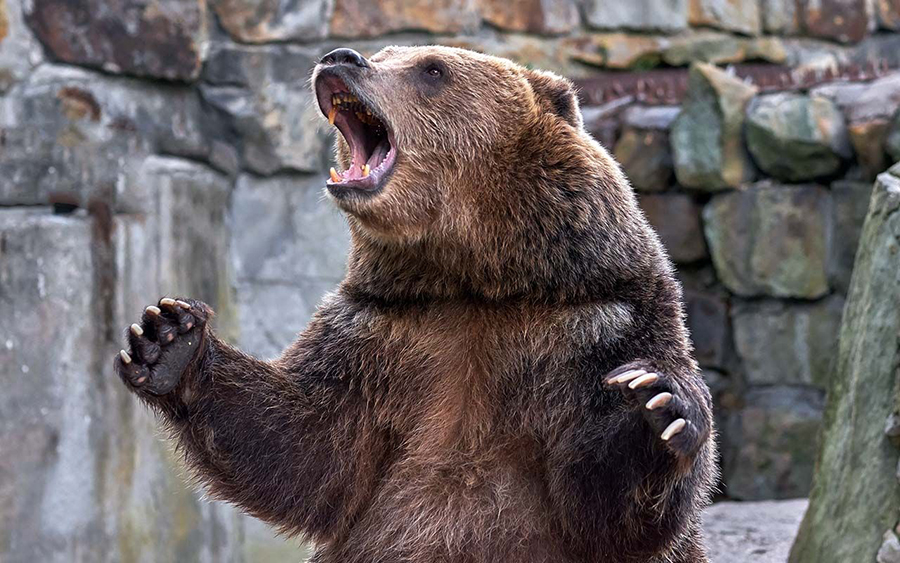

Nigeria’s stock market took a bearish turn following sell-offs in the shares of some bellwether stocks, thus driving the All Share Index (ASI) down by 0.19% to close at 24,779.26 points with a market capitalization of N12.926 trillion, while Month-to-Date and Year-to-Date losses prints at -1.98% and -7.78%, respectively. Investors lost N24.7 billion.

Similarly, market turnover finished lower compared to the previous trading session. Total volume and value of stocks traded decreased by 28.62% and 34.41% to 124.68 million units and N1.31 billion respectively.

JAPAULOIL was the most traded stock by volume at 13.61 million units while GUARANTY was the most traded stock by value at N260.46 million.

Market sentiment, as measured by market breadth, was negative as 25 tickers declined, relative to 12 gainers. STANBIC and ARDOVA were the top losers of the day with -8.33% and 5.09% declines, while NESTLE and FIDSON recorded the largest gains with 7.72% and 7.49% respective appreciation in share value.

Performance across sectors mirrored the broad index. All indexes closed in the negative terrain with the exception of the Consumer Goods Index which closed as the lone gainer. Price decline in BUACEMENT (-2.27%) dragged the Industrial index down by -1.50%. Decline in PRESTIGE, LAWUNION and AIICO resulted in the Insurance Index shedding -0.87%.

READ MORE: Nigeria’s stock market drops by N16.88 billion

The Banking and Oil & Gas index followed, lowered by -0.60% and -0.53% due to price wane in STANBIC (-8.33%), GUARANTY (-1.73%) and ARDOVA (-5.09%). Conversely, gains in NESTLE (+7.72%) spurred the Industrial index to grow +2.10%

Top gainers

NESTLE up 7.72% to close at N1179, FIDSON up 7.49% to close at N3.3, STERLNBANK up 6.67% to close at N1.28, AFRIPRUD up 5.25% to close at N4.21, FCMB up 4.65% to close at N1.8

Top losers

STANBIC down 8.33% to close at N30.25, ARDOVA down 5.09% to close at N13.05, FLOUR MILL down 3.43% to close at N19.7, NB down 2.63% to close at N37, BUACEMENT down 2.27% to close at N43

Outlook

Nigerian bourse started on a poor note as market liquidity remained thin, coupled with resurgences in COVID-19 cases. Investors remain on the sidelines.

Nairametrics advises caution when buying Nigerian stocks, as geopolitical uncertainty strengthens.