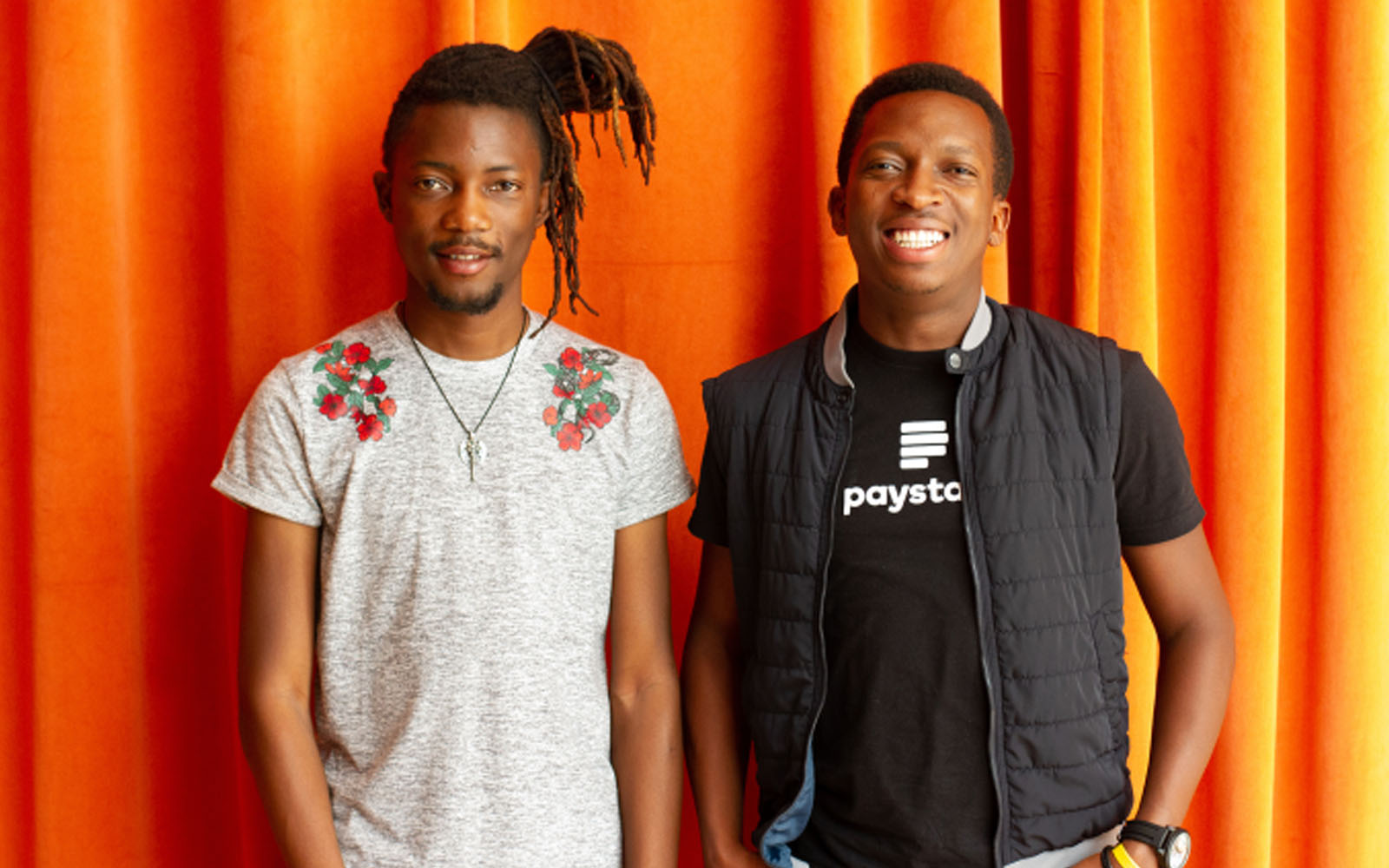

After almost five years of having to be described as the Stripe of Africa, Paystack finally became a part of Stripe in a major acquisition which caused ripples of excitement across the fintech industry. The reality that two young Nigerian men, who did not school abroad, could start and grow a company that would be acquired by a Silicon Valley Company is more than a little exciting.

The acquisition is valued at over $200 million, Stripe’s biggest acquisition to date and the biggest startup acquisition in Nigeria so far. This is the story the world knows, what many do not know is the history that preceded and naturally led to this acquisition.

Attracted by a similar vision

“When we first started Paystack, there was just no way I could describe it to people other than to say it was like the Stripe for Africa. Both companies were simply chasing the same goals so standing before the YCombinator interview, one thing I could simply say that made sense was that we are just like Stripe,” Shola Akinlade, Paystack co-founder and CEO narrated.

In 2016, Akinlade joined the YCombinator program – an American seed money startup accelerator that selects two or more batches of companies per year to receive seed money, advice, and connections in exchange for 7% equity of the company.

