The crypto market continued to climb into new territory on Wednesday morning surpassing $2.23 trillion on the day crypto exchange giant Coinbase is scheduled to make its debut on the Nasdaq, trading under a sticker “COIN.”

Crypto market pundits believe that the scheduled listing of Coinbase has most likely triggered Bitcoin, Ethereum, and XRP in breaking new all-time highs.

At its current price level, the flagship crypto has gained more than 125% since 2021 when it was trading below $29,000.

READ: Coinbase executes over $1 billion Crypto trades for world’s biggest clients

At the time of writing this report, Bitcoin, Ethereum and XRP traded above $64,000, $2350, and $1.93 on the FTX exchange amid strong buying pressures.

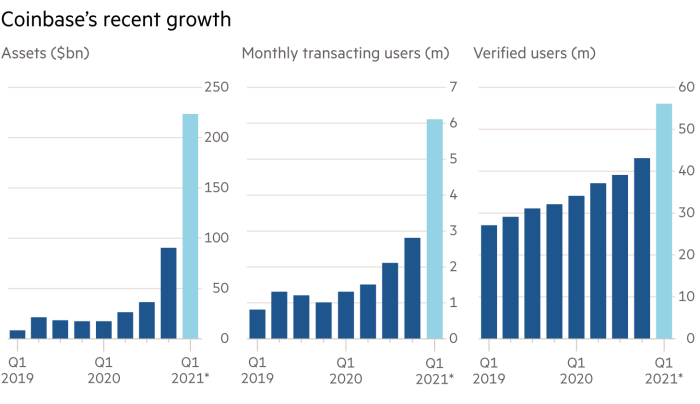

Coinbase is the world’s most valuable crypto exchange, with a market valuation of about $90 billion. The crypto exchange currently has about 56 million verified retail customers, capitalizing on the demand for an easy-to-use Crypto storage solution for institutional and retail clients.

In addition, investors seem to be keying in on the pioneer crypto exchange’s unique advantage where it acts as a broker and holds assets in custody for large clients far more than any known crypto exchange in the world, with assets under management estimated at roughly $ 225 billion.

READ: Meet the billionaire twins who bought $10m worth of Bitcoin when it still sold for $8

READ: Bitcoin ETF in North America has reached $1 billion in assets

Coinbase major customers include Third Point, a $17 billion hedge fund and MicroStrategy, which has over 91,000 Bitcoins.

That being said, a hovering dark cloud of crypto regulation still remains a risk for Coinbase, as such might deter its future upsides. It has also its own share of regulatory issues.

Just recently it had to pay $6.5 million to settle charges that it reported untrue trading data and a former staff engaged in manipulative wash trading often prevalent on many other crypto exchanges.

Err, XRP not at all-time highs yet, chief