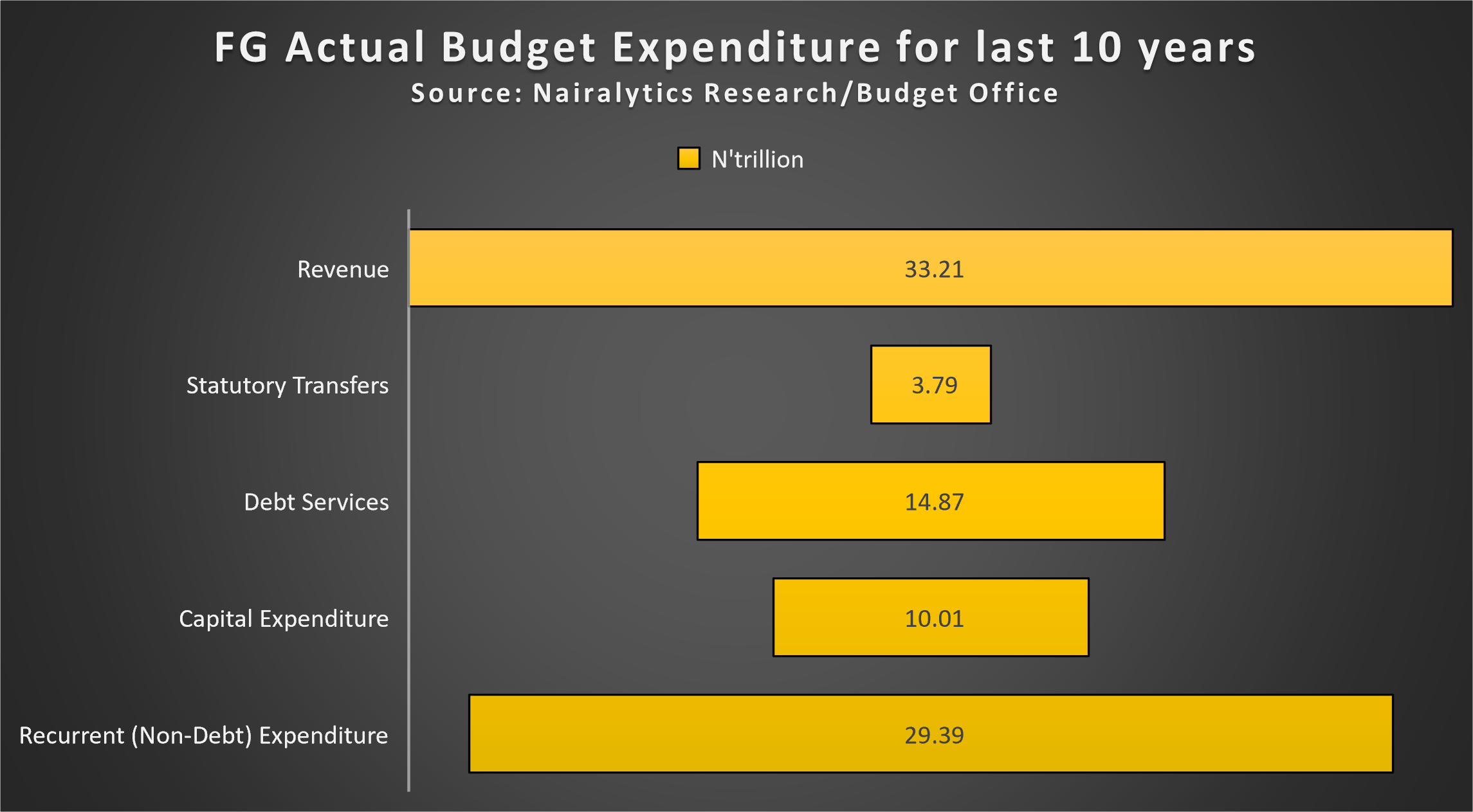

The Federal Government of Nigeria has spent N29.3 trillion in the last 10 years on (non-debt) recurrent expenditure. The government has earned N33.2 trillion as revenue in this period.

This is according to data compiled from the budget implementation report of the federal government compiled and published by the Budget Office of Nigeria.

High on non-debt recurrent expenditure

Nigeria’s recurrent expenditure includes spending on personnel expenses, pensions, and gratuities, service-wide votes, and overheads. It has consumed about 50.6% of total budget expenditure and 88.5% of revenue in the last decade.