Akinlade stood on the stage of the Tech Accelerator YCombinator to defend his business idea on the same stage Patrick and John Collison had stood some 7 years earlier to talk about Stripe. Both companies were after the same goal – to make online and offline payments seamless and easier, in order to expand e-commerce and open up their environments to endless economic potentials available on the internet.

By the end of the presentation, Akinlade and his co-founder, Ezra Olubi did not only get the incubator’s investment of $120,000, but they also got an offer to meet with the ‘actual’ Stripe. Akinlade was introduced to Patrick in San Francisco and this marked the beginning of a mentor-mentee relationship.

Akinlade recalls that he went to Stripe office for lunch with Patrick, and all he could do was ask questions.

“We didn’t talk about Paystack. I was literally just asking questions around what is this? How do you do this? How do you handle this, you know?”

Prior to this time, Akinlade confessed that he often had to refer to Google search engine when he found himself in a dilemma, uncertain of a next move, or trying to find out how to get something done. Even for things like interview questions for Engineers, he had to resort to online searches. However, after their first meeting, Patrick became Akinlade’s google, as it made more sense to him to ask from someone who had been there and had a genuine interest in seeing Paystack grow. This development must have given Paystack competitive advantage, in comparison to other startup founders who mostly have to grope in the dark till they find the light.

After the YC, Akinlade and Ezra Olubi the co-founders, focused on running the business. They had already attracted the interest of major players and investors but were not yet ready to enter the Series A fundraising. They instead accepted some Pre-seed funding amounting to about $1.3 million.

Funding could have tied our hands too early

Olubi recounts it thus, “a couple of people were already reaching out to us to inquire about our fundraising interests, and we actually met a couple of VCs at that time. But for the most time, we as a company were not ready to fundraise so we were just keeping this on the back burner waiting for the right time.

According to Olubi, the co-founders enjoyed some autonomy in running the business which they were not ready to relinquish on the altar of fundraising. “We were not in a hurry to start going chasing after the big tickets, and that is why up till the acquisition, we literally had no board member that was different from us the co-founders,” he said.

They also understood that if and when they started fundraising, it could take a significant part of their time – time that could be better invested in growing Paystack, so they decided to keep it on the backburner.

When Patrick Collison called to ask if they minded Stripe coming in as investors, it was clear to them that the time was ripe for Series A. Stripe offering to lead the fundraising series, further took the pressure of fundraising off the founders.

“I wasn’t fundraising, I think at that point I was already thinking about the next level or the next phase of Paystack, but I was also just worried about getting distracted with running a Series A process. I’m one of those founders that really doesn’t like fundraising, so when Stripe asked, I was just like, you know what, I’m happy to have a conversation. And, it was a very short process, and the deals were really very founder-friendly,” Akinlade said.

“Tencent was one of our early investors, so they joined the series. We had already discussed with Visa before then so they also came in,” Olubi explained in the Founders Connect interview.

Post-Series A

The injection of $8 million from Series A in 2018 expectedly aided Paystack’s rapid growth, with investors getting good returns. Paystack broke grounds in Ghana and soon after launched a pilot product in South Africa. The next expectation in the fintech community would have been a Series B fundraising, but the co-founders were being careful.

Any merger, acquisition or further funding would have to be a strategic one, with the investors bringing more than money to the table. The pair did not want to have to deviate from the roadmap they already had for Paystack.

When Stripe made the approach, both founders say that they were convinced that joining forces with Stripe would help them to get to their destination faster, and isn’t this what corporate deals should be about? This deal was a natural outcome of a close work relationship over the years, more like partners deciding to get married after courting for years.

“I tried to be very capital efficient after the series A, you know, and all that but ultimately it got to a point where we needed to think about what was the next phase of Paystack going to look like? You know, what are the partners that are going to work with you? And of course, there were lots of options, but it became very obvious that Stripe will be a very good partner because the incentives are really, really aligned.”

The other options that might have been considered for an acquisition are the other two major investors, Visa and Tencent, but neither approached Paystack for an acquisition.

Why Paystack? Why now?

Stripe business lead in Europe, Middle East and Africa, Matt Henderson says Paystack acquisition was not random in any way. The company was expanding fast but had not yet gone into the Middle East or Africa, and Paystack was trying to cover Africa. Paystack’s African drive fit clearly into Stripe’s bigger picture.

“In just five years, Paystack has done what many companies could not achieve in decades. Their tech-first approach, values, and ambition greatly align with our own. This acquisition will give Paystack resources to develop new products, support more businesses and consolidate the hyper-fragmented African payments market. We can’t wait to see what they will build next and how their growth can turbocharge the African tech ecosystem.”

Akinlade agrees with this when he said in an interview that both companies had strikingly similar roadmaps. Despite the achievements so far, the founders had been dragging feet over a Series B funding because they did not want to lose their autonomy, or bring in an investor who did not understand what they wanted to achieve with Paystack.

