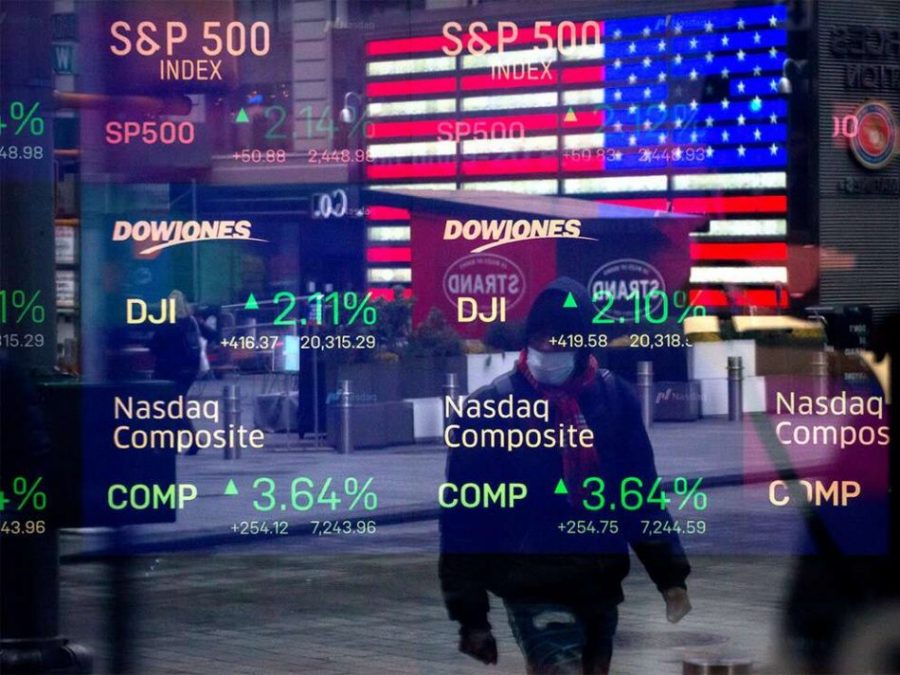

Wall Street soared this Monday as investors digested the monthly job reports. The Dow gained 1.13%, reaching a record high.

The S&P 500 also reached an intraday and closing record high and the Nasdaq jumped 1.67% as technology stocks stretched recent gains. The yield on the 10-year Treasury note jumped down slightly to about 1.71%. The S&P 500 increased by 1.44%.

- The current job growth being experienced by the US economy is a catalyst for economic growth.

- Despite lawsuits from the Federal Trade Commission and 48 state attorneys generally alleging anticompetitive business practices, shares of social-networking giant, Facebook scaled by 3.4% to $308.91 per share.

- Google parent company GOOGLE, +4.19%, Alphabet Inc. GOOG, +4.11% and Microsoft Corp. MSFT, +2.77% closed at record highs Monday.

- Also, more gains were seen in; Texas Instruments Inc. TXN, +2.54%, Lam Research Corp. LRCX, +3.36%, Applied Materials Inc. AMAT, +1.08%, and KLA Corp. KLAC, +2.24%

READ: U.S leading stocks suffer biggest daily plunge since October 28, 2020

Top gainers

- Norwegian Cruise Line up 7.18 % to close at $29.71

- General Motors up 5.61% to close at $61.04

- MGM up 5.04% % to close at $41.70

- Freeport-McMoran up 4.74% to close at $35.36

- Carnival Corp up 4.65 %to close at $28.11

Top losers

- Occidental down 7.56% to close at $25.31

- Pioneer Natural down 7.55% to close at $152.18

- Diamondback down 7.17% to close at $75.40

- APA Corp down 6.95% to close at $17.54

- Helmerich Payne down 5.59% to close at $26.85

READ: Meet the 39 years old Chinese billionaire electric car maker

Outlook

Technology stocks such as Apple, Facebook, Google & Microsoft shares hit a record high.

- Nonfarm payrolls increased by 916,000 for the month while the unemployment rate fell to 6%. Hence, signs of economic growth may also lead to a bull market.

- Cautionary spike of the Bond market draws trades attention to the uncertainty of the market.

- Nairametrics, however, advises cautious buying in this era of growing uncertainties.