Japaul Gold stocks have continued with its streak of gains today with no sign of slowing down, as the shares of the company gain 9.45% at mid-day on the floor of the Nigerian Stock Exchange, taking its year-till-date gains to 104%.

Checks by Nairametrics at today’s trading session revealed that the company which has become investors’ delight on the exchange, yet again gained an additional 12 kobo, which translates to 9.45%, as the share price of the rebranded company clears at N1.39, with 10 million shares of the company exchanged in 43 deals worth over N14 million.

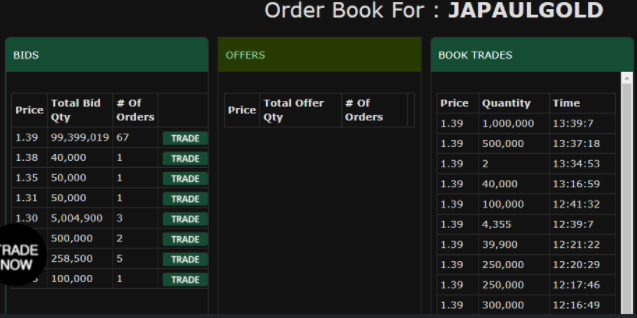

As of 12:55 WAT, during active trading on the floor of the Nigerian Stock Exchange, the bid books of the company revealed that almost 100 million bids have been placed at today’s price of N1.39 in 70 orders for the shares of the company, without a single offer.

Read Also: U.S. approves New York Stock Exchange listing plan to cut off investment banks

This suggests that the share price of the company will close at N1.39 today, and the momentum of the recent increase in the shares is expected to extend over to tomorrow.

What you should know

- An industry expert revealed that the key driver behind the recent gains in the shares of the company on NSE remains the recent restructuring process of the former oil servicing company into its new business of mining natural resources.

- As investors are optimistic about the performance of the company in this new line of business, it is important to note that the Management of Japaul has taken avid steps by rebranding and changing its logo and name from Japaul Oil & Maritime Services to Japaul Gold & Ventures Plc.

Read Also: Dangote Cement market capitalization increased by 28% to cross N3 trillion mark in November

- The company has also partnered H&H Mines Limited to mine gold, it is also set to receive approval in principle from representatives of H&H Mines Ltd for Japaul to invest in or acquire some shares of the company.