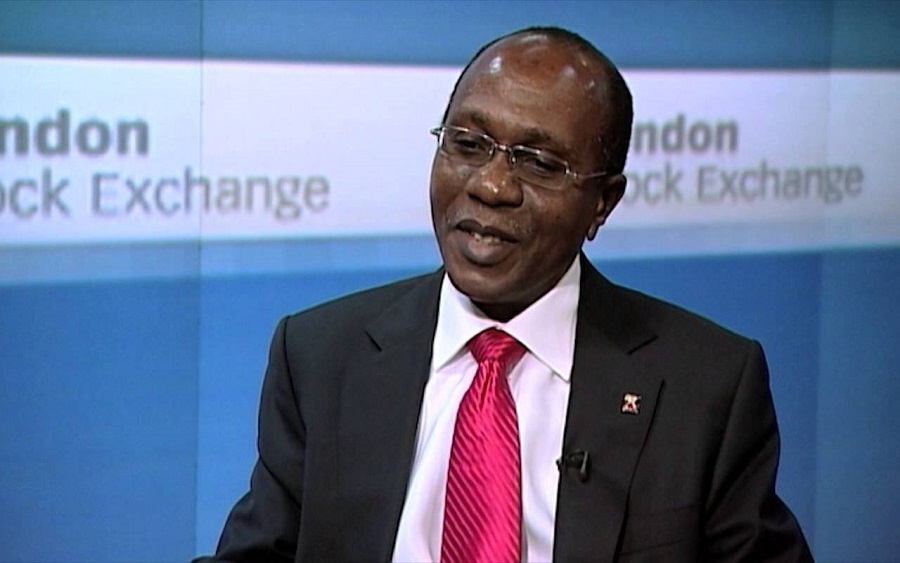

The Governor of the Central Bank of Nigeria (CBN), Mr Godwin Emefiele, has said Nigeria’s external reserves, which is currently at $35bn, is sufficient to cover 7 months of imports of goods and services.

This disclosure was made by Emefiele at the 55th Annual Bankers Dinner organized by the Chartered Institute of Bankers of Nigeria in Lagos on Friday.

READ: Why Nigeria’s external reserves is stuck at $35 billion

He pointed out that like other emerging market countries and countries that rely on earnings from oil exports, the decline in crude oil earnings, as well as the retreat by foreign portfolio investors, significantly affected the supply of foreign exchange into Nigeria.

Emefiele said, “Our external reserves currently stand above $35bn and are sufficient to cover seven months of import of goods and services.’’

‘’In order to adjust for the decrease in the supply of foreign exchange, he said the naira depreciated from N305/$ to N360/$, and subsequently to N380/$.’’

READ: Nigeria’s foreign debt has breached a 15-year trigger

“With the decline in our foreign exchange earnings and successive exchange rate adjustments, the CBN has continued to implement a demand management framework, which is designed to bolster the production of items that can be produced in Nigeria, and aid conservation of our external reserves.

“Due to the unprecedented nature of the shock, we continued to favour a gradual liberalization of the foreign exchange market in order to smoothen exchange rate volatility and mitigate the impact which, rapid changes in the exchange rate could have on key macro-economic variables.’’

READ: IMF expects global GDP to shrink by 4.9% in 2020

“This we believe is in line with international best practices in countries where managed float arrangements are in operation,’’ he said.

The CBN Governor reiterated that the measures being put in place by the authorities to improve the non-oil exports and other sources of foreign exchange had helped to prevent a significant decline in the country’s reserves.

READ: IMF expects Nigeria’s GDP to shrink by 5.4% in 2020

What you should know: External reserves management according to the CBN act, is guided by core objectives like providing a level of confidence to markets that a country can meet its external obligations, hedging the domestic currency, limiting external vulnerability and providing adequate liquidity to finance day-to-day official transactions and unforeseen needs.

This will also help the CBN maintain some stability in the foreign exchange market in the next few months. The continuous drop in the country’s external reserve will impact negatively in the forex market which has already been under intense pressure for some months.

I thought reserves will last for eternity since there is negligible import now thanks to cbn policy