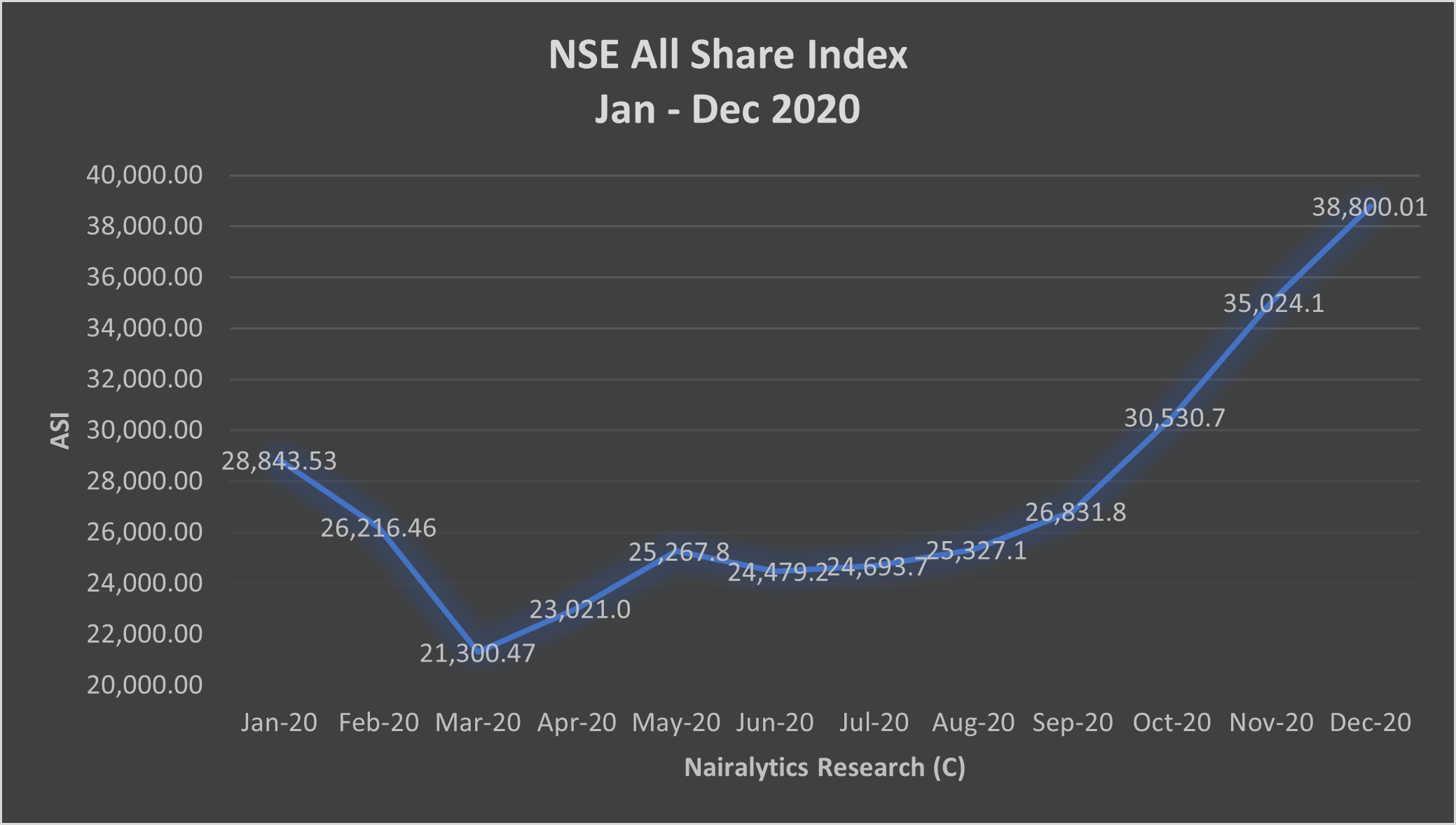

The Nigerian stock market has returned a whopping 43% year to date making it one of the best performing stock markets in the world this year.