- Nigeria is amid an economic crisis brought upon by the fall in oil prices and more recently the covid-19 pandemic.

- The federal government currently relies on about 33% of its actualized revenue since 2015 when oil prices started their sustained fall. It was about 55% between 2013 and 2015.

- With oil revenues falling, the impact of a continuous increase in recurrent expenditure has widened Nigeria’s fiscal deficits closing at N6.1 trillion in 2020, the highest since we started tracking records in 2009.

- Economic analysts have for years pointed to Nigeria’s high spending on recurrent expenditure compared to capital expenditure as a phenomenon that is inimical to economic growth.

Nigeria has recorded a budget deficit every year since 2009 averaging about N1.1 trillion in the 5 years before the Buhari Administration came into power in 2015. However, since 2015, budget deficits have averaged N3.3 trillion.

The government budget deficits have meant increased borrowing, exacerbating the situation. Last year, Nigeria borrowed N2.8 trillion from the central bank via the Ways and Means provisions. To service this borrowing about N3.2 trillion was spent in 2020, once again the highest on record.

Recurrent expenditure vs Capital expenditure

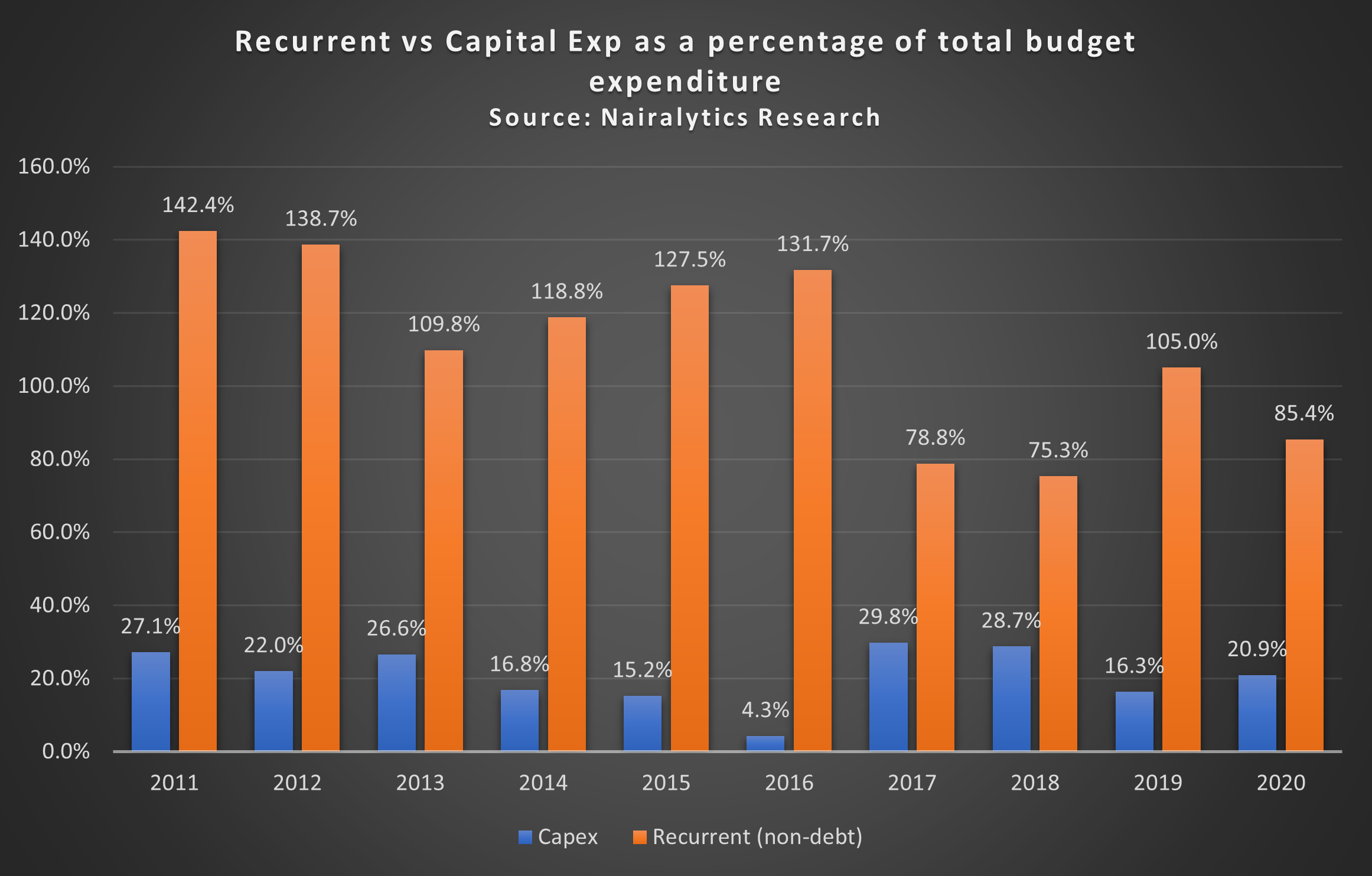

A cursory review of the data shows that at N29.3 trillion, recurrent non-debt expenditure is about 3x more than the N10 trillion spent on capital expenditure in the last 10 years.

- The Buhari Government has often compared itself with prior PDP led governments claiming it has spent more on capital expenditure. In 2020, the government spent N1.7 trillion on capital expenditure, the highest on record.

- They have also spent between N1.4 trillion and N1.7 trillion between 2017 and 2020.

Whilst, their numbers have been impressive, spending on Capex as a percentage of total government expenditure is far lower than any other year in the last 10 years.

Here are some stark numbers

- Nigeria spends on average 21% of the total budget on capital expenditure. The highest percentage was 29.8% in 2017.

- It was 20.9% in 2020.

- In contrast, recurrent expenditure as a percentage of total expenditure is as high as 115% on average in the last 10 years. It was 86% in 2020.

- While capital expenditure has risen to N1.7 trillion in 2020 compared to just N958 billion in 2017, it is far lower in dollar terms at $4.6 billion compared to $5.8 billion respectively.

In the recently approved budget for 2021, Nigeria plans to spend N13.5 trillion in budgetary expenditure out of which N4.3 trillion is for capital expenditure and another N5.64 trillion on recurrent(non-debt) expenditure.

If this plan pans out the government would have succeeded in increasing its capital expenditure as a percentage of total expenditure to 32% in line with 30% included in the ERGP.

