The World Bank Group would be deploying to the tune of $160 billion over 15 months through June 2021 for COVID-19 interventions, according to its 2020 Annual report.

According to the report:

- The interventions would be through a series of new operations, the restructuring of existing ones, the triggering of catastrophe drawdown options, and support for sustainable private sector solutions that promote restructuring and recovery.

- “The World Bank deployed the first set of projects under this facility in April, aimed at strengthening health systems, disease surveillance, and public health interventions. To soften the economic blow, IFC and MIGA moved quickly to provide financing and increase access to capital to help companies continue operating and paying their workers”.

- International Finance Corporation (IFC) – a member of World Bank Group expects to provide $47 billion in financial support through June 2021 as its part of the Bank Group’s response.

- “In its initial package, IFC is providing $8 billion to help companies continue operating and sustain jobs during the crisis. This package will support existing clients in vulnerable industries, including infrastructure, manufacturing, agriculture, and services, and provide liquidity to financial institutions so they can provide trade financing to companies that import and export goods and extend credit to help businesses shore up their working capital”.

What you should know

- The focus of the interventions would be on investing in prevention, remaining engaged in crisis situations, protecting human capital, and supporting the most vulnerable and marginalized groups, including forcibly displaced populations.

- The second phase of the IFC’s interventions is intended to support existing and new clients using its Global Health Platform, which aims at increasing access to critical health care supplies, including masks, ventilators, test kits, and, eventually, vaccines. This also includes financing to manufacturers, suppliers of critical raw materials, and service providers to expand capacity for delivering products and services to developing countries.

- IFC expects to contribute $2 billion from its own account, as well as mobilize an additional $2 billion for private sector partners.

- Multilateral Investment Guarantee Agency (MIGA), on its own part, formally launched a $6.5 billion fast-track facility towards its interventions to the private sector investors and lenders to tackle the pandemic in low- and middle-income countries.

- The various interventions by both IFC and MIGA complement the World Bank’s broad-based efforts in ensuring the preservation of the global supply chains, particularly for the production and distribution of vital medical supplies.

- The World Bank as well IMF have intervened to call for the suspension of bilateral debt payments from the International Development Association(IDA) countries to ensure that countries have the liquidity needed to grapple with the challenges posed by the outbreak and allow for an assessment of their financing needs.

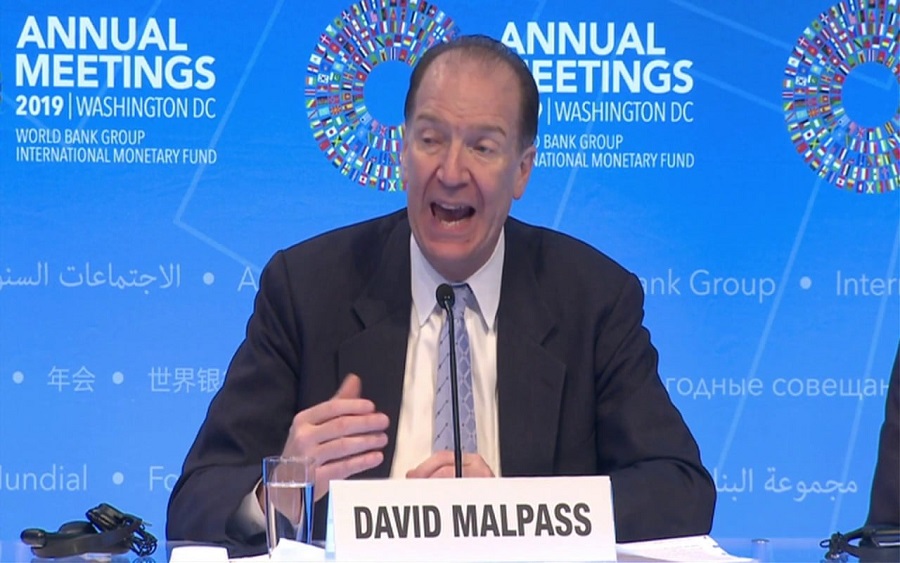

According to the World Bank President, David Malpass, “Debt relief is a powerful, fast-acting measure that can bring real benefits to the people in poor countries.”