Paystack already had over 60,000 businesses (small businesses, larger corporations, fintechs, educational institutions and online betting companies) in Nigeria and Ghana using it to process hundreds of millions of dollars each month. Paystack had also gotten the PCI DSS Level 1 Certification, the most stringent level of certification in the global payments industry, enabling companies to transact across Africa safely and securely.

Some sentiments say that the founders sold too early and that if they had waited a little longer, they could have sold for more, but the founders do not think there could have been a better time.

Was Paystack up for sale when Stripe approached them?

Certainly not!

Answering the question, “Why now?” Akinlade said, “Why not now?”

If they had already established that Stripe was the most strategic investor to come giving its experience, and having provided guidance for Paystack through its rapid growth, what need was there in delaying it further? If it was a certainty that at some point Paystack was going to have an acquisition or a merger with a bigger company, it was best coming sooner than later, so that the founders can finally stop fund-hunting and focus.

With this deal, Akinlade saved himself the hundreds of hours some other founders would spend fund-raising or seeking investors, and can now channel all the time into growing the business.

“Paystack is a growth engine for modern businesses in Africa, and we couldn’t be more excited to join forces with Stripe, whose mission and values are so aligned with ours, to nurture transformative businesses on the continent. Leveraging Stripe’s resources and deep expertise, we’re excited to accelerate our geographic expansion and introduce more payment channels, more value-added services, and deeper integrations with global platforms,” Akinlade noted.

Stripe was the number one on CNBC’s disruptors list in 2020 and it was tagged Silicon Valley’s most valuable private company, valued at $36 billion, with more than 80% of American adults using Stripe to complete their purchases.

Despite this, the company trusts in Akinlade’s ability to continue leading Paystack as it grows its operations into the rest of Africa and adds more international payment methods.

Henderson explained it this way. “It’s different than a team within a company or a division within a company. This is, as we’ve expressed, more a situation where we think they’re executing so well as an independent company that we want to give them the autonomy to continue moving very, very fast and operating as an executive team, rather than operating as a sort of divisional manager team.”

“Most of what we will be building in Africa has not been built yet,” Akinlade said of the expansion plans.

With time, Paystack’s capabilities will be embedded in Stripe’s Global Payments and Treasury Network (GPTN), a programmable platform for global money movement that currently spans 42 countries. Stripe has been severally hinted to be an IPO candidate but the company has never commented on those plans.

Why Africa?

Prior to this acquisition, Stripe was already on an expansion spree and had even picked up $600 million which it said was to expand its API-based payments services into more geographies. However, its strategy in the past has been to acquire smaller companies to expand its technology stack, rather than its global footprint.

Stripe reports that the company had even expanded into 17 countries within 18 months before acquiring Paystack, but few people expected that it would make any bullish moves into Africa.

Why?

Because even though Africa has 17% of the world’s population, only 2% of online transactions globally are traceable to the continent. However, Patrick Collison, co-founder and CEO of Stripe sounds certain the increase in internet and smartphone users in the continent will soon upturn the balance and make this a long-term win.

In an interview with TechCrunch, he said “Because we are an infrastructure company, we have to look on to long term as nothing radical happens in infrastructure overnight. And as we look on the world in 2025, 2030, 2040, it is obvious that Africa is going to be a significant part in the years ahead.

“There is an enormous opportunity. In absolute numbers, Africa may be smaller right now than other regions, but online commerce will grow about 30% every year. And even with wider global declines, online shoppers are growing twice as fast. Stripe thinks on a longer time horizon than others because we are an infrastructure company. We are thinking of what the world will look like in 2040-2050.”

Acquiring Paystack was not just another corporate deal for Stripe to expand its footprints, or an attempt to tie it up in complicated strategic investments. Collison says they were particularly interested in Paystack and how well it had been built.

“A lot of companies have been, let’s say, heavily influenced by Stripe, but with Paystack, clearly they’ve put a lot of original thinking into how to do things better. There are some details of Stripe that we consider mistakes, but we can see that Paystack ‘gets it,’ it’s clear from the site and from the product sensibilities, and that has nothing to do with them being in Africa or African,” Collison said.

What is in it for Paystack

This acquisition has moved Paystack to another level altogether, and for Akinlade, it removes the question of whether or not they would succeed, allowing them to focus on payment solutions and reliability.

“So the good thing about it is that it’s no longer a zero-sum game. It’s not like we fail or succeed. It’s like, how successful are we going to be? Are we going to be slightly successful or very successful? And that is going to depend on the amount of prosperity, the amount of opportunity we can unlock for people in the continent,” Akinlade said in the Flip interview.

For Stripe, this acquisition completely settles expansion into Africa.

Article collected from interview with Shola Akinlade on The Flip podcast

I love this article. It really brings context to the acquisition of Paystack by Stripes.