Ten of the Nigerian banks quoted on the Nigerian Stock Exchange (NSE) spent a total of about N12.2 billion on travels for the financial year ended December 2020.

This represents a 38.7% drop from the N19.8 billion spent in the same period in 2019, and is much lower than the N22.56 billion recorded in 2018. These were obtained from the banks’ financial reports.

The banks are GTBank, Zenith Bank, United Bank of Africa (UBA), First Bank of Nigeria (FBN), Union Bank of Nigeria (UBN), Fidelity Bank Plc, Wema Bank, Stanbic IBTC, FCMB, and Sterling Bank Plc.

Highlights of banks’ travel expenses

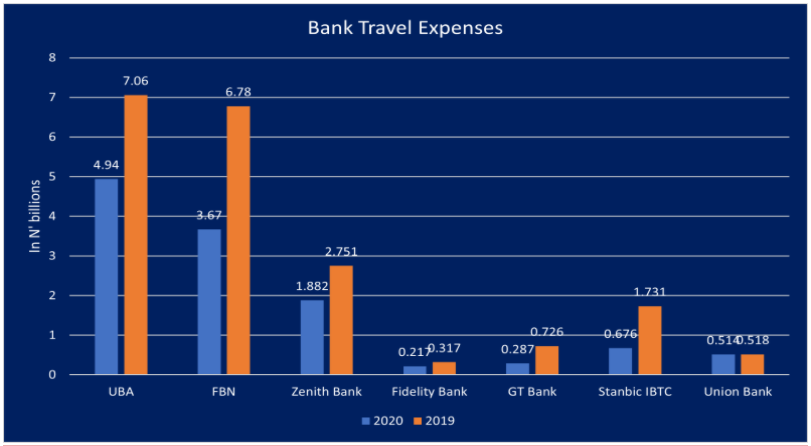

UBA: Of all the banks, UBA incurred the most on travels last year with N4.94 billion as against N7.06 billion in 2019.

FBN: Next on the list is FBN with N3.67 billion as against N6.78 billion in 2019.

Note that the recorded travel expenses represent how much was spent across FBN Holdings Plc and its subsidiaries. FBN is the parent company of First Bank of Nigeria Ltd. It has other companies under its umbrella, including FBNQuest Capital Ltd, FBNQuest Securities Ltd, FBNQuest Capital Asset Management Ltd, etc.

Zenith Bank Plc: The third on the highest travel list is Zenith Bank with N1.882 billion in 2020 as against N2.751 billion in 2019.

Fidelity Bank Plc: On the other hand, Fidelity Bank spent the least on travels in 2020, compared with all of its competitors. The financial institution spent N217 million in 2020. It also recorded the lowest in 2019 when it spent N317 million on travels.

GTBank: According to information obtained from GTBank’s audited financial statement for full-year 2020, about N287 million was spent on travels in 2020. The amount is less than the N726 million, which the bank incurred for the same purpose in 2019, and the N727 million in 2018. This is the lowest amount that was spent by a tier-1 bank in 2020.

Stanbic IBTC: The bank’s travel costs stood at N676 million in 2020. This is less than the N1.731 billion, which the company spent on trips during the comparable period in 2019 and N1.897 billion in 2018.

Union Bank: UBN also recorded a low travel expense in 2020; it spent N514 million against the N518 million incurred in 2019 and N1.136 billion in 2018.

What it means

The drop could be attributed to the lockdown imposed by the Federal Government due to the coronavirus pandemic, which hit the nation in February 2020.

The development forced most businesses, including banks switch to virtual operations in compliance with the government’s sit-at-home directive.

The lull is not limited to the travel expenses of the banks alone, it also took a toll on the revenue of airlines and aviation handling firms. Though none of the airlines are listed on the NSE, which made it difficult to access their data, two aviation handling firms listed on the Exchange, recorded a drop in their revenues.

What you should know

The pandemic, which warranted nationwide lockdown measures, had adverse effects on businesses (the banking sector included) and the economy as a whole. Many financial institutions, especially in commercial cities, were forced to suspend operations, resulting in job losses and salary cuts.

As financial services were not categorised by the government as essential services, the comparatively large drop in bank travel expenses was not unexpected.

The reduction in travelling expenses may not be analysed in isolation. With the mode 9f ooerandy during lockdown period one expects a corresponding higher spent ( expense and asset acquisition)on telecomminication: soft ware acquisitions set up and maintainable costs) Security software on the lead due to rampant hardings by fraudsters that also took advantage of large volume of transactions on line.