The fast-rising Nigerian stock broking application, Bamboo, is currently offering an exchange rate of N492 to the dollar.

About two weeks ago, the Nigerian stock trading app offered an exchange rate of about N484 to $1.

The green-colored trading app known for allowing local-based Nigerians to invest in stocks listed on the world’s biggest stock market (New York Stock Exchange and NASDAQ) is currently offering its users a premium of more than 20% compared to the official exchange rate set by the Nigerian apex bank.

READ: Nigerian Bitcoin P2P surges by 15% since CBN Crypto ban

That being said, Nairametrics’s most recent research observed Chaka. ng offers the lowest exchange rate charge of N480 to 1$, other Nigerian-based stock trading apps that include Trove and Risevest currently offer their clients N491.68 and N486 to $1 respectively.

In addition, other leading fintech platforms reviewed by Nairametrics also presently offer exuberant rates as high as about N519 to a dollar, thereby adding more transaction costs on a significant number of Nigerians hoping to trade such financial assets.

A growing number of Nigerians are currently increasing their exposure to the U.S stock market taking to the current bearish trend that is being witnessed in the Nigerian Equity market and growing urge in hedging against the weakening local currency.

Consequently, a lot of Nigerians are flocking the New York Stock Exchange (NYSE) on the account it has about 2,800 companies listed, while the NASDAQ has about 3,300 stocks listed. This gives Nigerian investors numerous options where they can invest their money. It is also why the US economy attracts billions of dollars in portfolio investments annually.

READ: Many Nigerians are trooping into foreign stock markets

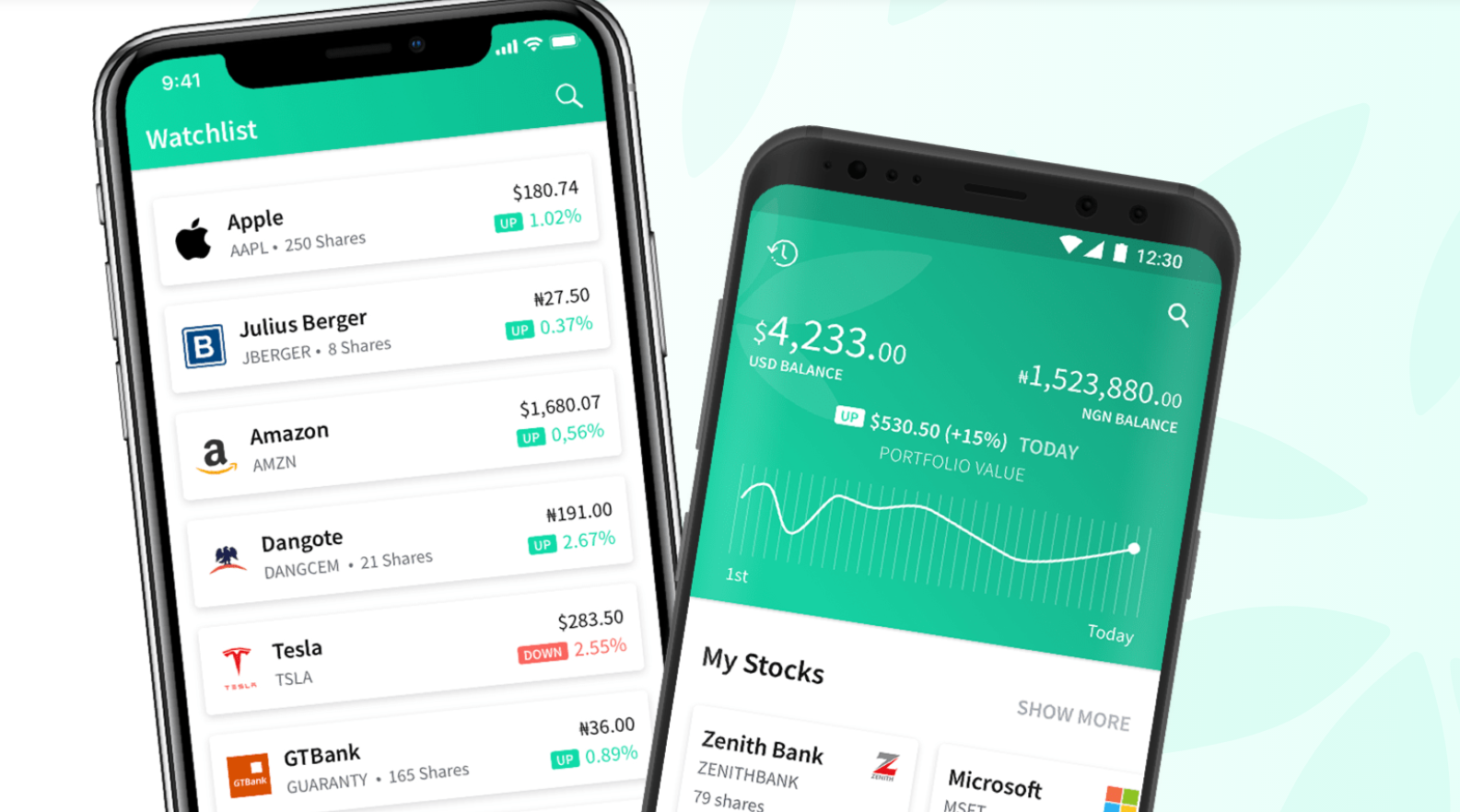

Bamboo is an investment platform that gives Africans real-time access to invest in or trade over 3,500 stocks listed on the American and Nigerian exchanges right from their smartphones or personal computer.

In partnership with US-based Drive Wealth LLC, Bamboo provides seamless, secure access to US and Nigerian securities.

Hello ,please how do I join h bamboo platform in other to invest in foreign stocks. Is there a training of how to on foreign stocks