This year’s performance contrasts sharply with 2019 when stocks closed negatively at 14.9% and it is on track to beat 2017 returns of 42.3%. The stock market turnaround began right during the lockdown but took off in late August as new monies from matured treasury bills and Omo auctions flowed into the economy.

READ: STANBIC IBTC posts Profit After Tax of N45.2 billion in H1 2020

READ: Why Access Bank has a SELL recommendation

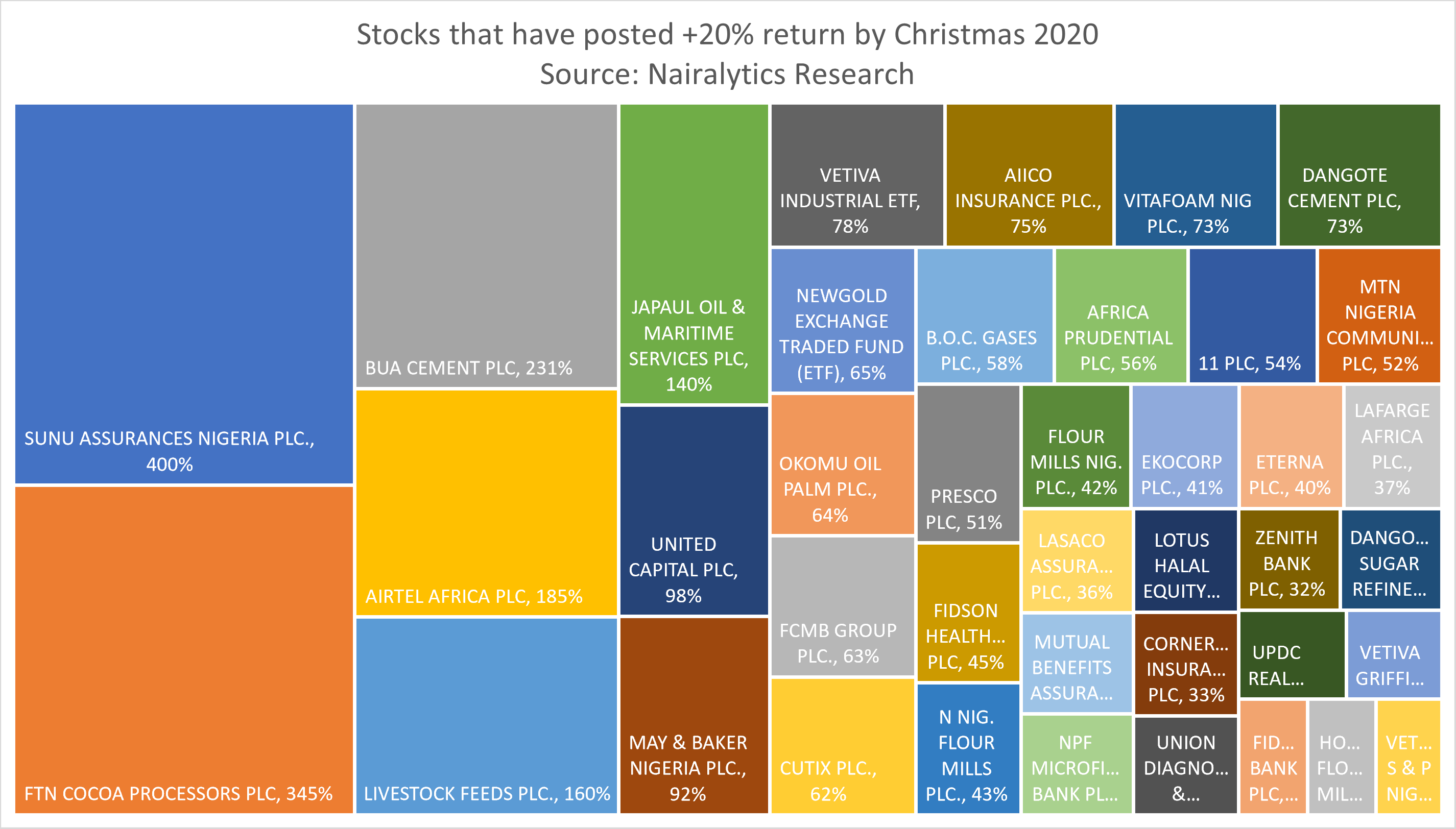

According to information from Nairalytics research, about 57 stocks posted year-to-date gains at Christmas, a figure that is likely to touch 60 stocks by the end of the year. About 65 stocks currently post year to date losses.

Considering how beautiful the year has been for most stocks, Nairalytics data also reveal about 21 stocks have gained above 50% this year. See snapshot

READ: Sterling Bank upgraded to a HOLD

Further breakdown

- Above 20% – 40 stocks

- Above 30% – 34 stocks

- Above 50% – 21 stocks

- Above 100% – 6 stocks

- Above 200% – 3 stocks

- Above 300% – 2 stocks

- Above 400% – 1 stocks.

READ: Nestle Nigeria: Rising cost slash profits

Top 5 stocks in ascending order

Livestock Feeds – The Agro-allied company has had an amazing 2020 aided by the government’s support for the Agriculture sector and the border closure. Nigerian farmers may not be happy with the price of feeds but company’s like Livestock have reaped the benefit of higher prices and scarcity.

Current share price: N1.3

Opening 2020: N0.50

Year high: N1.52

Year low: N0.46

YTD return: 160%

Current earnings per share: N0.749

Airtel Africa – The telecoms giant has had a stupendous 2020 riding on the thirst for data amidst the Covid-19 lockdown. Its revenue rose 16.4% to $1.8 billion while EBITDA also rose 19.3% in the first half of the year respectively. The stock has also attracted the attention of foreign investors who have taken advantage of its duel listing to take dollars out of the country.

Current share price: N851.8

Opening 2020: N298.9

Year high: N851.8

Year low: N298.90

YTD return: 185%

Current earnings per share: $3.0

