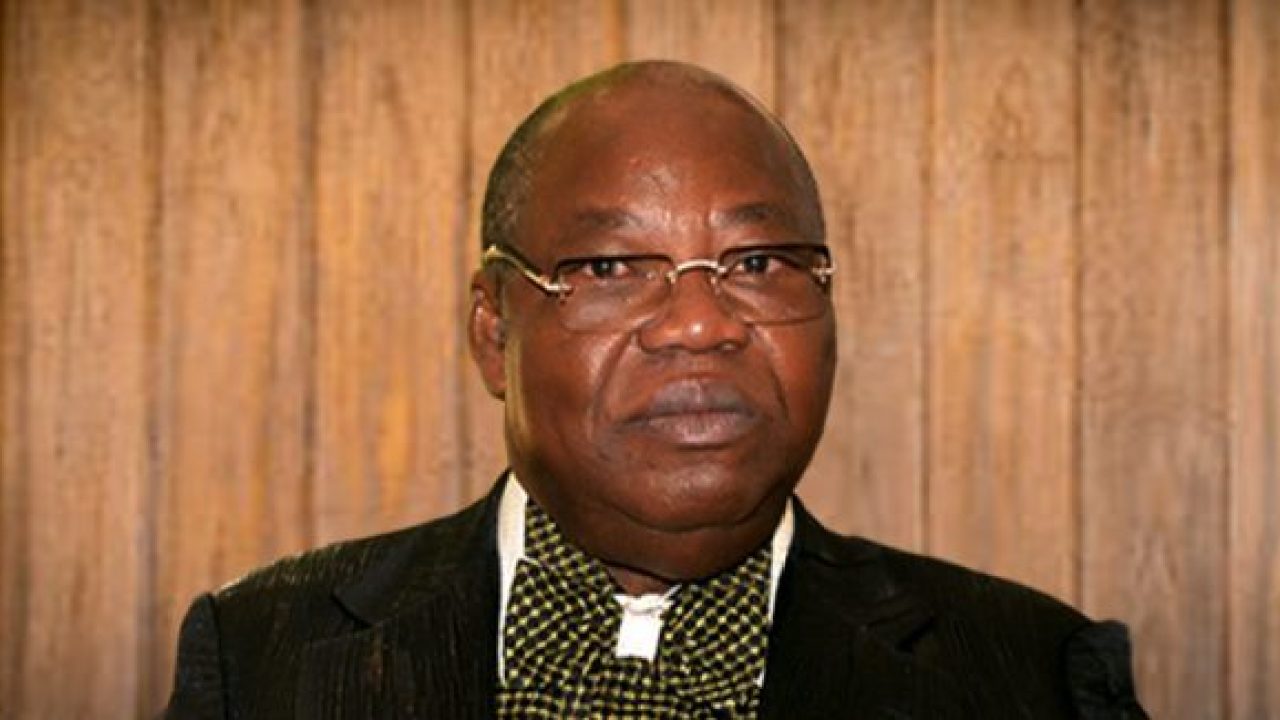

Dan Etete, former Nigerian Minister of Petroleum has said that the $1.3 billion sales of Malabu oil field to Shell and Eni in 2021 was legally perfect, with zero traces of corruption in the deal.

He disclosed this on Wednesday through his lawyer, Antonio Secci, in a Milan Court, investigating the cases of bribery and corruption related to the deal, as reported by Reuters.

READ: Why Nigeria is suing Royal Dutch Shell and ENI for $1.1bn

In Wednesday’s hearing, Dan Etete’s lawyers called for the former Nigerian Minister to be acquitted of corruption charges related to the deal.

Reuters disclosed that 13 other people are involved in the corruption case including CEO of Eni, Claudio Descalzi.

READ: Court adjourns trial of Shell, Eni officials over bribery allegation in Nigeria

The accused pleaded non-guilty and said that the proceeds of the deal were paid into accounts owned by the Nigerian Government.

The ex-Shell executives also accused in the case will have a hearing on the 9th of December.

What you should know

Multinational oil companies, Eni and Shell, paid $1.3 billion in 2011 to acquire OPL 245 offshore field.

The payment was to a company called Malabu, which was owned by Nigeria’s former Oil Minister, Dan Etete.

However, Italian prosecutors claim that most of the payments were kickbacks to Nigerian government officials. Italian prosecutors also claim that nearly $1.1 billion was stolen by Nigerian politicians and middlemen, with Dan Etete keeping half.

READ: $85 Million Malabu oil money has been refunded to FG

Nigeria’s Minister of Justice, Justice Abubakar Malami, reported in July that the Dutch and Swiss governments were expected to send the sum of $200 million from the OPL 245 Malabu Oil deal to Nigeria.

Multinational Petroleum oil and gas giant, Royal Dutch Shell, announced that it would write down its investment in the controversial Malabu OPL 245 offshore field in Nigeria.

READ: Italian Court jails Nigerian, one other over Malabu oil deal

in June, the Federal Government tracked down and grounded a luxury private jet, owned by the country’s former Petroleum Minister, Dan Etete, over his alleged involvement in the $1.1 billion Malabu oil scam. The luxury private jet was alleged to have been purchased with proceeds from that oil deal.

Nairametrics reported that the Federal Government, on Wednesday, September 9, 2020, asked a court in Milan to order Royal Dutch Shell and Eni to pay the sum of $1.092 billion as an immediate advance payment for damages in the Malabu oil scandal.