Fidson Healthcare Plc’s reported revenue for Q2 2020, increased year on year by 16.19%, from N3.83 billion to N4.45 billion.

Fidson Healthcare Plc is one of the leading pharmaceutical manufacturing companies in Nigeria. It is the second-largest pharmaceutical company in the country by Q2 2020 revenue, after GlaxoSmithKline Consumer Nigeria Plc – with a revenue of N5.44 billion.

Explore the Nairametrics Research Website for Economic and Financial Data

A cursory analysis of the company’s result shows revenues got a boost, despite the challenges of Covid-19. The lockdown affected the importation of products including some of its exports. Yet revenue topped, thanks to an increase in sales of prescription drugs.

Fidson has two key segments – Prescription (Ethical) drugs, and Over the counter sales. While revenues from over the counter sales were flat; the company booked revenues of N4.69 billion, compared with N3.7 billion in the period under review. COVID-19 pandemic has largely boosted sales for most healthcare companies, as Nigerians rushed to buy immune boosters, thought to provide protection against the virus.

READ: Japan’s Ohara Pharmaceutical takes over 20% stake in Fidson Healthcare

Prescription drugs (Ethical drugs), also increased as a result of that, when compared with Q2 2019. The COVID-19 pandemic boosted the revenue of pharmaceutical companies, compared with previous periods as medicine sales surged.

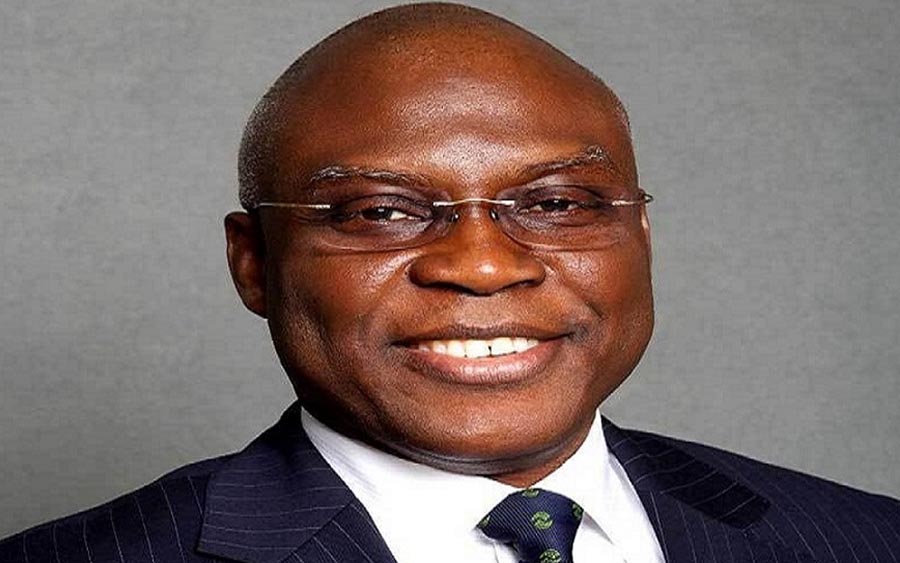

Apart from growing demand, the sector has also attracted interest from the CBN and the FG. Recently, The Central Bank of Nigeria (CBN), intervened in the sector through the provision of N100 billion credit, towards managing the pandemic, “providing opportunities to explore the development of new products,” according to the Chairman of the company, Mr. Segun Adebanji.

READ: Nigeria’s total foreign trade drops to N6.24 trillion in Q2 2020, export plunges by 52%

Despite the interventions, the sector still faces a major challenge, as noted by the Pharmaceutical Manufacturers Group of the Manufacturers Association of Nigeria (PMG-MAN). The association said that local drug manufacturers may run out of business, as most raw materials and nearly finished pharmaceutical products are imported into the country. The Association submits that the reason for this is inconsistent government policies, which results in a lack of investment in the sector.

Commenting on the surge in profits and reduction in certain costs, the Chairman of the company noted that various cost-cutting strategies were utilized in driving performance upward. The Earnings Per Share (EPS) of the company, grew by 433.33% from -6 kobo at the end of 2018, to 20 kobo at the end of 2019.

READ: Fidson reports over 500% increase in profit for 2019

Fidson shares currently trade at N3.50 per unit. The share’s highest price in 52 weeks was N4.05 and the lowest was N2.21. A total volume of 1,132,011 units was sold in the last seven days trades. Shares outstanding is 2,086,360,250 units. As for GSK, a total volume of 2,882,893 units, was sold in the last seven days trades. Shares outstanding is 1,195,876,488 units.