In March 2021, the Department of Petroleum Resources (DPR) announced the provisional award of licenses for 57 marginal fields in the 2020 marginal fields licensing rounds to 161 indigenous oil companies. While the selected companies are yet to be publicly announced, the DPR has written a series of letters to them, the most recent of which requested payment of the signature bonuses within a 45-day period.

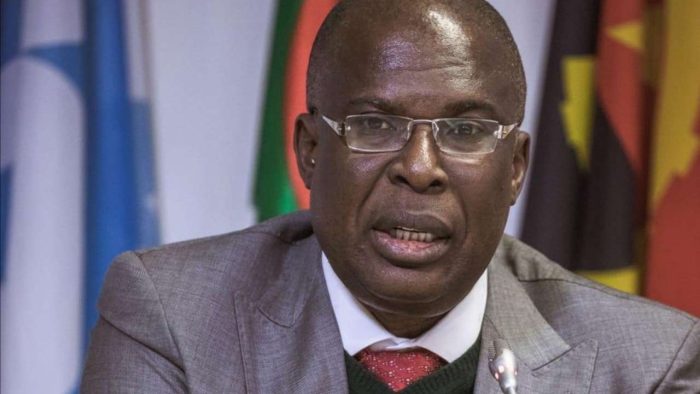

According to Sarki Auwalu, the DPR Director, “We expect Nigeria to net $500 million from the signature bonuses on the fields.” However, projections from observers estimate the country could realize as much as $1.14 billion from the signature bonuses alone.

READ: Oil & Gas: DPR announces 2020 marginal field licensing round

The DPR chase of the provisional awardees for swift payment of signature bonuses is revealing. When the bid rounds launched last year (the first in almost 20 years) with a 3,300% increase from what was paid as signature bonuses in the 2003/2004 rounds even in the heart of the pandemic, it was clear the DPR’s focus was shoring up as much financial gains from the fields as possible – perhaps not fiendish if long-term interests rather than immediate gains were prioritized.

The signature bonuses which start at $5 million and go all the way to as much as $20 million, come after the initial payment of a host of fees – N3 million bid processing fee, $15,000 data prying fee, $25,000 data leasing fee, $50,000 competent person’s report fee and $25,000 field-specific report fee. Currently, provisional awardees are running helter-skelter seeking financing for exorbitant signature bonuses in a very challenging oil and gas market. The nature of signature bonuses allows the federal government to gain from the fields upfront irrespective of the economic success of the awardees on the fields eventually.

READ: FG explains why it revoked 4 Addax Petroleum Oil Mining Licenses

Could it then perhaps be that the excessive bonuses are the government’s means of trying to maximize benefits and hedge any possible losses in the event that, as with 15 of the 24 fields in the last licensing rounds, most of these 57 fields fail to achieve commercial production? Is the DPR bearish on the marginal fields market? Should investors be worried?

Many challenges face the provisional awardees at this time, first of which is funding for the signature bonuses, for which many of them would require third-party financing. Some of this financing may be sourced from offshore lenders, given the reluctance of Nigerian financial institutions to lend to upstream oil and gas development, due to legacy non-performing loans reported to amount to at least N1.21 trillion as at the end of H1 2020.

READ: Nigeria’s revenue burden to ease off as DPR announces bids for marginal oilfields

These non-performing loans constitute the greatest liquidity barrier for the country’s financial sector. Financial institutions are also wary of the opaqueness of the current rounds- the fact that the bid winners are unknown to the public, awardees are unaware of the co-holders of interests in the fields that they have been forcefully grouped with and the award letters are merely ‘provisional’ and cannot serve as sufficient security for any lending.

The DPR’s approach is akin to eating your broth while it is cooking and then burning your tongue in the process, rather than waiting till it is cooked. The frenzy to earn as much as it can from the fields prior to the commencement of production or even prior to constituting the partnership amongst the joint awardees, could end up being counterproductive.

READ: DPR warns against hoarding of petroleum products by depot owners, threatens sanctions

The uncertain regulatory and fiscal framework of the industry, the non-passage of the PIB, the lack of commencement of the gas flare commercialisation programme, the paucity of midstream gas infrastructure (where large gas deposits are realized) equally create a significant challenge. Has the government attempted to close these gaps in the build-up to finalizing the licensing or is it merely focused on the fat signature bonuses? The shift to renewables is also certainly a major challenge for any current fossil fuel investment as is the lack of regulatory clarity around dealing with host community clamour for percentages in the equity of producing companies.

The DPR seems to forget the very nature of marginal fields, which is that they are fields not considered by the original licence or leaseholders for development because of assumed marginal economics under prevailing fiscal and market terms. In light of the even steeper current economic and fiscal market conditions, it should aim to be more of a partner than a brute taskmaster.

READ: FG’s plan for N350 billion revenue from oil field licensing suffers setback

Wood Mackenzie has estimated that the 25 largest oilfields in these rounds have the potential to unlock $9.4bn of investment over the first five years, generating more than $38bn in revenue over their lifetime. The DPR should take a long-term view and look to providing support for these awardees to achieve commercial production from these fields, which will in the end earn taxes and royalties for the country and lead to significant economic development as well as increased domestic supply of fuels, rather than a short-term view that will quell the country’s immediate hunger to fund the national budget and may eventually result on the 2003/2004 scenario playing out again.

Additionally, the DPR should provide more transparency in the process which will ensure more accountability for not just them, but also the companies awarded the fields.

.gif)