If history is to be relied upon as a basis for projecting, the government is more assured of hitting its recurrent non-debt expenditure spend than capital expenditure.

Nigeria’s Capital Expenditure challenges

According to a world bank report, capital expenditure involves spending on transport, information technology, power and utilities, defense, etc.

- A recent Moody’s report indicates Nigeria needs to spend about $3.3 trillion in capital expenditure over the next 30 years or $1.1 trillion a decade to close its infrastructure deficit.

- This amounts to $100 billion (N40 trillion) per annum or 28% of Nigeria’s GDP of N144 trillion, a tall task considering where the country is at the moment.

- Nigeria is far from this goal and may not meet this target if it continues to spend more on recurrent expenditure compared to capital expenditure.

Also, the government will also need to explore new revenue sources other than oil to boost its revenues while relying less on budget deficits.

- Doing this will require massive tax reforms that target the informal sector, block leakages and reduce wasteful incentives.

- Unfortunately, the covid-19 pandemic has pushed back any immediate plans to aggressively tax revenue.

- For example, in its 2021 budget, the government is projecting a tax revenue of N1.4 trillion down from N1.6 trillion a year earlier.

The Private Sector way

Another possible area of increasing achieving Nigeria’s infrastructure goals is via the private sector. But to do this, Nigeria will need to improve its capital formation policies that enable the private sector to invest in public infrastructure while delivering a legal path to recovering its investments and profits.

- There is also the public-private partnership initiative pursued by the federal government towards funding infrastructure development in the country.

- Just recently, the president approved the setting up of a $39.4 billion Infrastructure Company, wholly focused on critical infrastructural investments in Nigeria.

According to the president, “this Infrastructure company will raise funding from Central bank of Nigeria, Nigeria Sovereign Investment Authority, Pension funds, and local and foreign private sector development financiers.”

Upshots: Nigeria plans to spend N5.6 trillion on recurrent non-debt expenditure in 2021. The increase is coming from the following;

- Personal cost for MDA’s rising from N2.8 billion (as per 2020 budget) to N3 billion in 2021 budget.

- Personal cost for government-owned enterprises (GOEs) will more than triple from N218 billion to N701 billion.

- Overheads also increased considerably during the year.

- In addition, debt servicing for 2021 is budgeted at N3.1 trillion up from N2.6 trillion in 2020.

Where is the money