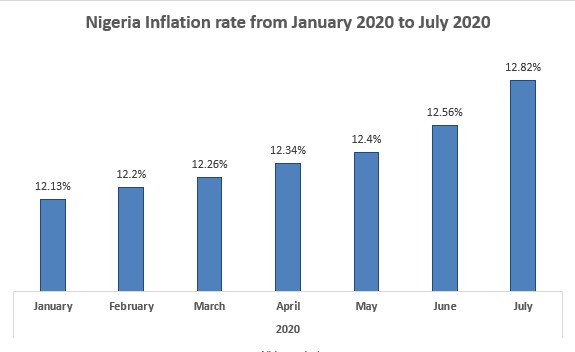

Nigeria’s inflation rate rose by 12.82% (year-on-year) in July, compared to 12.56% recorded in June 2020. This is the highest rate recorded in 27 months since March 2018 when headline inflation was 13.34%.

This information is according to the Consumer Price Index (CPI) report released by the National Bureau of Statistics (NBS).

READ MORE: Nigeria’s inflation rate rises to 12.56% in June, as food prices surge

The report also shows that Nigeria’s inflation has consistently increased for 11-months, rising from 11.02% in August 2019 to 12.82% in July 2020.

Download the Nairametrics News App

Food inflation

The composite food index rose by 15.48% in July 2020 compared to 15.18% in June 2020. This represents 0.34% increase compared to June figures. Also, on a month-on-month basis, the food sub-index increased by 1.52% in July 2020, up by 0.04% points from 1.48% recorded in June 2020.

The rise in the food index was caused by increases in prices of Bread and cereals, Potatoes, yam and other tubers, Meat, Fruits, Oils and fats, and Fish.

Core inflation

The ”All items less farm produce” or Core inflation, which excludes the prices of volatile agricultural produce stood at 10.10% in July 2020, down by 0.03% when compared with 10.13% recorded in June 2020.

The highest increases were recorded in prices of Medical services, Passenger transport by air, Pharmaceutical products, Hospital services, Passenger transport by road, Maintenance and repair of personal transport equipment, Paramedical services, and Vehicle spare parts.

Worst hit States

In July 2020, all items inflation on year on year basis was highest in Bauchi (16.10%), followed by Kogi state (15.90%), Sokoto and Plateau (15.20%), and Ebonyi state with 15%. On the other hand Lagos (10.70%), Adamawa (10.60%), and Kwara (10.50%) recorded the slowest rise in headline Year on Year inflation.

In terms of food inflation on a year on year basis, Kogi state (20.09%) recorded the highest followed by Sokoto (19.28%) and Plateau (18.05%), while Adamawa (13.37%), Abia (13.33%), and Lagos (13.13%) recorded the slowest rise.

How this rate affects the ordinary man

An increase in inflation rate means that fixed income individuals have less purchasing power and their ability to afford the same quantity of goods and services has reduced significantly.

Also, with the rise in price of goods and services, consumers may be more inclined to try and purchase more quickly before prices rise further which, could further have a negative effect on prices of goods and services.