In the past few years, consecutive hikes in domestic fuel, kerosene and diesel prices always precede protests (usually online) as Nigerians constantly reject high fuel prices. The blame is usually pinned to the costs of importing fuel and other petroleum products into the country as seen in the image below.

Every month, the figures above are subject to changes. The most important figures in the list are the cost of Brent Oil – currently at ($62.22) according to the template and the average FMDQ Importer $ Exporter (I&E) Naira/USD Exchange Rate – $403.80.

READ: NNPC says no plans to increase pump price of petrol

Notably, these figures are based on the average costs from 1st – 28th of February 2021.

It is important to note the current Brent Oil price as at the time of writing is at $69.41 per Barrel after pushing the highest finish for the front-month contract is May 28th 2019. Additionally, the FMDQ importer and exporter (I & E) naira/usd exchange rate as at 12th March 2021 closed at N410 after reaching a day high at N412.

If these figures (Brent oil price and Exchange rate) stay consistently on the upside- which is very likely, retail fuel prices would be high. There is an empirical direct relationship between both.

The Conundrum

Here is a look at the few issues concerning a potential petrol price increment.

What will be the reasons for the potential hike in fuel prices?

The two major factors responsible for a potential increase in fuel prices are the volatility in foreign exchange rates and the continued rise in international crude oil prices. During the pandemic, the Naira depreciated against the dollar as a result of dwindling foreign revenue and earnings. Technically, as we import refined petroleum products, the importers are subject to the exchange rate at the I&E window which is currently at $410 as at 12th March 2021.

You might ask, why will an oil-producing nation be affected by a continued rise in international crude oil prices?

READ: CBN Governor says Dangote refinery will sell refined products to FG in Naira

Although the 212 naira valuation has been debunked by the authorities, there is mutual exclusivity with producing oil and importing refined petroleum products. In a country that does have a refinery that works in an optimal capacity, Nigeria will be subject to import charges that come with importing petroleum products.

To buttress this – The United States of America averages 11.3 million barrels per day (b/d) in 2020 which is immensely higher than the 1.79 million barrels per day (b/d) in 2020. However, fuel prices per litre is estimated at N331 to Nigeria’s purported N212 (using $403.80 as conversion rate).

READ: Nigeria and its long standing fuel subsidies

Will oil prices and exchange rates continue rising?

Earlier in the week, I wrote that once oil prices break through that psychological $70 barrier, we might be in for a breakout in higher oil price. The prices of oil have significantly increased and as we approach the one year anniversary of negative oil prices we experienced last year, it is a commendable effort that prices have reached these levels. It appears that oil-producing countries are milking out of the high prices we are experiencing and a lot of economic agents (countries and consumers) are hurting as a result. OPEC+ have decided not to increase production and there are fears the oil markets are tightening as a result of that decision. In a Donald Trump administration, OPEC’s excesses would have been checked as he clamoured for lower gasoline prices for his citizens.

The Naira-Dollar exchange rate would also be subject to increase as the forex market is under siege from currency speculators who are racketeering and profiteering from the shortage of dollars in the economy.

The shortage issues are being addressed by the CBN and is one of the underlying motives for the introduction of the Naira for Dollar promo currently championed by the Central Bank.

What is the main problem with fuel prices in Nigeria?

