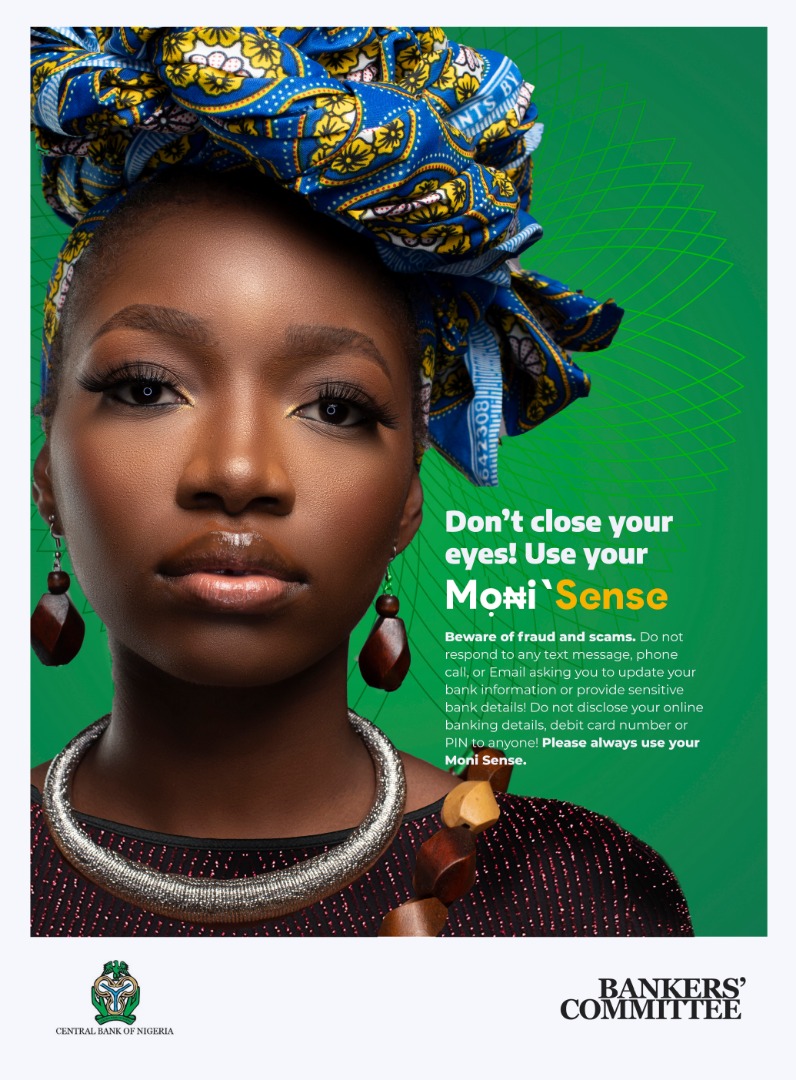

The Central Bank of Nigeria (CBN) and the Bankers’ Committee of Nigeria, on Monday, September 7th, 2020 launched its cybersecurity & fraud awareness campaign, called ‘Moni Sense’; to educate the general public on protecting themselves against cyber fraud and scams. As we kick off the end of year business season, comprehensive fraud and cybersecurity awareness remains important in ensuring the general Nigerian public is informed on their role in protecting their banking information from fraudulent activities.

Speaking on the initiative, Mr. Emeka Emuwa, Chairman, Financial Literacy and Public Enlightenment Sub-Committee (FLPE), said;

“Fraudsters and scammers continually devise new ways to deceive the unsuspecting public, usually to lure them to inadvertently disclose confidential bank information. We encourage Nigerians to always be cautious and ignore any text message, phone call, or email asking to update your bank information, provide sensitive bank details, disclose online banking details, debit card numbers, bank verification number (BVN) or PIN to anyone.”

Financial literacy and public enlightenment are a critical pillar of the Bankers’ Committee mandate, making initiatives like this critical to the goal of increasing the number of financially included citizens in the country. With this initiative, the Central Bank of Nigeria (CBN) and the Bankers’ Committee of Nigeria aims to ensure Nigerians are empowered with critical information and knowledge necessary to make important financial decisions, enhance economic prosperity, stay fraud aware and cyber safe, and drive poverty reduction across the country.

In March 2020, the Central Bank of Nigeria (CBN) and the Bankers’ Committee introduced credit support schemes for households, MSMEs and businesses across several sectors including Healthcare, Manufacturing, Agriculture, Trading, and Aviation. The Bank unveiled a succession of targeted facilities starting with a N50 billion credit facility to support households, and micro, small and medium enterprises (MSMEs), followed by another N100 billion credit support intervention for the health sector as part of efforts to combat the negative impact of coronavirus (COVID 19) on the Nigerian economy.

For any enquiries, please send an email to contact@monisense.org