BUA Cement – The cement conglomerate has had a very busy 2020 where the fruit of its 2019 merger was expected to be fully operational. Some may attribute its share price increase to several factors including the usual Forbes effect. However, N59.3 billion posted in the first 9- month of this year as pre-tax profits is higher than the N50 billion posted in the whole of 2019.

READ: Investors gain big on Airbnb, now worth over $100 billion

Current share price: N60

Opening 2020: N18.1

Year high: N60

Year low: N27.6

YTD return: 231%

Current earnings per share: $3.0

READ: Dangote Cement, MTN hit N3 trillion market cap, as GT Bank crosses N1 trillion

FTN Cocoa – Another Agro-allied company but with more opaque than transparent operations in the year under review. There are no fundamental reasons (from our point of view) why the stocks should be attracting this much value so we are left to assume the shareholders are bracing up for a potential capital raise. The company also posted a loss in its latest period to date result.

Over half of its current returns were made in the last 25 days.

READ: GTBank, Nestle, Zenith Bank soar high, investors gain N140 billion

Current share price: N0.89

Opening 2020: N0.2

Year high: N0.89

Year low: N0.2

YTD return: 345%

Current earnings per share: -N15.9

Sunu Assurance – Yet another one of the less glamorous stocks on the exchange that have attracted a significant increase in its valuation this year. In fact, this is officially the best performing Nigerian stock on Christmas day.

Sunu has a francophone owned insurance company and borne out of the merger between Equity Indemnity Insurance and First Assurance. Just like, FTN Cocoa there is no apparent fundamental reason for its share price appreciation so we are left to assume this is due to the recapitalization effort being carried out in the Insurance sector. It is likely that the recent rally is tied to a potential fundraising in the company.

Current share price: N1.00

Opening 2020: N0.2

Year high: N0.22

Year low: N0.2

YTD return: 400%

Current earnings per share: N1.3