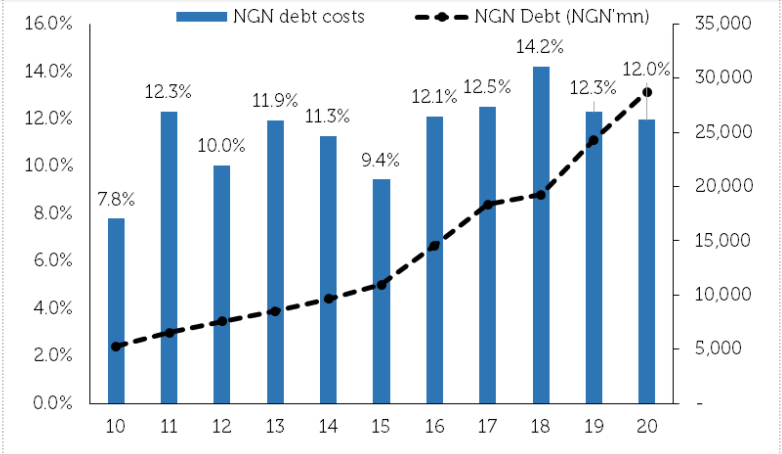

March 2021 MPC: A pause before tightening? At the second MPC meeting of the year, the CBN by a 6-3 vote held all policy parameters constant with the benchmark policy rate left at 11.5% and the asymmetric corridor at +100/-700 basis points. The dissenters’ vote was for rate increases of 50-75 basis points, which in the context of Nigeria’s historic double-digit inflation rates implies these were merely for symbolism as rate moves in Nigeria have to be in units of 100bps to matter.

As I noted last week, Nigeria’s exit from recession appears on a tender footing and the MPC shared this view with the Communique citing sub-50 PMI readings over January and February which would suggest that manufacturing GDP remains in contraction. (Curiously the CBN has stopped publishing the monthly PMI). Indeed as the Governor suggested in the press conference afterward, the Q1 2021 GDP number would be the predictor of policy direction.

Should the economy remain in growth, the CBN would likely embark on rate hikes of 200-300bps accompanied by strident liquidity tightening, an outcome that debt markets appear to be aggressively pricing (YTD: +410bps). On the other hand, a return to contraction would likely dissipate any hawkish intentions as the CBN would now need to rely on its supply-side interventions to deal with runaway food inflation as against tightening interest rates.

Figure 1: Monetary Policy Rate and Market Interest Rates

Source: CBN, FMDQ

Source: CBN, FMDQ

March 2021 Bond Auction – ‘Gbogbo wa la ma je breakfast’: At the monthly bond auction where the Debt Management Office (DMO) had NGN150billion worth of bonds to sell, I had expected a repeat of the pattern over the first two auctions as my thinking was that the DMO would rely on non-competitive bids. That did not play out and with an eye on the large coupons over March, the DMO took advantage of relatively strong effective (not speculative) demand with a bid-cover of 2.2x to take up more than its original plan (NGN261billion).

Hence as the popular phrase goes “Gbogbo wa la ma je breakfast” (We are all going to eat breakfast), everybody who needed a bond got fully served. This sale allowed the DMO to achieve over 30% (face value: NGN637billion) of its target domestic borrowings for 2021 (NGN2.1trillion) as at the end of Q1 2021 – All going according to plan.

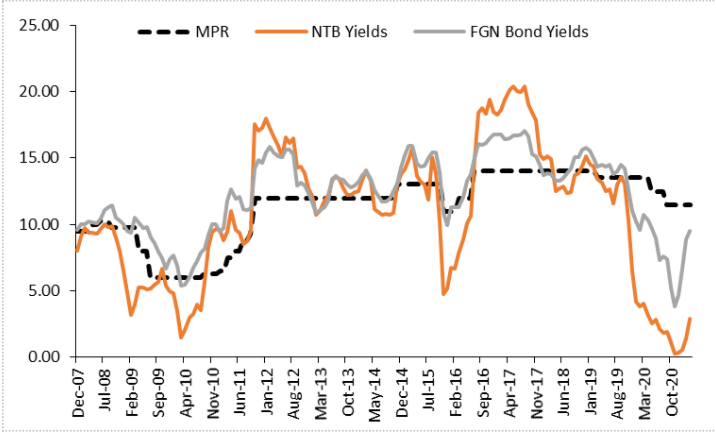

Inversion in full swing? Continuing from last week, the Naira yield curve climbed on average 31bps (YTD: +410bps) with drivers remaining intact: an aggressive sell-off on the front-end (+107bps w/w) driven by repricing on the 1yr (+249bps w/w) relative to an average 9bps w/w increase in bonds yields.

The rise in short-term interest rates reflects a liquidity squeeze on banks as institutional investors re-price their money market exposures higher. To cover these liquidity positions, banks are being forced to liquidate their holdings of the 90-day CBN Special Bills (SPEBs) with discounts quoted at 6.19% (yield: 6.26%) relative to the 0.5% on the issue in early March.

For bonds, an interesting dynamic is worth noting: secondary market activity appears to have dried up with institutional investors preferring to go for the auction. Indeed with the over-allotment at the auction, many of these players had no reason to hit the secondary market. As a result of there was little activity in the secondary market as only auction papers re-priced with scant activity on the long end.

