The Nigerian stock market continued its bearish streak for the 7th consecutive week as the All-share index dipped by 0.69% to close at 38,382.39 index points.

The total market capitalization also depreciated from N20.221 trillion in the prior week to N20.082 trillion.

Nigerian investors are significantly hunting for consistent returns on investment thus increasingly selling off their equity portfolios and ploughing the proceeds in fixed income instruments at a time yields are hitting yearly highs.

READ: Sell-offs in Bitcoin, Gold, U.S stocks on rising U.S dollar

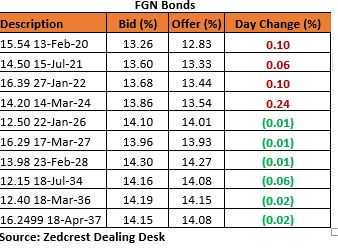

Though it’s been a tepid end to the week for sovereign bonds as several yields remained unchanged at the close of trades.

The open buy-back and overnight rates doubled to close at 25.00% and 25.50% respectively at their most recent trading session on the back of the CBN’s end-of-week retail FX auction.

Olamide Adeboboye an investment analyst, at FSDH Capital, in an exclusive note to Nairametrics, spoke on the market expectation and investors growing interested in Nigerian yields.

READ: Cryptos: Nigerian financial experts talk risks associated with trading digital assets

She said, “Well….for this week. I don’t see major catalyst (s) for the market. Also bearing in mind that there is a bond auction this week, so investors will likely position to take advantage of the anticipated increase in yields.”

On the foreign side, S&P 500 and Nasdaq rallied high at their most recent trading session as Facebook and energy shares lifted the U.S stock markets value on the account of falling U.S. Treasury yields, but such narrative seems to be changing as the U.S dollar ticked up at the time of writing this report.

READ: XRP posts a big bang, as legal tussle with SEC lingers

Stephen Innes, Chief Global Market Strategist at Axi in an interview with Nairametrics spoke on prevailing market condition weighing deep on global riskier assets like equities;

“Risk markets are taking a short breather from last week’s risk-off and oil is stabilizing.

“Still, the swift moves in yields showed the Fed’s complacency around upcoming inflation might have unintended and lasting consequences.

“It’s a busy week ahead, so the pause makes sense as markets will continue to digest the reopening boom and higher yields cycle through the lens of a series of crucial and timely PMI releases.”

What to expect: That being said, timing is still everything. The next leg of the reflation will have to be carried more and more by a continued recovery in economic growth, as fiscal and monetary stimulus gets increasingly packed into the prices of global equities.