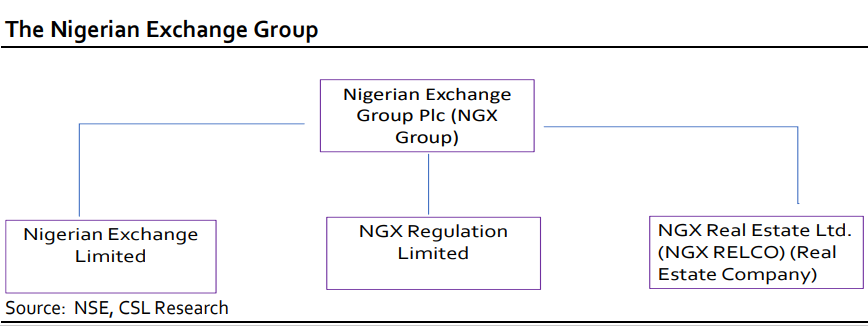

Recently, the Nigerian Stock Exchange (NSE) completed its long-awaited demutualization after getting the approval of the Securities and Exchange Commission (SEC) and CorporatebAffairs Commission (CAC). The demutualization exercise is expected to produce a new non-operating holding company with three operating subsidiaries.

The subsidiaries are Nigerian Exchange Limited (NGX), NGX Regulation Limited (NGX REGCO), and NGX Real Estate Limited (NGX RELCO), saddled with operating, regulating, and acting as the real estate arms of the Exchange, respectively.

The Nigerian Stock Exchange (formerly Lagos Stock Exchange) was founded on 15 September 1960 and began operations on 25 August 1961. In a bid to catch up with the needed efficiency to take its place as the leading Exchange on the African continent, members had agreed at an Extra-ordinary General Meeting in 2017 to demutualize the Exchange.

A decision that became more pronounced as the demutualization bill became law in August 2018. Demutualizing the Exchange changed it from its earlier status as a nonprofit organization limited by guarantee into a public company.

According to the Group Chief Executive Officer, Mr Oscar Onyema, ‘The Nigerian capital market should play a role commensurate with Nigeria’s status as Africa’s largest economy. At the Nigerian Stock Exchange, we have a vision that the new Group will become the premier exchange hub for Nigerian businesses and for the African economy. We are implementing a series of measures towards this goal, demutualization being a critical milestone. The completion of demutualization is a truly significant moment, and we welcome the new possibilities that have opened up for us today.’

In our view, the exercise will provide an avenue for the Exchange to achieve greater efficiency in all its core activity areas. The Group’s listing on the Exchange makes the current ownership stakes tradable while also providing an avenue for Capital (Equity or Debt) raise should the company need financing.

Furthermore, the Group’s incorporation would subject it to more public scrutiny, a factor that we expect would engender better corporate governance and better reporting standards. The company plans to invest in the necessary infrastructure to lower trading cost, improve real-time access to deals matching and reduce system downtime.

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.