Figure 2: NGN Yield Curve

Source: FMDQ, NBS

Source: FMDQ, NBS

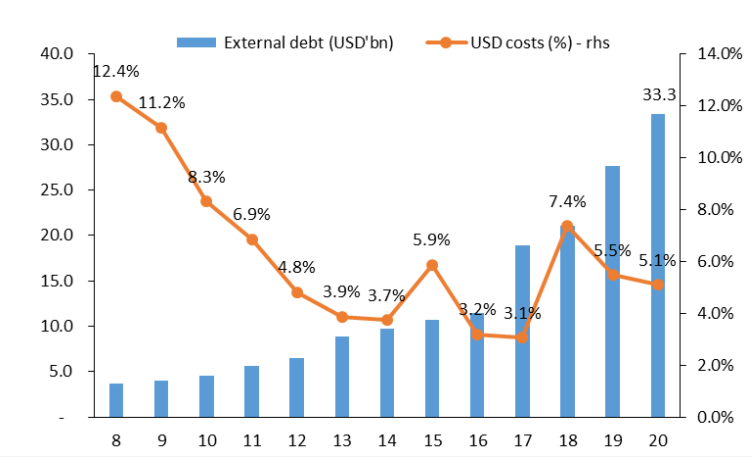

IMF loans drive total debt higher: The DMO released official data on Nigeria’s debt position for 2020 which showed that total debt (FG & States) rose 20% y/y to NGN32.9trillion (21.6% of GDP) driven by a faster increase in external borrowings (+21% to USD33billion) relative to only 10% increase in domestic debt to NGN20.2trillion.

The pick-up in external borrowings largely reflects the addition of the USD3.5billion rapid financing instrument loan which Nigeria tapped from the IMF in April 2020 at the height of the COVID-19 pandemic. In terms of character, Nigeria’s debt remains dominated by concessionary loans to multilateral agencies: World Bank (USD11.4billion), IMF (USD3.5billion), and AfDB (USD2.7billion) while China remains our largest bilateral creditor (USD3.3billion) and Eurobonds (USD11billion) make up the most of the remainder.

The rise in domestic debt reflects FGN bond sales over 2020 to finance the deficit. In terms of borrowing costs, these moderated reflecting the decline in domestic borrowing costs brought about the drop in NGN yields over 2020.

Figure 3: Nigeria: Debt metrics

Source: DMO

Looking ahead, plans to convert NGN10trillion worth of CBN loans to the FGN into official debt alongside planned borrowings over 2021 (NGN5.2trillion or will drive the biggest increase in debt metric since the historic pay down in 2005. However, it is important to note that the CBN loans effectively represent the full weight of the 2014-17 oil price shock on fiscal accounts (as these loans helped bridge the shortfall) while the 2020-21 jump captures the impact of the COVID-19 on fiscal revenues.

FX reserves climb, Eurobond talk in the air: FX reserves notched the first weekly gain in two months (+0.5% to USD34.6billion) likely reflecting the impact on the up move in oil prices over February (+30%). The outlook appears to be headed in a positive direction with news that the long-awaited Eurobond tap is about to get underway. In the event, that Nigeria is able to stomach the courage to shoot for a record USD5billion Eurobond sale and oil prices remain between USD60-70/bbl, the resulting boost to FX reserves outlook should help anchor Naira outlook. In terms of the direction of convergence, my suspicion is that it’s more likely that parallel market rates move lower. For the Naira itself, it held steady at NGN410.00/$ and NGN485.00/$ at the I&E window and parallel market respectively.

The Week ahead (March 29-April 2, 2021)

In the week ahead, system inflows are as follows: OMO bills (NGN181billion), NTB maturities (NGN96billion), and FGN bond coupons (NGN41billion). As such there will be an NTB auction on Wednesday wherein keeping with the trend in recent auctions, the 1yr could close 50bps higher at 8%. The annual deposit insurance payments loom over the near term which could put more liquidity pressure on money markets. Debt markets could also see a bout of portfolio trades as participants close their position for quarter-end reporting.

Q2 2021 Outlook: Going into the second quarter, fundamentals appear to point towards rate increases. Inflation will likely accelerate towards 18-19% as the lean season drives food prices higher with additional support from a mix of higher energy costs (following hikes in fuel and electricity prices) and pass-through from Naira weakness.

Granted, economic growth remains on shaky ground in the light of adverse regulatory actions to telecoms operators even as OPEC+ compliance will likely result in a sharp drop in oil GDP, the base case is for GDP to scrape through with another positive print. Though improving oil prices and possible progress on external borrowings via the sale of Eurobond will strengthen CBN’s ability to drive convergence in FX markets, the apex bank’s near-term focus could be on FX reserve accretion which will support tightening.

Within debt markets, supply remains key and markets should expect a reprisal of the Q1 bond issuance trend where the DMO cleared well in excess of NGN637billion to put it in a strong position ahead of H2 2021. Given thin system maturities over Q2 2021 and likely liquidity tightening by the CBN, focus will be on staying liquid for banks (who will bear the brunt) which will likely underpin sell-offs in NTBs past the 10% on the 1yr.

For long end, it appears the key actors (pension funds) behind the Q1 sell-off have cleared out a significant portion of duration exposures in the trading portfolios in line with regulatory guidance. This development limits their desire to trade bonds and they are likely to be less active in the secondary market going forward with a focus on monthly auctions where rates could approach 13%.