in the financial sector

- The US Federal Reserve outlined a mixed review for this risk for the US. Specifically, traditional banks are perceived to be fairing okay given that they have witnessed rapid growth in total assets driven by uptick in low-risk assets such as central bank reserves, treasuries and government-backed loans such as the PPPLF.

- Additionally, capital adequacy related restrictions such as limitations on bank dividend payouts and share repurchases continue to be in place.

On the flip side, the Fed noted its concern about debt levels for Life-insurance companies and hedge funds.

- For the life insurance companies, this concern is further compounded by the fact that Insurance companies typically invest in commercial and industrial real estate (CREs), thus additional exposure in the event of asset valuation declines.

- The European Central Bank (ECB) outlines that it has heightened concerns for Euro area banks compared to the US. Especially in terms of emerging risks to their profitability due to potential growth in loan losses, corporate insolvencies, as well as climate change risks.

- In other words, asset value declines will likely lead to higher loan loss provisions for Euro area banks, which may impact their profitability.

Furthermore, loan exposure to companies who are exposed to climate change threats (e.g. insurance claims for floods, forest fires etc.) may create a drag on profitability for Euro area banks.

4. Global economy

- The US Federal Reserve’s concerns about external factors outside of its jurisdiction which may create slacks in the global economy and ultimately impact the US relates to issues such as:

- The risk of Europe or large emerging market economies (India, Brazil, ASEAN etc.) not fully overcoming the pandemic as this could import stability risks to the US;

- The risk that EM countries, rapidly raise interest rates to attract capital flows or deal with domestic inflation; as well as

- The risk that EM governments lack the fiscal capacity to provide continued support to their economies.

- The European Central Bank (ECB), and the Bank of England (BoE) have similar external concerns.

These relate to improved US Treasury yields attracting capital flows away from Europe and the UK, whilst any sudden decline in US Risk-asset values may have a knock-on effect on Europe and the UK.

- Furthermore, the shared concerns persist about emerging markets experiencing the prolonged effect of the pandemic due to low vaccination rates, as well as the risk of EM region increasing interest rates to attract capital flows thereby triggering sharp rise in global interest rates.

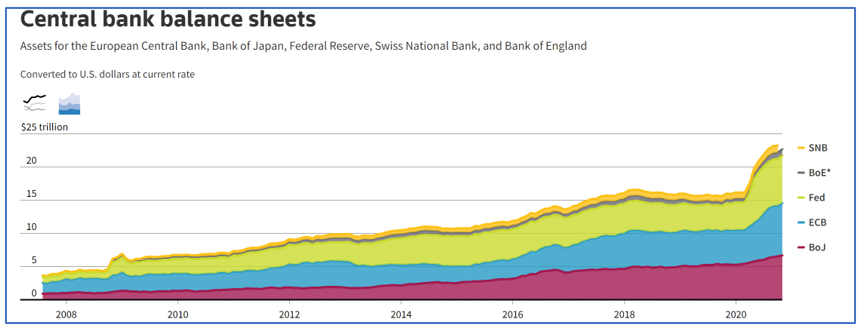

5. Inflation

So, what is the point? Why are all the central banks really concerned? In one word, it’s inflation.

Specifically, the central banks through various monetary policy actions such as quantitative easing, stimulus packages and low interest rates have provided a significant amount of liquidity into their respective economies (balance sheet sizes increased from $16.2 Trillion to $23.3 Trillion in less than 12 months).

As GDP recovers and money velocity spikes due to increased consumer spending, this should trigger moderate inflation which should spur business investment and capital expenditure until price stability objectives of Central banks are achieved.

- Typically, most global central banks prefer moderate inflation ranging between 2% to 3%. A sustained period of higher-than-expected inflation would mean more drastic action is required

However, there are significant concerns from investors that excess liquidity already created by the central banks to deal with the pandemic will cause sharper-than-expected inflation which central banks will not be able to tame without drastic actions (as the Fed did in the 1980s).

- On one side, large institutional investors who fear sustained high inflation rates (i.e., over 3% to 5 % for multiple quarters) are urging that interest rates need to be increased as soon as possible to avoid inflation spiralling out of control. This is also to avoid central banks needing to overcompensate and possibly induce recessions thereby damaging all the work done to manage the economic fallout of the pandemic.

- However, on the flip side, central banks have relaxed inflation targets and are prepared to overshoot their preferred range of 2% to 3% for a while. The central banks’ stance is driven by projections that there are multiple financial stability downside risks to rapidly increasing interest rates as outlined in their macroeconomic reports.

Unfortunately, this pandemic has created uncharted monetary policy territory, and there is a lot of uncertainty regarding how the global recovery will unfold. So, we continue to watch this space.