The bearish grip in the crypto market has led to heavy losses of crypto investors’ funds at the wrong side of the current trade, as roughly $120 billion worth of crypto assets evaporated into thin air within a day.

The flagship crypto that surged to a record price level of over $58,000 last weekend has now depreciated by over $11,000, as the present price shows that it trades around the $46,800 price level.

The global crypto market cap is $1.41 trillion, an 8.23% decrease over the last day.

- The total crypto market volume over the last 24 hours is $151.74 billion, which makes an 8.97% decrease.

- The total volume in DeFi is currently $13.96 billion, 9.20% of the total crypto market daily volume.

- The volume of all stable coins is now $123.76 billion, which is 81.56% of the total crypto market daily hour volume.

- Bitcoin’s price is currently $46,765.78.

- Bitcoin’s dominance is currently 61.63%, an increase of 0.10% over the day.

- For the day, 130,475 traders were liquidated.

- The largest single liquidation order happened on Binance-BTC valued at $3.56 million

READ: Investors get burnt, lose $1.6 billion in crypto within a day

Other leading crypto assets that include Ethereum, XRP, Litcoin, Chainlink, Binance coin, and Stellar lost more than 9% in value at the time of writing this report.

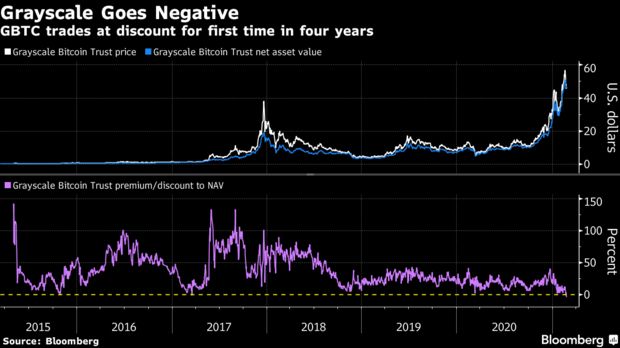

In addition, recent data suggest that the world’s biggest digital asset manager has seen its $32 billion Grayscale Bitcoin Trust (ticker GBTC) plunge by 20% this week alone, according to Bloomberg News, outpacing a 13% decline seen in the price of Bitcoin lately.

This suggests that after lots of money was poured into GBTC, as institutional investors sought exposure to Bitcoin’s dizzying rally, investors are now taking their exits as the current bullish rally seems to have stalled.

READ: Red Monday: Investors lose $2 billion trading crypto

Sell-off in the crypto market is likely due to widespread profit-taking by global investors, coupled with strong anxiety that leading financial regulators might clamp down on its reach.

Some weeks ago, leading United Kingdom financial regulator, the Financial Conduct Authority, issued a piece of stern advice on crypto investments.

The statement highlighted the risks associated with investing in Bitcoin and other crypto-assets, and warned the public that there were high chances that all their funds could be lost.

READ: Cryptos likely to gain at least 1000% very soon

“The FCA is aware that some firms are offering investments in crypto assets or lending or investments linked to crypto assets, that promise high returns.

“Investing in crypto assets, or investments and lending linked to them generally involves taking very high risks with investors’ money. If consumers invest in these types of products, they should be prepared to lose all their money,” said the FCA.

That said, a significant number of crypto investors appear to be shrugging off the huge falls as another typical bump on the crypto path, and one which, no doubt, will likely see crypto trading volume return as crypto investors look to buy what many are viewing as a bargain to buy in what is still very much a bullish run.