The U.S dollar regained its safe-haven status and crushed its major rivals at London’s trading session, as China and India fired shots at each other, around their borders, increasing geopolitical tensions around the world’s most populated countries.

The dollar index stood firm at about 97.003, having risen about 0.4% yesterday.

“Just recently a violent face-off happened as a result of an attempt by the Chinese side to unilaterally change the status quo there. Both sides suffered casualties that could have been avoided had the agreement at the higher level been scrupulously followed by the Chinese side,” Anurag Srivastava, official spokesperson for the Indian foreign ministry, said.

READ ALSO: The implications of India’s recent ban of its seafarers off Nigeria’s waters

Why you need to know: The trade imbalance between the two countries heavily gives China an advantage, which doesn’t go well with many Indian politicians. The powerful economies failed to resolve their border dispute and Indian media stations had repeatedly reported Chinese military invasion into India’s land.

Both nations have escalated the world’s anxiety with the continual buildup of military infrastructure along border areas.

What it means: Individuals hoping to meet foreign exchange payment obligations, and process transactions via the dollar to countries like Europe, and Japan, will need to pay fewer dollars to fulfil such transactions.

“With both sides accusing each other of violating their initial agreement it will be harder to push forward with previously agreed-upon de-escalation moves,” Kelsey Broderick, China analyst at consultancy Eurasia Group, said in a note.

READ MORE: Dangote, Promasidor, 13 other companies denied exemption from income tax

“The fact that the 15 June incident, despite the fatalities, did not boil over into a larger conflict is one positive signal that higher-ups on both sides are not interested in sparking any kind of war,” Broderick said.

He explained that India and China were likely to return to de-escalation, but that the process would take “significantly longer,” with a higher risk of another flare-up, as both governments had to tackle hardened domestic attitudes against the other side and resist calls for retaliation.

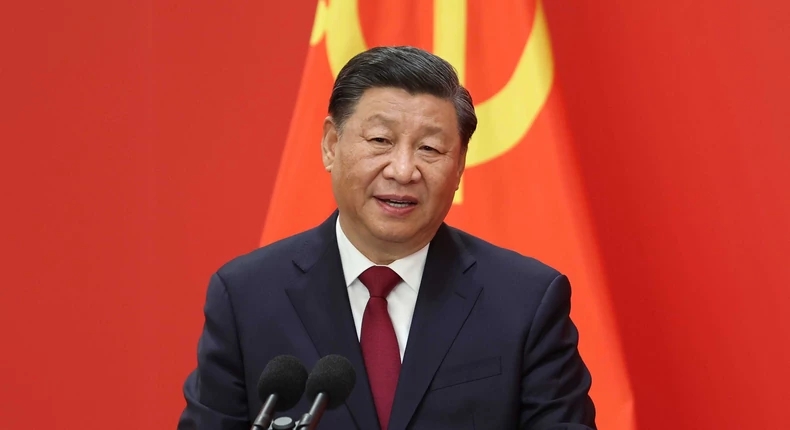

“If talks at the military and foreign ministry level are flailing, a conversation between (President) Xi Jinping and (Prime Minister) Narendra Modi is likely to prevent major fallout,” Broderick said.