“Covid has acted like a time machine: it brought 2030 to 2020.” This statement by Loren Padelford, the vice president at Shopify Inc. epitomizes the shift in work cultures globally as a result of the pandemic. More companies and businesses are open and opting for remote work and the use of technology in their daily operations.

The consequence?

Less human interactions, less commute, less travel, and inadvertently less demand for petroleum products.

While writing this article on an almost empty European flight, I began to wonder if life would continue like this. In the short-term, probably, as there have been reports of the third wave in certain European countries. There have been talks of vaccine passports to substitute the constant hassle I go through with taking a COVID-19 test 72 hours before departure along with ‘Passenger Locator Forms,’ a form that tracks arrival’s possible locations just in case of exposure to the virus.

In the long-term, probably not. Humans are by nature, nomadic, and would find it a lot harder staying indoors. In a recent interview, the CEO of Goldman Sachs called “work from home” an aberration. David Solomon, the Chief Executive Officer of the Investment bank said, “I do think for a business like ours which is an innovative, collaborative apprenticeship culture, this is not ideal for us and it’s not a new normal.”

The concern for Nigeria?

Based on data from Statista in 2020, Europe has been Nigeria’s main crude oil trade partner. In Quarter 4 of 2020, the value of export to Europe was estimated at N853 billion ($2 billion). With lockdowns and reports of a third wave, shipments to Europe may continue to decline.

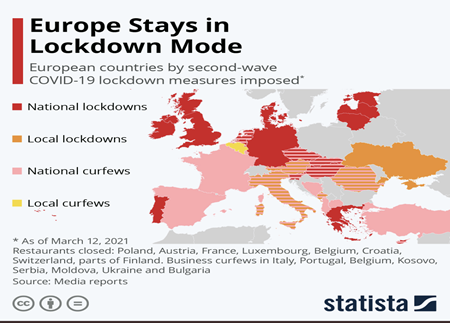

The image below shows the current situation in Europe as lockdowns persist.

Most businesses and office places are adopting work from home till further notice, while most companies will revert to normal after vaccination.

Switch to Asia, Nigeria’s largest destination region of crude oil in Quarter 4 of 2020. According to Statista, oil exports to that region amassed over N880 billion.

Notably, in 2020, the top 9 countries that imported crude oil from Nigeria were:

India – N1.6 trillion;

Spain – N1.02 trillion;

Netherlands – N989.82 billion;

South Africa – N947.52 billion;

China – N311.55 billion;

France – N280.39 billion;

Italy – N272.99 billion;

Portugal – N243.74 billion;

Turkey – N239.9 billion.

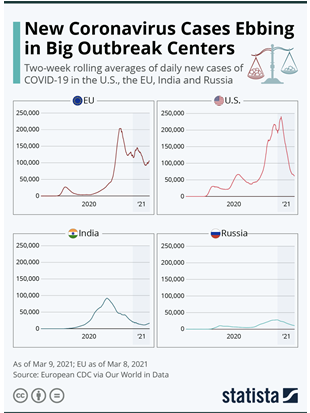

The top export location, India, which recently pleaded with OPEC to increase outputs to stabilize market prices, appears to be handling its exit from COVID well with declining daily new case figures. This could be a stroke of good fortune for Nigeria, but for Europe, it might take more time.

S&P Global Platts believes that the pandemic-related shift to remote work could remove between 1 million and 1.5 million barrels per day from global demand, which makes sense because workers and companies have now seen that it is possible to be productive while working remotely, and so, a certain percentage of workers may never go back to daily commuting.

For employers, this translates to lower operational costs as items such as large and expensive office spaces, employee transport and feeding allowances, time lost in daily commuting, and other costs gradually fizzle out. For many workers, it means only one thing: no more commute.

According to analysts at Raymond James, a diversified financial services firm, the assumption is that “vehicle fuel consumption in 2021 will be impacted by 1.6 million BPD versus pre-COVID levels, all else held constant, with the impact decreasing to 400,000 BPD in 2022.”

When it comes to jet fuel consumption, the firm believes a slowdown in business travel will mean 2 million BPD of demand loss in 2021, before recovering slightly to 800,000 BPD in 2022.

All these would certainly impact crude oil. Although prices may be high, demand may not follow the same trajectory. The policymakers at the helm of Nigeria’s affairs need to be cautious and prepare for a possible shift in the work culture of the nation’s trading partners.