The list of the leading profitable companies around the world offers a glimpse of which business sectors are commanding the most economic influence.

Unsurprisingly, three of such companies (Berkshire Hathaway, Apple, Microsoft) are headquartered in the world’s largest economy.

Methodology: Their most recent annual earning results were used. This means the 2019 earnings of the companies below were the metrics used in compiling their profitability.

Saudi Aramco $88.2 billion

- Saudi Aramco leads the top spot as the world’s most profitable company. The oil juggernaut is known to have by far the largest oil reserves in the world.

- Saudi Aramco is the national energy company of Saudi Arabia. It produces five grades of crude oil and natural gas liquids.

It also produces refined energy products that include liquefied petroleum gas, ethanol, naphtha, and other products. - It exports about 75% of its crude oil to foreign markets, most often with its oil tankers.

- Saudi Aramco has access to crude oil reserves of about 260 billion barrels.

Berkshire Hathaway $81.4 billion

- Berkshire Hathaway is a holding company for many businesses that include GEICO and Netjets. It is managed by arguably the most popular investor, Warren Buffett.

- Berkshire Hathaway is headquartered in Omaha, Nebraska, and was originally a business that focused on just textile milling plants.

- Buffett is the Chairman and biggest shareholder of Berkshire Hathaway, the investment group. According to the Bloomberg Billionaire Index, Warren Buffet is now worth $85.7billion. Surprisingly, he misses out of the top five rankings of the richest people on earth.

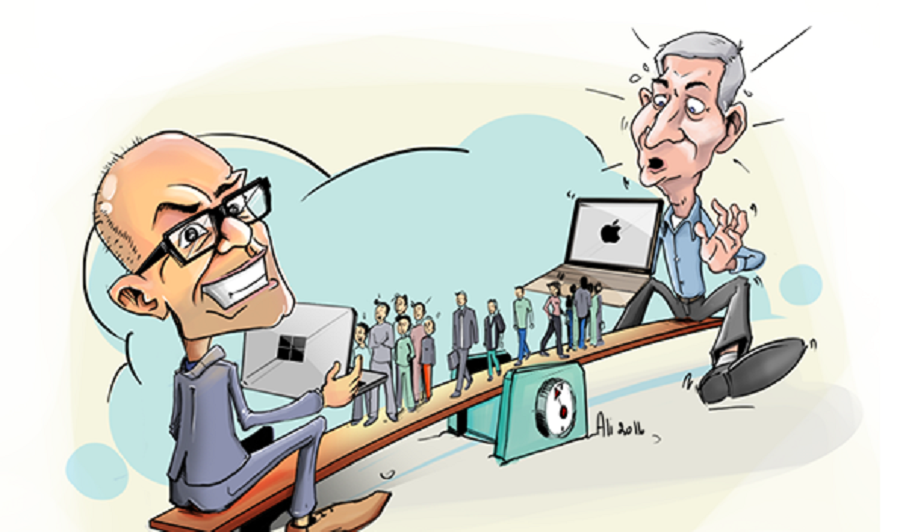

Apple $55.2 billion

- Apple is the most valuable U.S. company listed on the Stock Exchange with a market capitalization of over $2 trillion, with most of its revenues coming from iPhones and Macbooks.

- The world’s most valuable tech company designs, manufacture and market personal computers and related personal computing and mobile communication devices, along with a variety of related software, services, peripherals, and networking solutions.

Industrial and Commercial Bank of China $45.19 billion

- ICBC is the world’s leading bank by the number of customers and asset its controls. ICBC presently has over 607 million retail customers with over $4.3 trillion in assets. Yet with such an astronomical size, the financial juggernaut managed to attract 40 million more retail customers in 2018.

- That said, ICBC has recently been displaced as the most valuable public business listed in mainland China. First place was taken by Kweichow Moutai, a liquor maker.

Microsoft $39.2 billion

- Microsoft is an American software company founded by Bill Gates and Paul Allen over four decades ago and quickly rose to become the leading software company globally.

- Its software popularly referred to as Windows is the most popular desktop operating system, including Office – the most popular productivity suite.

- Some months back, the software giant won the most prized cloud-computing contract with the Pentagon, worth up about $10 billion, a deal that would help solidify the company’s standing as a leading cloud vendor.

Data Source; Fortune

What you should know

- Net income or net profit is widely regarded as the business profitability.

- Net profit accounts for the total cash inflows and outflows within a company. Numerically it is calculated as the revenue of a company less all operating expenses, income from subsidiary holdings, debt payments, interest paid, and also taxes.