Earlier this month, Nigerian online betting company, BetKing, announced its sponsorship deal with The Football Kenya Federation (FKF). This was adjudged the biggest sponsorship deal in the history of Kenyan football.

Valued at $11 million (1.2 billion Kenyan shilling), the new sponsorship deal will end in 2025. According to the FKF, each club in the Kenyan league will receive 8 million Kenyan Shillings a year ($1= 107.85 Kenyan shillings) thanks to this partnership.

BetKing replaced local Kenyan betting firm, SportPesa, after the company stopped all its sports sponsorships in Kenya following a dispute with the Kenyan Government over taxes. Following this new deal with BetKing, the Kenyan league would now be called the BetKing Premier League.

Other Nigerian companies in Kenya

It should be noted that BetKing is not the only Nigerian-owned company that is doing great things in Kenya. Instead, the company joined the likes of Access Bank, UBA, and GTBank, and Dangote Cement which also operate in the East African country.

Access Bank Plc: Just last week, Nairametrics reported that Access Bank completed the acquisition of Kenya’s Transnational Bank Plc, a medium-sized commercial bank.

United Bank for Africa Plc: UBA officially entered the Kenyan market in 2009 “as part of a concerted effort of by UBA Group to expand its African footprint,” the Bank says on its website. Since that entry, Kenya has been contributing positively towards UBA Group’s objective of buildings a strong African banking brand.

At the moment, the tier-1 Nigerian bank operates 3 branches in Kenya’s capital Nairobi. As of 2019 year-end, customers’ deposits increased to KSh 6.9 billion from KSh 6.6 billion during the preceding year, even as loans to customers increased to KSh 3.6 billion from KSh 3.4 billion. Overall, UBA recorded a total net profit of KSh 67.6 million in 2019, compared to KSh 53.1 million in 2018.

Guaranty Trust Bank Plc: GTBank entered the Kenyan market in 2013, after a 70% acquisition of Fina Bank Group. Following the successful completion of the acquisition process, Fina Bank’s name was changed to Guaranty Trust Bank Kenya Limited. The bank’s shares are currently held in the following order – 70% owned by GTBank Nigeria, 7.81% by Dhabaria Limited, 7.99% by Dhanji Hansraj H. Chandaria, 7.03% by RARE Limited, and a 7.17% by Mr. Rameshkumar Manubhai Patel.

GT Bank Kenya Limited reported a Profit after Tax of KSh 347.32 million as at the end of 2019 and balance sheet of KSh 41.2 billion.

CcHUB: On the tech side, Nigeria’s Co-creation Hub (CcHUB), a technology and innovation Centre, announced in September 2019 that it acquired Kenya’s iHub for an undisclosed fee. Nairametrics reported that the deal was expected to foster a direct innovation link between Kenya and Nigeria which are two of Africa’s most active markets for VCs and startup formation.

Flutterwave: Another Nigerian tech company with a presence in Kenya is Flutterwave. The firm plays a major role in Kenya’s IT ecosystem through its existing third partner logistic provider called Sendy in Kenya.

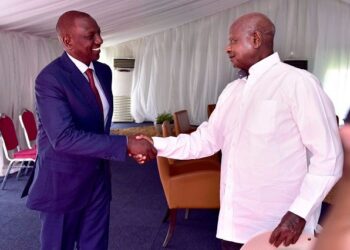

Interestingly, Nigeria’s commercial presence in Kenya transcends banking, sports betting, and tech. In terms of church business, Nigeria also has a domineering presence in the East African nation. For example, Nigerian religious organization, Winners Chapel International, opened the largest East African Church auditorium in Kenya in 2013; a 15,000 sitter arena. Construction began in 2005 and was inaugurated in 2013 by William Ruto, Kenya’s Deputy President.

Harnessing the advantages of AfCFTA

The growing number of Nigerian-owned companies looking to take advantage of inter African trade aligns with the ratification of the African Continental Free Trade Area (AfCFTA) which the African Union hopes will accelerate intra-African trade and boost Africa’s trading position in the global market. Kenya was one of the first countries to ratify the document in May 2018. The African Union hopes to fully launch the agreement in January 2021.

With the ratification of the African Continental Free Trade Area (AfCFTA), we could see an influx of other Nigerian companies making big moves in East Africa. Gtbank’s and UBA’s successes are proof that Africa is ripe for development. Africa is a market to 1.2 billion people and the AfCFTA ratifications aim to reduce business barriers like tariffs in Africa which would make it even easier for Nigerian companies to do business not only in Kenya, but around the continent.

You didn’t mention Dangote Cement’s take over of Athi River Mining giving it an entrance into the Kenyan cement market.

Hello sir, point of correction, church is not a business.