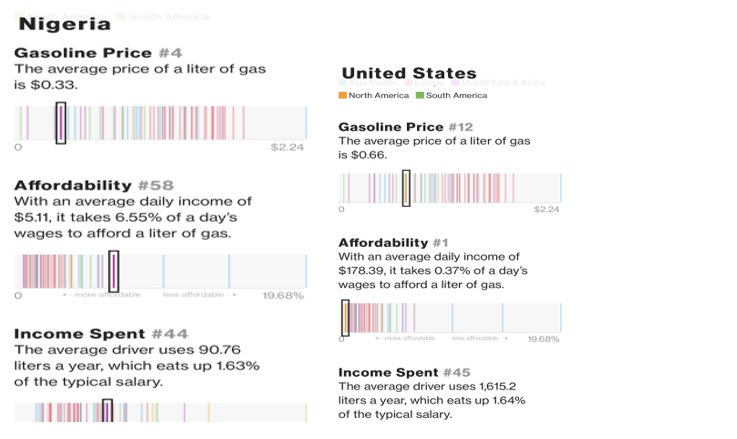

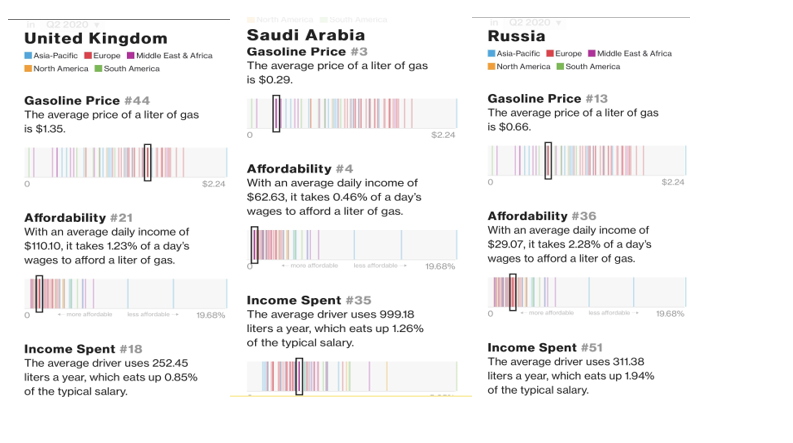

Protagonists of the government are of the opinion that fuel prices are a reflection of the economics of importing oil. To buttress their points, they compare the prices of fuel in Nigeria to prices of fuel in other oil-producing countries.

To be candid, the protagonists are right. That’s the way the cookie crumbles in other countries.

Based on data available with GlobalPetrolPrices.com as at 8th of March 2021, fuel prices in the following oil contemporary nations are mixed depending on different factors (tax, freight and exchange rates). Still abiding by a 408 naira to $1 conversion rate, The fuel price in Saudi Arabia has increased to N210 ever since President Buhari’s tweet above. Egypt fuel prices have also increased to N220 a litre, Russia is at N263 per litre. Togo and Ghana stand at N312 and N380 respectively.

READ: Oil prices soar above $70 a barrel over terrorist attacks on Saudi’s oil station

Similarly, Angola, our major rivals in the oil production ranking in Africa, retail fuel at N105. However, this is an outlier as the Angolan government pays heavily for fuel subsidies which people are still contesting. The Petroleum Minister of India, Dharmendra Pradhan, who is also facing the heat in respect to increasing fuel prices said this earlier to defend the retail prices – “Generally, the prices of petroleum products in the country are higher/lower than other countries due to various factors, including the prevailing tax regime and subsidy compensations by the respective countries.”

On the other side of the debate, Nigerians do not care about what other countries are selling fuel at. They want cheap fuel as their purchasing power is different from the Saudi Arabians and Russians.

READ: Nigeria’s external reserve falls to lowest in 10 months

This is also correct.

According to data extracted from a Quarter 2020 data by Bloomberg, the average daily income of Nigerians is at $5.11 which is 2,084 naira. (408 to $1). The data shows that it takes 6.55% of a day’s wages to afford a liter of gas. This is relatively higher than the affordability percentages of U.K (1.23%), Russia’s (2.28%), United States (0.37%) and Saudi Arabia’s (0.46%).

The debate

The question is, should Nigeria return to the fuel subsidy regime or in fact, are the government still paying subsidies on fuel? There is a lot of opacity around the subsidy removal scheme.

The lack of transparency and translucency in the government’s promises and policies keeps everyone in the dark on the debate of subsidy.

Last week, the Minister of State disowned the increase in the price of petrol as announced earlier by the Petroleum Products Pricing Agency, PPPRA. Although the agency later deleted the N212 retail price, the kite has already been flown. The Minister of State for Petroleum, Timipre Sylva says he and President Muhammadu Buhari, who also seats as the Minister of Petroleum were not informed about PPPRA’s decision and “the pump price of petrol was not approved to be increased by one naira”

READ: N250bn to be spent to fund compressed Natural Gas infrastructure

In a deregulated, “free market” and non-fuel subsidized economy, retail petrol prices fluctuate with respect to both global crude prices and exchange rates.

So the question is what economics is at play for a Minister to say, the “pump price of petrol was not approved?” Especially when the Minister also said one year ago, that the President will not intervene in fixing the pump price in the country again.

Conclusion

The almost 30% increase in fuel prices announced by the PPPRA will be challenged by the union and Nigerians in entirety. Despite political differences, Nigerians always unite to fight fuel hikes as “suffer” does not know political party. In the short-term, how will the government fix this faux pas? Are they insinuating the fuel price will never increase? Is the gaffe the reality of things the petroleum importers are facing?

As I usually say in a game of musical chairs, somebody will eventually lose a seat.