Enugu State House of Assembly today passed the state’s 2021 appropriation bill of N169.8 billion.

According to the News Agency of Nigeria, the budget christened “Budget of recovery and Continued Growth,” earmarked N101.1 billion (60% of the overall budget size) as capital expenditure, while the remaining 40% which translates to N68.1 billion was budgeted for recurrent expenditure.

Nairametrics learnt that the budget aligns with the Enugu State Medium Term Expenditure Framework (MTEF) 2021-2023 and Fiscal Strategy Paper (FSP), aimed at prudent fiscal management coupled with prioritization of public expenditure, all focused on achieving a better balance between capital and recurrent expenditures.

What you should know

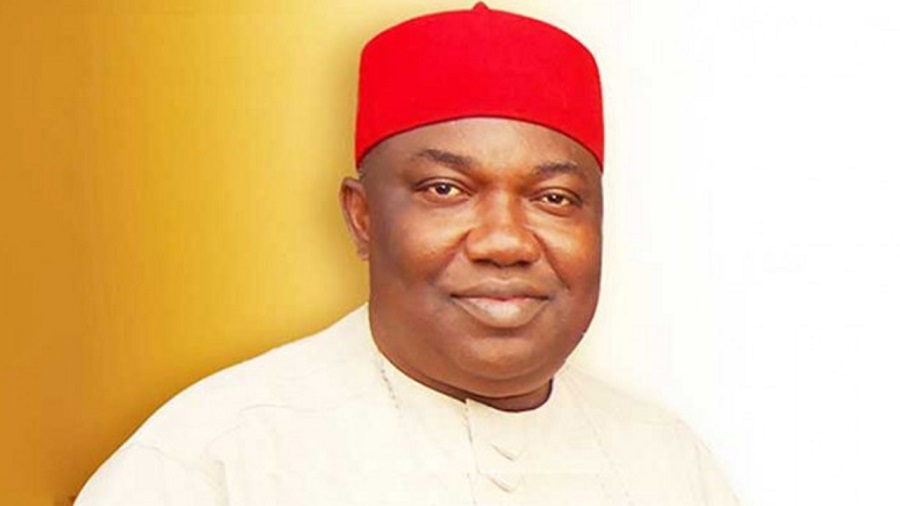

- The Governor of Enugu State, Ifeanyi Ugwuanyi, on 9 December 2020, presented the 2021 budget proposal of N169.8 billion to the State Assembly.

- The 2021 budget estimate is about 16% higher the 2020 revised budget of the state which stood at N146.4 billion.

- The projections for the state 2021 budget are predicated on the micro and macro-economic indicators of national inflation rate of 11.95%, national real GDP growth of 3%, oil production benchmark of 1.86 million barrels per day, oil price benchmark of $40 per barrel and an exchange rate of N380 per dollar.

- Some of the key deliverables of the 2021 capital budget include; rehabilitation of the 9th Mile Crash Water Borehole Programme, commencement of AFD-Funded 3rd National Urban Water Sector Reform, amongst others.