The Nigerian Stock Exchange is neck-deep in a bear market, after a bullish run that started in April Last year came to a halt in the first week of January as local investors cycle-out funds from the market in search of impressive yields in the fixed securities space.

This move has seen many stocks on the NSE trade lower than their open price this year, while some have retraced significant fraction of their gains this year, at the back of sustained sell-off in the Nigerian equity space.

Inflation and its impact on investors’ real return

READ: NSE-30 companies lose N1.13 trillion in market capitalisation year-to-date

In line with standard practice, with the headline inflation rate at 17.33%, it is important that gains from investment provide a hedge against the persistent drop in purchasing power of naira, as the Nigerian inflationary pressure strengthens into a galloping phase.

However, investors in the stock market who opened positions in key stocks at the beginning of the year can’t brag of substantial gains in their portfolio, while the few ones who sit on profits are clearly making losses in real terms – when the going inflation rate of 17.33% is deducted to reflect the real return on their investment.

While a vast majority of shares on the Nigerian Stock Exchange have been affected by the sell-off in recent times, some stocks on the Nigerian Stock Exchange have delivered gains in excess of 33% – at least 15% higher than the recent inflation rate.

READ: Food inflation rate in Nigeria surges to highest in over 15 years

Some of these stocks include the shares of the following consumer goods companies:

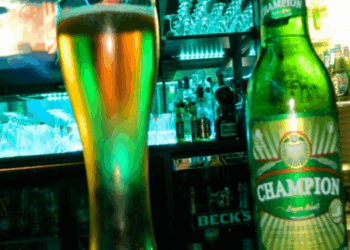

Champion Breweries Plc (CHAMPION), 183% YTD GAINS

The medium capitalized brewery stock stands as the best performing stock on the NSE, printing gains in excess of 180% in less than three months, amid buying interests by investors at the back of the expectation of a takeover bid from Heineken.

The company has been in the news for a while, following the acquisition of its shares worth N4.96 billion by Heineken through its wholly-owned subsidiary, Raysun Nigeria Limited.

This acquisition represents 24.3% stake in the local brewer, as it raised the ownership stake of Raysun to 84.7%, giving Heineken the advantage to successfully launch a takeover bid to acquire the balance of 15.3% stake of the company.

READ: Analysis: Japaul, Ardova, Champion Breweries; What is behind the deals?

The shares of Champion Breweries at the close of the market today presently stands at N2.44 per share, at this price there is a slim 6.5% upside potentials, should Heineken launch a takeover bid of N2.60 per.

Note that Heineken acquired 24.3% of the total issued shares of the brewer at N2.6 per share.

McNichols Plc (MCNICHOLS), YTD GAINS 58%

The shares of McNichols since the beginning of this year has increased by a whopping 58% at the back of renewed buying interests by investors who see tremendous value in the fundamentals of the consumer goods stocks.

McNichols Plc an indigenous homegrown fast-moving consumer brand, a food and beverage company that commenced operations in April 2005, was migrated from the Alternative Securities Market (ASeM) to the NSE Growth Board on the 30th of November 2020, alongside Chellarams Plc, Living Trust Mortgage Plc, McNichols Plc, and The Initiates Plc.

READ: Buharinomics: In Stagflation we trust

Since then, the shares of McNichols have surged by 59.35%, from N0.50 to N0.80. While the YTD gains stand at 58.09%.

Guinness Nigeria Plc (GUINNESS), YTD 33.16%

The shares of Guinness Nigeria Plc, a leading beverage and alcohol Company have gained about 33.2% since the beginning of this year.

Recall that the shares of GUINNESS declined to an all-time low of N13 in July 2020, amid fears of the impact of the disruption occasioned by the covid-19 pandemic on the long-term fundamental strength of the company.

The sell-off which dropped the shares of the brewer to N13.0 per share was driven by sentiments around the knock-on effect of the COVID-19 lockdown which took a toll on the on-trade channel, which accounts for about 60% of the sales of Guinness.

The company’s Board however issued guidance on this, to reassure shareholders of their commitment, stating that the company’s balance sheet, however, remains strong, and this gives the Board the confidence that the Company has the right resources to continue to deliver value for its shareholders.

Disclaimer: The objective here is to give the needed insight into consumer goods shares with impressive real return. This article should not be seen as a piece of investment advice or guide, as the author advises one to seek the services of a certified financial advisor for such services.